Recent developments indicate that the turmoil within the proprietary trading sector may be starting to subside. The prop firm MyFundedFX, which announced the suspension of its services to US clients earlier this week, has now declared that it will migrate all accounts to the DXtrade platform. The migration process is set to begin on Friday.

MyFundedFX to Transition Clients from MetaTrader to DXtrade

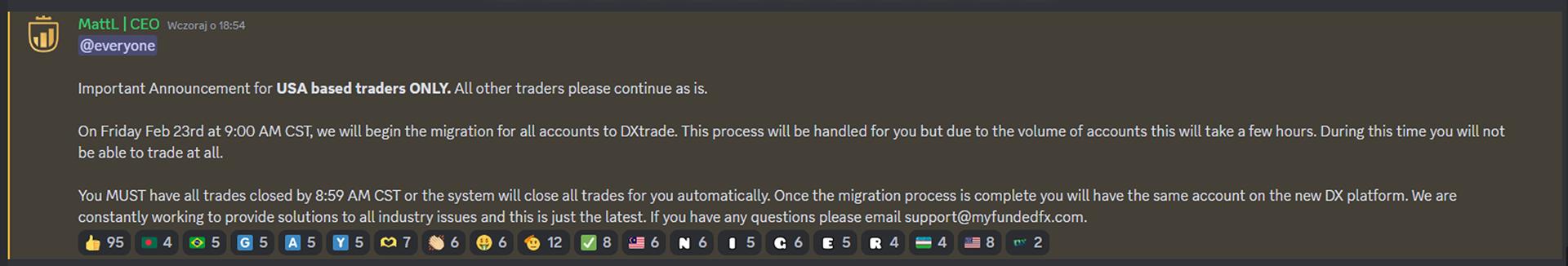

MyFundedFX announced last night that on 23 February, at 9:00 AM CST, it will start migrating all US client accounts from MetaQuotes platforms to DXtrade servers.

"This process will be handled for you but due to the volume of accounts, this will take a few hours. During this time, you will not be able to trade at all," the prop firm's CEO, Matt Leech, stated.

He emphasized that all transactions must be closed before the migration begins, or the system will automatically close them for traders. After the transfer is complete, users can use the same account on the new platform.

"We are constantly working to provide solutions to all industry issues and this is just the latest," assured Leech.

MetaQuotes, the company behind MetaTrader 4 and 5, is reportedly increasing control over the platforms' use, particularly in terms of compliance with US regulations. This move has had significant repercussions within the proprietary trading industry, leading multiple firms to end their relationships with MetaQuotes due to concerns over serving US clients.

This has caused considerable disruption in the industry and led to the suspension of services by some prop firms, including MyFundedFX, at the beginning of the week, which announced significant restrictions for its US clients. In fact, it completely suspended trading on MetaQuotes platforms and the acceptance of new clients from the region.

Prop Firms Making a Comeback

MyFundedFX is only planning its migration, but other firms are already offering their services again. Among them is Funding Pips, which, as reported by Finance Magnates on Wednesday, announced that it has successfully completed the transfer of user accounts and transaction history to a competing platform offered by Match-Trade Technologies.

On the official Discord channel, Khaled Ayesh, the company’s CEO, informed: "Match-Trader is 100% done, everything is migrated," and the platform is conducting additional stress tests of trading conditions and connections with liquidity .

True Forex Funds also announced its return, having implemented its own-branded cTrader platform. Previously, it had suspended its operations after MetaQuotes discontinued its MT4 and MT5 services.

“We are proud to announce that we are relaunching with one of the safest platforms for prop trading: our own-branded cTrader!” The company shared on X.