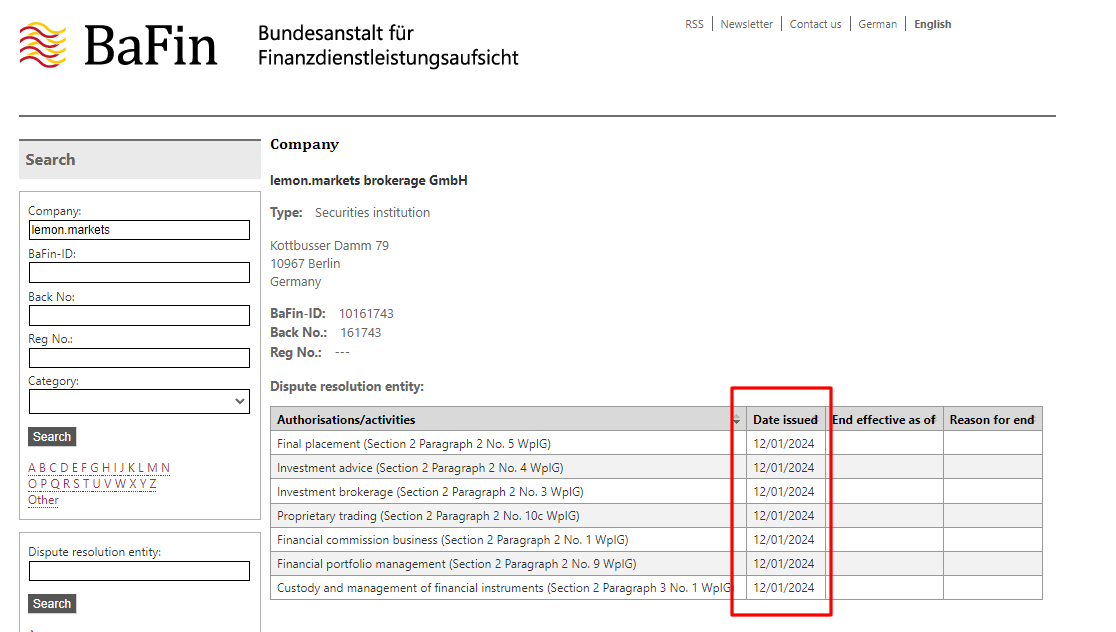

Berlin-based FinTech startup lemon.markets has officially launched its brokerage-as-a-service platform after receiving a license from Germany's Federal Financial Supervisory Authority (BaFin) in January.

The company is partnering with industry leaders BNP Paribas, Deutsche Bank, and Tradegate to provide a white-label solution for financial services providers and other FinTechs looking to offer securities trading to their customers.

lemon.markets Launches Brokerage-as-a-Service Platform with Major Banking Partners

BNP Paribas will serve as the custodian for lemon.markets, processing all transactions, while Deutsche Bank will handle payment transactions between lemon.markets and its end-users.

"With the support of established institutions such as BNP Paribas, Deutsche Bank and Tradegate, we offer our business partners and their customers the maximum degree of reliability and professionalism,” the CEO of lemon.markets, Max Linden, commented on the launch.

Tradegate Exchange will provide investors access to a wide range of financial instruments and extended trading hours. Investors can trade more than 8,000 financial instruments from 8 AM to 10 PM.

The first partner to utilize lemon.markets' infrastructure is the financial education app beatvest, which will now allow users to invest directly in ETFs through the app.

lemon.markets plans to onboard additional partners and enhance its platform throughout 2024, including expanding its investment offerings and introducing new features, such as savings plans and various order types.

lemon.markets is another European company that has recently received support from BNP Paribas. Finance Magnates reported that United Fintech Group Limited could count on such support.

Democratizing Access to Capital Markets

The Berlin-based startup , is on a mission to grow investing opportunities and make participating in the stock market accessible to every European. By providing the infrastructure for the next generation of innovative companies, lemon.markets aims to enable these businesses to help their customers build wealth through investing.

The company recognizes that the current equity rails are still plagued by manual processes and legacy technology, which can hinder the development of great investment products According to Linden, the company's long-term vision is to become Europe's leading brokerage-as-a-service provider, expanding across the continent and providing the rails for any European to invest.

As retail investing becomes more widespread, lemon.markets aims to be the go-to choice for developers looking to launch projects that offer tailored solutions to a wider, non-technical audience.

With its recent €15 million funding round, lemon.markets plans to accelerate its product development, extend its usage to businesses seeking to integrate stock trading into their services, and strengthen its in-house regulatory knowledge team.