Six months after launching its prop trading offering, OANDA has updated the conditions for trading challenges. OANDA Prop Trader aims to attract experienced investors, especially amid recent disruptions in the prop firm space.

OANDA Updates Prop Trading Program

The revamped program offers more flexible assessment criteria and higher profit-sharing opportunities. Traders who successfully complete one of the challenges can now unlock an 80% profit share as signal providers, a substantial increase from previous rates.

OANDA has also streamlined the qualification process by reducing profit targets for the challenge stage and eliminating the minimum trading day requirement. This change allows traders to potentially pass the challenge and become signal providers in as little as two to three days.

Main improvements to the program include:

- Lowered profit targets of 8% in the first assessment phase

- Removal of minimum trading day requirements

- Increased profit sharing to 80% for qualified traders

- Leverage of 100:1

- Refund of challenge fees on the first payout, in addition to profit share

"We're constantly listening to our prop traders and reviewing our offering to provide the most competitive conditions possible," OANDA Prop Trader commented. "These changes will allow us to provide even more talented prop traders with an opportunity to thrive in the financial markets."

The company also hinted at future developments, including the introduction of new challenges designed to accommodate various trading styles and risk appetites.

The shift occurred as another European regulator, this time Italy's Consob, issued a warning against prop trading, calling it a "video game." Similar warnings have previously come from Belgium and Spain.

Brokers Enter the Prop Trading Industry

OANDA's move into prop trading comes when many prop traders seek new, reliable partnerships due to recent industry disruptions. In February, MetaQuotes began terminating contracts for the use of its MetaTrader platform, which led many retail prop firms to suspend operations or halt registrations for new users.

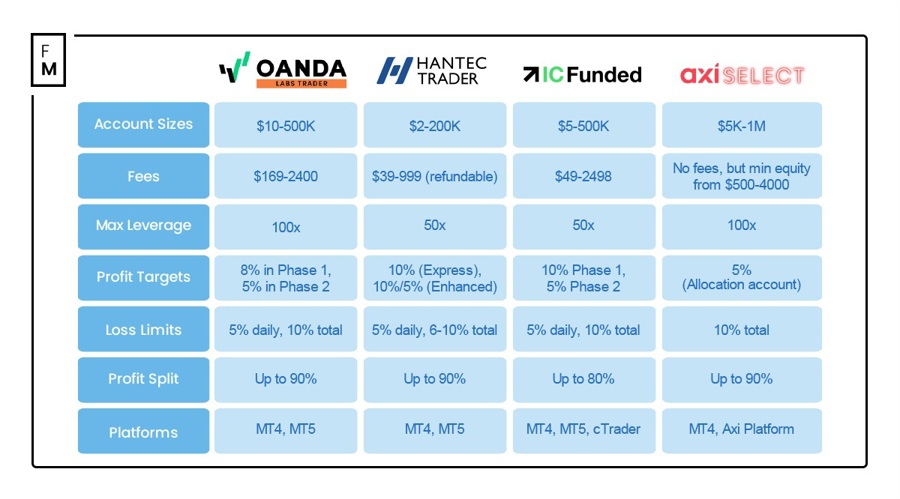

OANDA decided to enter the prop trading market half a year ago and is now one of the few FX/CFD brokers who have made a similar move. Other brokers including Hantec Markets, IC Markets, AXI, and as of July, Think Markets have also joined this trend.

Finance Magnates recently compared the offerings of four firms that were among the first to enter the prop trading market, and a full review can be found here.

Representatives from OANDA are convinced that prop trading could be the future of retail brokers, potentially surpassing the traditional FX and CFD industry. In April, Crystal Lok, OANDA’s Head of Emerging Markets, told Finance Magnates that this sector is "more accessible, has lower barriers to entry, such as upfront fixed fees, and involves limited downside risk."

Unlike unregulated prop firms, prop trading with an FX/CFD broker primarily offers access to the MetaTrader platform, which has not been so obvious in recent months, and the assurance that you are trading with a regulated entity.