Despite having above-average financial knowledge, most women believe they know too little to engage in investments. Moreover, the fear of discrimination and the dominance of advertisements targeted at men effectively deter them from becoming more involved in financial markets.

Safety and Inclusion, Not Social Status, Drives Women's Financial Preferences

A recent study by Futura, Solaris' network for women in fintech , has highlighted security, openness, and inclusion as the top factors influencing women's decisions when selecting financial products. The research surveyed 221 women and revealed that a mere 8% are swayed by the prospect of increased social status through financial services, pointing to a significant disconnect in the industry's marketing strategies.

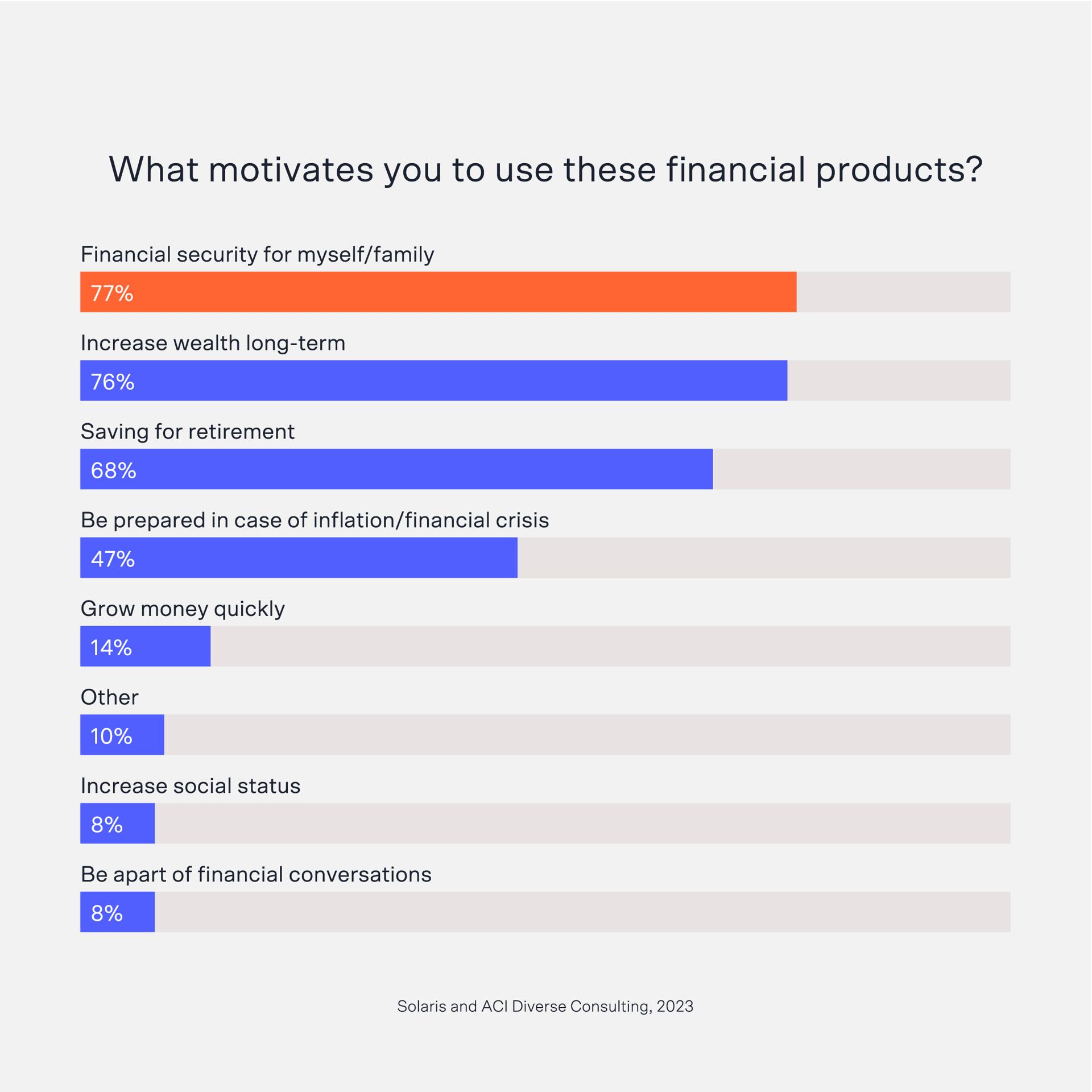

The report "Finance for Everyone" delves into the preferences and motivations of women in the financial sector. The average participant, 33 years old and working within fintech, preferred financial security and long-term growth over social status elevation. Notably, 77% prioritized building financial security, and 68% focused on retirement savings, while protecting against inflation and crises was a concern for 47%.

"There is at least $330 billion annual global revenue waiting to be unlocked by giving women better access to finance," Alicia Close, the Senior Manager of Cards Business at Solaris, said. "It's time to ask the question, 'Where are the products that serve them?' This research reveals refreshingly simple yet powerful solutions that providers can start turning to in order to remove the barriers for women within current financial services products."

Women are generally better investors than men, as many studies over the past few years have shown. They are certainly less prone to making impulsive and excessively risky decisions, and in the long term, their portfolios achieve higher rates of return. Wanting to encourage them to invest more actively, PayPal recently pledged $108 million to empower women economically.

“Macho” Status-Linked Financial Services Ads Put Women Off

The study also identified simplicity (88%), accessibility (77%), flexibility (63%), and security (58%) as the most appealing factors for women using financial products. Conversely, 71% of women felt deterred because of a lack of knowledge, 55% the fear of making wrong decisions, and 40% excessive complexity.

Particularly concerning is the impact of knowledge gaps and discrimination on the financial well-being of trans women and non-binary individuals. A significant portion of these groups reported not using basic financial services due to fear of discrimination, highlighting a critical area for improvement in the sector's inclusivity.

In addition, the women mentioned being put off by “macho” status-linked financial services ads. “If I walk down my street for just three minutes, I’ll see at least five or six giant billboards advertising some kind of financial product. One will be a luxury watch. The other will literally be a man and a bull,” one of the respondents said.

Investments Are the Least Popular Financial Services Products among Women

Women make up a very small fraction of the investing public. For instance, a survey by the German Sparkasse in 2021 positioned the percentage of German women who owned equities, equity funds, or equity-based ETFs at just 12%. Although in some countries, for example, in Australia, the investing gap is beginning to close, in most places, investing is still an industry dominated by men.

The most popular products among the surveyed women were online banking services, used by 96% of respondents. Investments proved to be the least popular; 60% of respondents own ETFs, 45% stocks, and only 15% cryptocurrencies , with a mere 1% hold NFTs.

“The issue standing in the way of more women buying these products is one of empowerment. Put simply, the way ETFs, stocks, and other investment products – especially cryptocurrencies and NFTs – are designed, and other barriers to entry, often put women off from buying them,” the report explained.

Respondents who feel that gender stereotypes restrict their access to financial products are not the majority, yet there is a prevalent sense of exclusion. 19% specifically attribute this to a lack of representation and role models. Furthermore, the gender pay gap and various structural inequalities frequently pose challenges to accessing certain financial services.

However, a separate study conducted by the French financial markets regulator has shown a light at the end of the tunnel. Women are increasingly willing to engage in various investment forms, at least in France.