The significant increase in EBITDA for the first nine months of 2023 led to a positive reaction among NAGA Group's (XETRA: N4G) shareholders, with the stock price rising nearly 20% during today's trading session. The 15% jump in the number of active clients also contributed to the positive sentiment among investors.

NAGA Group Reports EBITDA Growth of 15% in Brokerage Business

NAGA's preliminary EBITDA for the first three quarters of 2023 stood at €4.2 million, a stark contrast to the €4.2 million loss reported in the same period last year. The company generated €28.4 million in revenue from its brokerage business, resulting in an EBITDA ratio of around 15%.

One of the driving forces behind NAGA's growth has been its focus on reducing costs. The company has significantly reduced its operational and marketing expenses, allowing it to expand into new markets. The company has also optimized its user acquisition strategy, reducing its marketing and sales expenditure from €26 million in 2022 to €4 million in 2023. Despite this, the number of newly funded accounts only dropped 19%.

However, the number of active accounts increased by over 15%, from 17,700 reported for the first nine months of 2022 to 20,400 for the corresponding period in 2023. The data corresponds with H1 2023 results, where NAGA showed a jump of 22% in the active traders base.

“We have spent and hired in recent years according to established, capital intensive market standards, as has happened with many industry peers and tech companies,” Michael Milonas, the Chief Executive Officer (CEO) at NAGA Group, noted.

“Our focus this year has been to reduce spending and increase efficiency. Spending 80% less and seeing growth across all our core KPIs makes us confident for the upcoming months.” Blinski was promoted to the position of NAGA’s CEO in June when the company announced its successfully secured funding of $8.2 million.

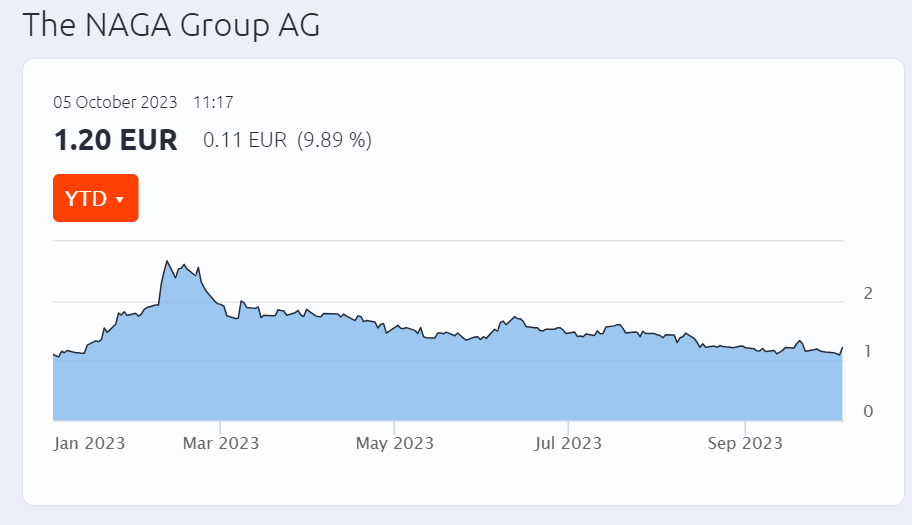

In response to the third quarter and first nine months of the 2023 report, NAGA's shares on the German stock exchange gained nearly 20% at one point. Currently, the price for one company share stands at €1.2.

Digging Deeper into the Data concerning Clients and Accounts.

Looking at more specific accounts-related data, the traded volume increased to €110 billion, compared to €98 billion, along with 7.3 million executed transactions, up from 6.2 million in the first nine months of 2022.

Client equity surged 47% to €34 million from €23 million on the same date in 2022. Additionally, new accounts contributed significantly more equity, rising from €6.2 million to €8.9 million and translating to an increase of 42%. This equates to an average of €913 per new account, marking an increase of 105% compared to the same period last year. Finally, the average monthly churn rate improved, dropping from 8.4% in the first three quarters of 2022 to 5.3% for the same period in 2023.

In the most recent move, NAGA has brought artificial intelligence technology to its social trading app and its proprietary payments technology in partnership with Rezolve AI Limited.