Is the "most disliked market globally" poised to reclaim the crown of Europe’s financial capital? Signs indicate that London's financial district is back on its feet and is close to overtaking Paris. The dollar valuation of the main indices of these two financial centers is now only slightly different. More importantly, major players are again looking optimistically at the market along the Thames.

London Nipping at Paris's Heels: The Battle for European Dominance

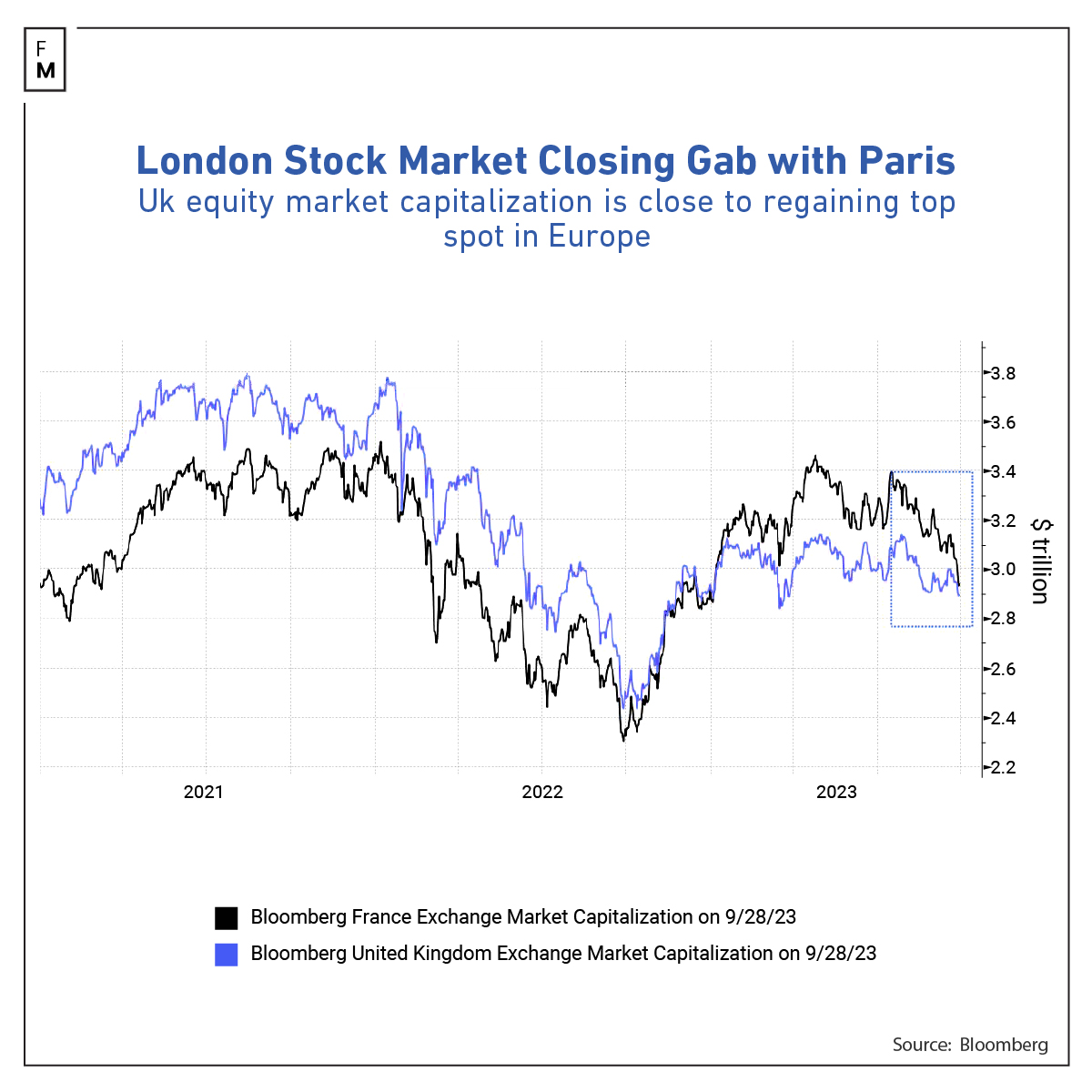

Last year, the valuation of the French stock market hovered at around $3.5 trillion, but this year it has dropped to $2.93 trillion. This decline is due to growing economic uncertainty in the key Chinese market and the fading rally of luxury Parisian stocks.

The same valuation for the London stock market currently stands at $2.90 trillion, hot on the heels of its continental rival in the battle for the title of European and global financial capital.

Just a year ago, a survey conducted by Bank of America labeled the UK as the most disliked market for global investment. Now, the mood is changing, and strategists from institutions like Barclays, JPMorgan, and HSBC believe that the London Stock Exchange (LSE) may finally be in for a good run after years of grappling with the specter of Brexit.

Global funds still have a net of 22% underweight in the local market, so the opportunity to build larger positions remains significant. According to Walid Koudmani, the Chief Market Analyst at XTB's London branch, the "unpredictable nature of the UK economy" has so far led investors to seek other markets, but this may now change.

Energy Trumps Luxury

The British financial market is currently winning mainly due to its strong dependence on energy companies. As oil prices reach their highest levels since 2022, companies like Shell Plc are experiencing a real bonanza. Their stock prices are close to five-year highs, and there are indications that they have not yet had their final say.

On the opposite end is the Paris stock market, which is largely dependent on luxury stocks. Brands like Kering, Hermes, L'Oreal, and LVMH have been breaking popularity records in recent years but are now suffering due to the global economic slowdown, especially in China. These companies make up nearly 20% of the entire value of the CAC 40 index and hurt its growth in 2023.

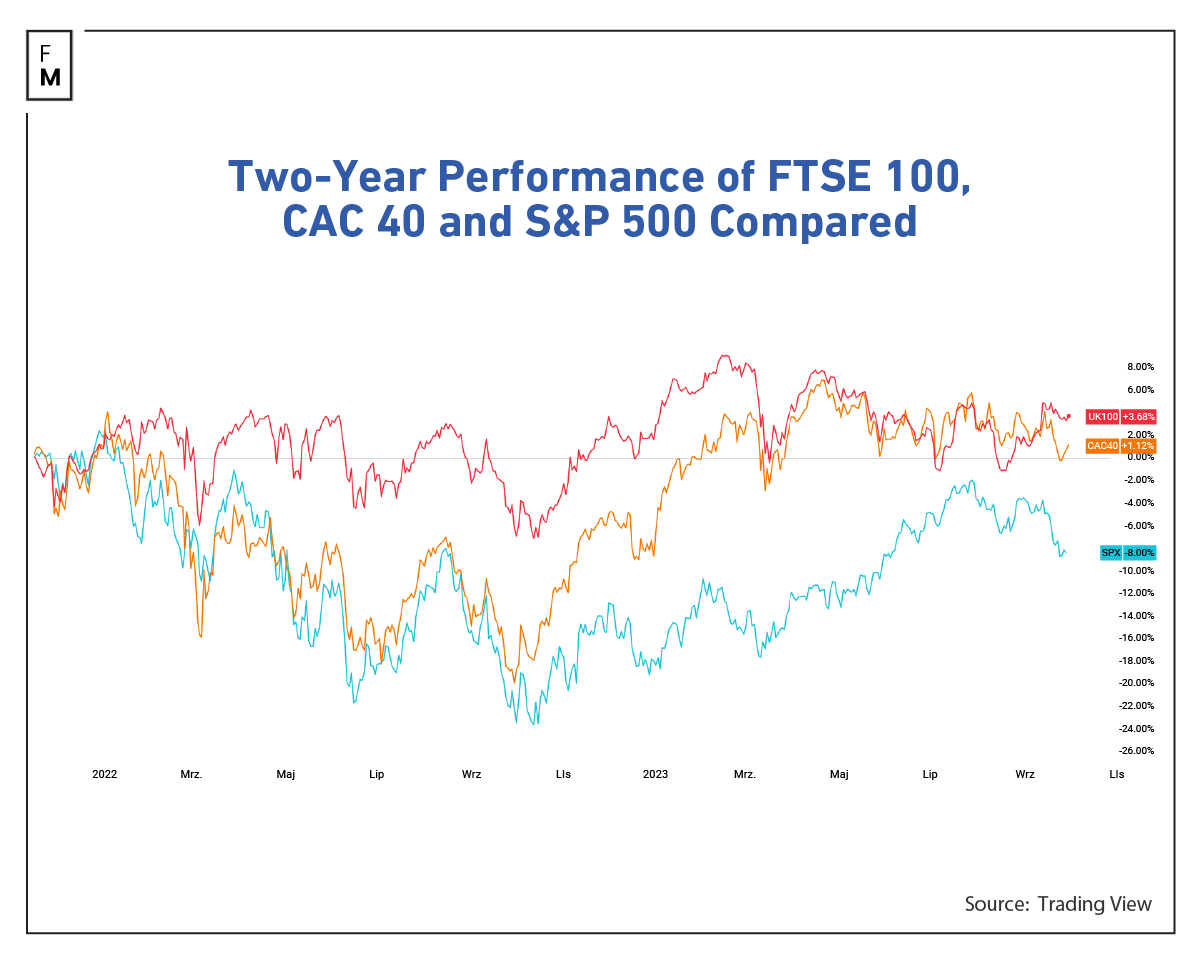

When comparing the returns of the CAC 40 with the British FTSE 100 and the American S&P 500 over the last two years, it's clear that the British market is taking the lead in terms of offered returns.

The weaker pound, which is at six-month lows against the dollar, also complements this picture. Considering that 75% of the sales of companies listed on the FTSE 100 occur outside the UK, the cheaper currency will undoubtedly positively affect their export results.

London Still Far from Seeing the Light of Day

Although the position of the London stock market is beginning to improve significantly, it is still far from emerging from its unfavorable conditions. Companies continue to flee to the United States, particularly to New York. Capital outflows have been enormous, totaling $23 billion since the beginning of 2023.

Moreover, despite its historical significance for global finance, the London stock market currently lags far behind the United States. According to data from the beginning of the year, the New York Stock Exchange (NYSE) had a total market capitalization of around $22.65 trillion, nearly ten times greater than the current dollar value of the LSE.

"UK companies often choose to debut on U.S. stock exchanges like the Nasdaq for several reasons with one primary reason being access to a larger pool of investors and a more extensive capital market as the US. has a large and liquid stock market, attracting global investors and providing greater visibility and liquidity for newly listed companies, which can be particularly attractive for technology and growth-oriented firms," added Koudmani.

Furthermore, 70% of the largest global initial public offerings (IPO) in 2022 took place in the United States on the Nasdaq exchange. The tech-rich benchmark welcomed 156 new companies that collectively raised $14.8 billion. In 2023, a year in which the IPO sector has entered a deep slumber, one of the biggest debuts also took place in the US. This refers to Arm Holding, a computer chip manufacturer that, ironically, hails from… the United Kingdom.

"The decision to list in the US can be driven by a desire for a higher valuation as US investors often assign higher valuations to tech companies, leading to potentially higher IPO prices which can be advantageous for both the company and its existing shareholders," XTB's Chief Market Analyst concluded.