FCA Fines ADM Investor Services

The Financial Conduct Authority (FCA) has imposed a fine of £6,470,600 on ADM Investor Services International Limited (ADMISI) for significant shortcomings in its anti-money laundering (AML) systems. The broker's business model and client base, which included Politically Exposed Persons, posed a high risk of money laundering. Despite warnings from the FCA since 2014, ADMISI failed to improve its AML systems, leading to the fine. The firm has accepted the FCA's findings and has taken remedial action to address the issues.

Therese Chambers, the Joint Executive Director of Enforcement and Market Oversight at the FCA, emphasized the importance of effective AML checks for financial firms. ADMISI's failures put the firm at risk of being used for financial crimes, even after receiving clear warnings to improve its systems. The firm did not contest the penalty and qualified for a reduction of 30% in the fine due to its acceptance of the FCA's findings.

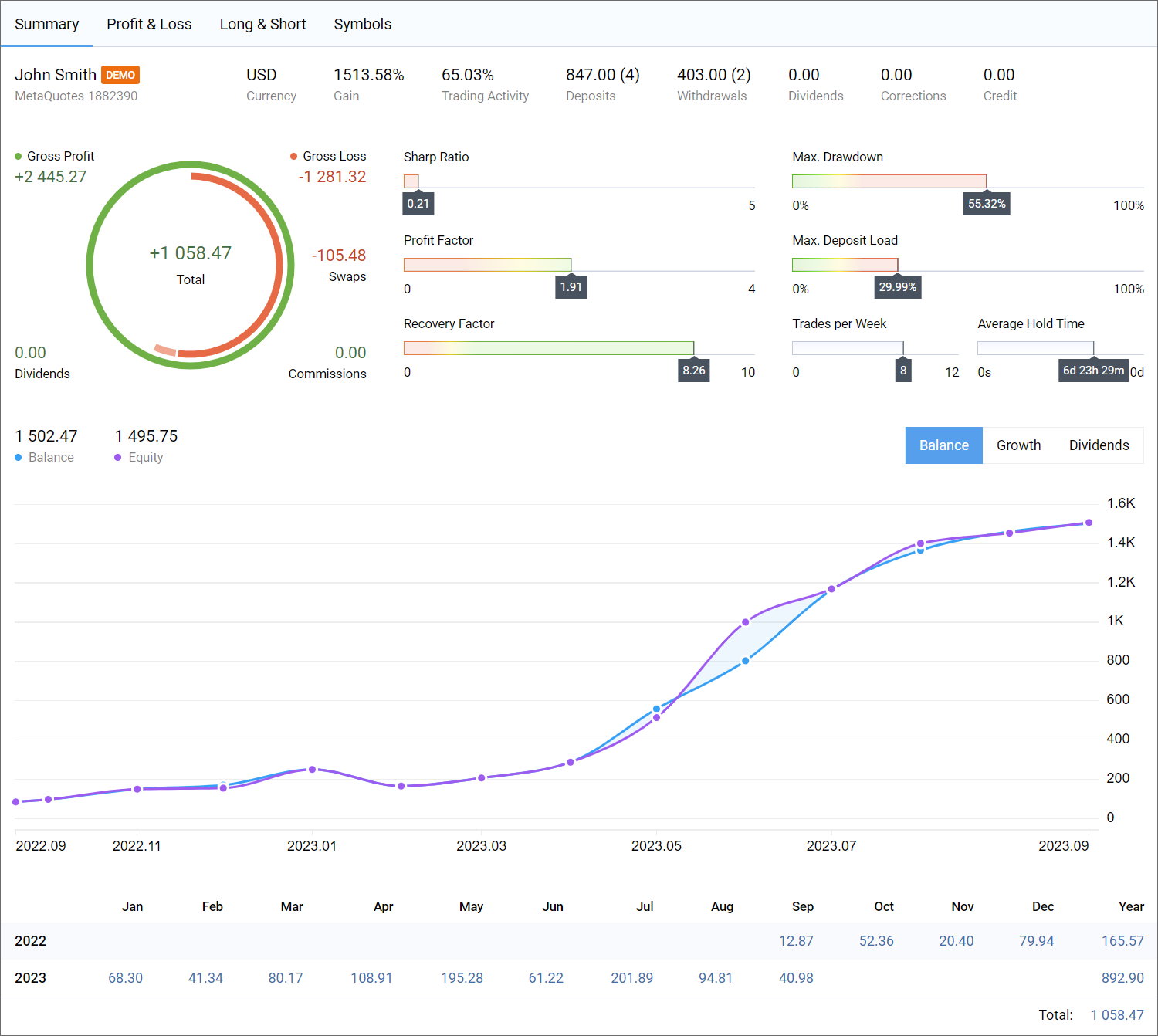

MetaTrader 5 Introduces New Trading Report and Web Terminal Features

MetaTrader 5 has rolled out its build 4000 update, which brings several enhancements to its trading reports and web terminal. The update includes a new display for monthly funds growth in trading reports, accessible through the Summary report in Balance mode.

Other improvements include a fixed and enhanced display of trading reports, an update to ONNX Runtime version 1.16, and various user interface translations. The web terminal also received fixes for password changes and account opening dialogs and improvements in displaying Stop Loss and Take Profit values.

Tusk Capital Management Loses Regulatory Permission

In a separate case, the FCA has revoked the Part 4A permission of Tusk Capital Management Limited, effectively barring the firm from conducting any regulated activities. The decision came after the firm failed to submit required returns and information to the Authority despite multiple notices.

Tusk Capital Management did not respond to the Authority's notices and failed to take corrective steps, leading to the cancellation of its regulatory permission.

Tap Global Group Announces US Launch

Tap Global Group Plc, a regulated cryptocurrency app, has announced its plans to launch in the United States through a partnership with Chicago-based Zero Hash LLC. The move aims to tap into the US's large cryptocurrency market, offering access to 24 digital assets, including BTC, ETH, XRP, and USDC. The app is expected to launch in the fourth quarter of 2023, targeting a significant waiting list of potential users in the US.

David Carr, the CEO of Tap Global Group, expressed excitement about the US launch, emphasizing that Tap offers a secure and regulated platform. The company aims to fill the gap left by platforms currently under regulatory scrutiny for their lax approach to consumer safety and digital assets.

CFTC Charges LYFE for Regulatory Violations

The Commodity Futures Trading Commission (CFTC) has charged Switzerland-based LYFE, SA, with regulatory violations, including failure to register as a futures commission merchant and inadequate anti-money laundering procedures. LYFE has been ordered to pay a civil penalty of $175,000 and disgorge $37,014.81 in profits. The penalty was reduced due to LYFE's cooperation with the authorities.

Ian McGinley, the Director of Enforcement, stressed the importance of firms adhering to market rules and AML responsibilities, warning that non-compliance would lead to enforcement actions.

Ex-Goldman Associate Faces Insider Trading Charges

US prosecutors have charged Anthony Viggiano, a former Goldman Sachs employee, with securities fraud for allegedly sharing insider information with friends. The information was shared through apps like Signal and Xbox audio chat to evade law enforcement. Based on this information, Viggiano and his friends reportedly made over $400,000 from trades.

Viggiano faces multiple counts of securities fraud, each carrying a maximum sentence of 20 years in prison, and one count of conspiracy, which carries up to five years. One of his friends, Christopher Salamone, has pleaded guilty and is cooperating with prosecutors.

BaFin Appoints Monitor at Deutsche Bank for Postbank Issues

Germany's top financial regulator, BaFin, is installing a special monitor at Deutsche Bank to supervise consumer service issues at its Postbank unit. This move comes as a blow to Deutsche Bank's reputation, which fines for lapses in money laundering controls and other penalties have already tarnished.

The regulator termed the disruptions in Postbank's online services and long customer service processing times as "unacceptable". Deutsche Bank stated that resolving the issue is of the "highest priority" and that they are making progress as part of an action plan agreed with BaFin.

UBS Adopts Broadridge's New DLT-Powered Repo Solution

Broadridge Financial Solutions announced that UBS has successfully gone live on its newly launched Distributed Ledger Repo platform. The platform aims to provide significant settlement cost savings, process simplification, and reduced operational risks through distributed ledger technology and smart contracts.

Christian Rasmussen, the Head of Investment and Execution at UBS, stated that the platform would increase efficiencies and lower settlement costs. Broadridge aims to transform the global repo market infrastructure, capturing $1 trillion in monthly volume.

Redwood Plans Reverse Takeover of R8 Capital Investments

UK-based challenger bank Redwood is planning a reverse takeover of London-listed R8 Capital Investments. Under the terms of the deal, R8 will acquire the entire issued share capital of Redwood Financial Partners Ltd, giving its shareholders a majority holding in R8.

The bank aims to raise fresh capital through a new issue, which will be contributed as common equity tier 1 regulatory capital. Redwood, which focuses on offering secured SME mortgages, has seen significant growth since its launch in 2017, posting a pre-tax operating profit of £2.2 million in 2021.