Two non-UK Trading 212 entities, one in Bulgaria and another in Cyprus, generated annual revenue of £16.2 million in 2022, the latest financials of the umbrella Trading 212 Group’s financials revealed. Revenue of both these entities came in at £44 million in the previous year.

Three Entities of Trading 212

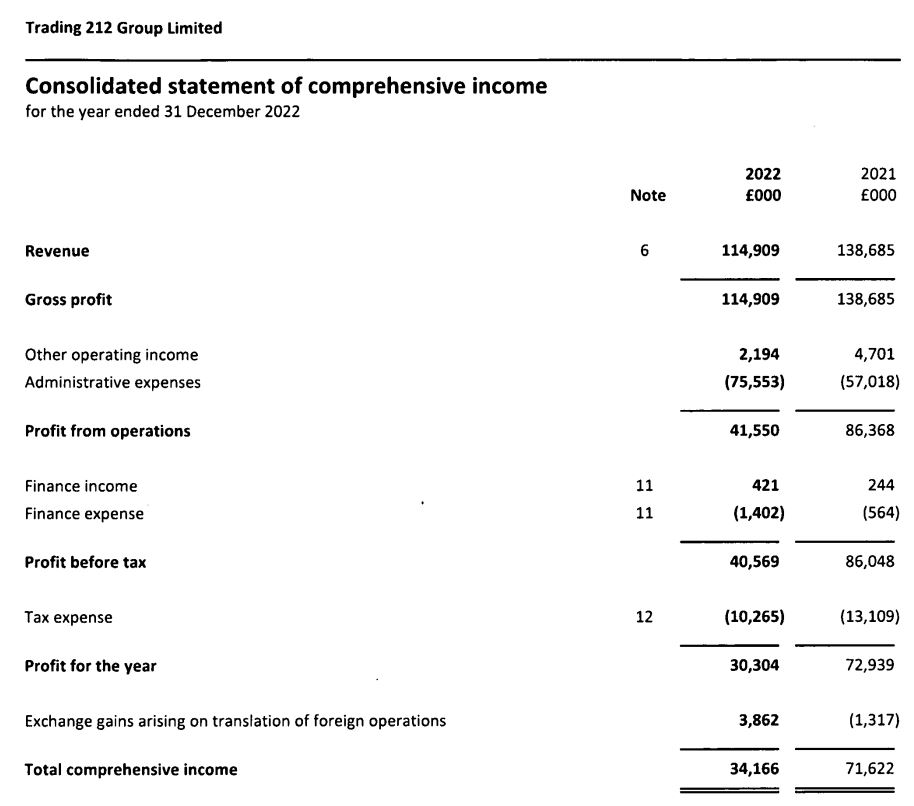

Although the group generated total revenue of £114.9 million, a year-over-year decline of 17 percent, its business in the UK alone brought in more than £98.7 million, according to earlier filed financials of Trading 212 UK Limited. The Trading 212 Group primarily holds three entities: Trading 212 UK Limited (registered and regulated in the UK), Trading212 Limited (based in Bulgaria), and Trading 212 Markets Limited (located in Cyprus). It closed down a German entity last year and migrated the clients' monies to the UK and the Cypriot entity.

The umbrella group turned a pre-tax profit of £40.5 million, down from the previous year’s £86 million. An earlier filing by the UK entity shows that it ended 2022 with a pre-tax profit of £50.8 million, meaning the Cypriot and Bulgarian branches ended the year with a loss of £10.3 million.

Trading 212 Group Limited closed the year with a net profit of £30.3 million, a yearly decline of 58.4 percent.

Client Onboarding Remains Strong

Trading 212 offers categorizes its business into two segments: a stock brokering platform and contracts for differences (CFDs) trading platform. The brokerage offers both products under the Trading 212 brand, and its clients are predominantly from the United Kingdom and the European Union.

After a few months of “voluntary and temporary” pause on client onboarding, Trading 212 UK resumed taking on clients again in August 2022 and ended the year with 165,968 unique customers. Meanwhile, the Cyprus entity onboarded 424,281 new clients last year.

The Trading 212 brand is now shifting its focus from the CFDs business towards the stock brokerage with its zero-commission business model.

“T212’s growth strategy focused on the stockbroking part of the business and growing the value of client money and client asset balances,” the Companies House filing stated. “While this growth continues to be driven in part by broader market trends and activities, crucially, it is driven by the increasing popularity of T212’s platform and our product offering.”