FINRA Amends Exemption for Proprietary Trading Firms

The Financial Industry Regulatory Authority (FINRA) has updated its bylaws to exempt proprietary trading firms from the Trading Activity Fee (TAF) for transactions carried out on an exchange where the firm is a member.

This change aligns with amendments to Rule 15b9-1 of the Securities Exchange Act of 1934, which narrows the exemption from FINRA membership for proprietary trading firms. The TAF amendment will take effect on 6 November 2023, the same day the Rule 15b9-1 Amendments become effective.

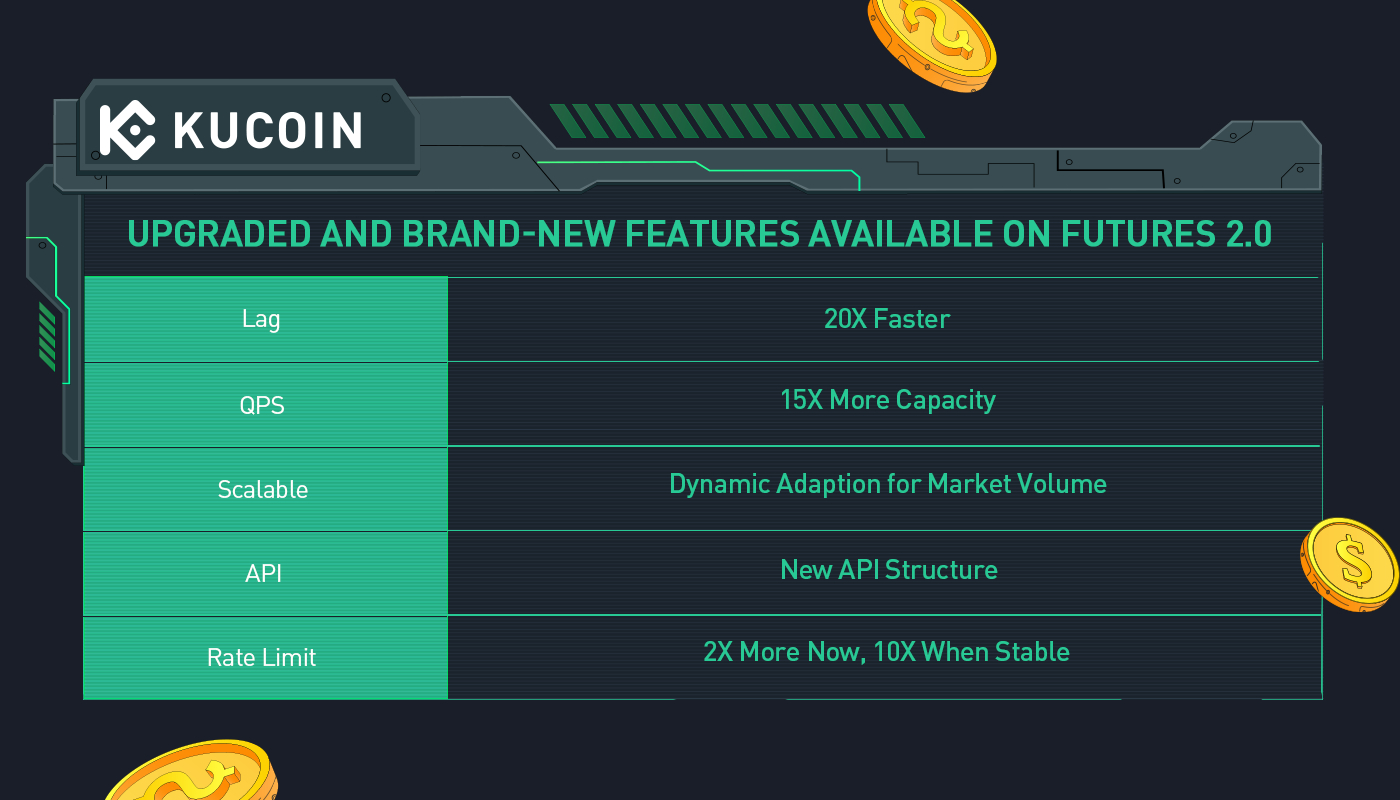

KuCoin Launches Upgraded Futures Trading Platform

KuCoin, a popular crypto exchange, has introduced Futures 2.0, an enhanced futures trading platform. The new platform offers improved pricing infrastructure, trial funds for new users, and an advanced API rate limit algorithm. A campaign to celebrate the launch is planned for November.

The platform aims to provide a more stable and efficient trading experience, especially for professional traders and institutions.

Validus Appoints Andrew Spence as Senior Advisor

Validus Risk Management has appointed Andrew Spence as a senior advisor focusing on pension plans and asset managers. Spence brings three decades of experience in economics, investment strategy, and risk management.

He has previously held senior roles at Ontario Teachers' Pension Plan and has been an advisor to HM Treasury and the Bank of Canada. The appointment coincides with plans to expand Validus' services in the pension and asset management sectors.

MAS Issues Prohibition Orders for Unlawful Sub-Agency Activities

The Monetary Authority of Singapore (MAS) has banned five individuals from engaging in illegal sub-agency activities related to financial advisory services. The prohibition orders range from 3 to 5 years and restrict these individuals from providing any financial advisory service or participating in the management of any financial advisory firm.

The orders follow a MAS investigation that found deceptive practices, including unauthorized sales of insurance policies.

Marathon Digital Holdings Diversifies Bitcoin Custody

Marathon Digital Holdings, a leader in the Bitcoin ecosystem, has added a new enterprise-grade custodian to diversify its Bitcoin treasury. The company holds 13,726 bitcoins as of September 2023 and has been producing over 1,000 bitcoins per month. The new custodian is part of Marathon's broader treasury management strategy to diversify its Bitcoin holdings across multiple providers.

“Diversification is a core component of our strategy that applies not just to our operations but to our treasury management as well,” said Salman Khan, Marathon’s Chief Financial Officer.

London Stock Exchange Group Announces Q3 2023 Results

The London Stock Exchange Group plc (LSEG) has released its trading update for the third quarter of 2023, showcasing a continuation of its transformative journey. The CEO, David Schwimmer expressed satisfaction with the group's performance, highlighting strong growth across various sectors.

Key takeaways from the Q3 2023 report include a total income growth of 8.0%, surpassing the expected year-end target. The Data & Analytics sector grew 7.2%, Capital Markets 6.2%, and Post Trade witnessed a substantial growth of 17.0%. The Organic Annual Subscription Value also saw an increase of 7.1%. All guidance for 2023, including EBITDA margin and capital expenditure, remains unchanged.

Eurex Expands Crypto Derivatives Suite

Eurex, the first European exchange to offer Bitcoin index futures, is expanding its crypto derivatives offerings with the launch of Options on FTSE Bitcoin Index Futures. The new product aims to provide a secure and regulated marketplace for trading and risk management of digital assets. The launch is scheduled for 23 October 2023 and has garnered interest from institutional investors.

“The right derivatives strategy starts with the right index, and our digital asset indices apply the same rigorous policy and governance framework used across our equity and fixed income products,” Shawn Creighton, the Director of Index Derivatives Solutions at FTSE Russell, commented.

Joint Operation against Corporate Fraud in Hong Kong

The Securities and Futures Commission, the Independent Commission Against Corruption, and the Accounting and Financial Reporting Council have conducted a joint operation against two Hong Kong-listed companies suspected of falsifying corporate transactions.

The operation resulted in the arrest of three persons, including an executive director, and revealed overstatements in revenue and assets that could lead to false or misleading information in financial reports.

Mondu Receives FCA Approval for UK Launch

Berlin-based B2B buy now, pay later startup Mondu has received approval from the Financial Conduct Authority (FCA) for its UK launch. The company will begin working with 16 British clients immediately, offering services like MonduOnline B2B BNPL for e-commerce checkout and MonduSell for multichannel sales. The UK launch coincides with Mondu's expansion into the French market.

“We are already primed to launch with a range of businesses across the UK," said Roger De’Ath, the Managing Director at Mondu.