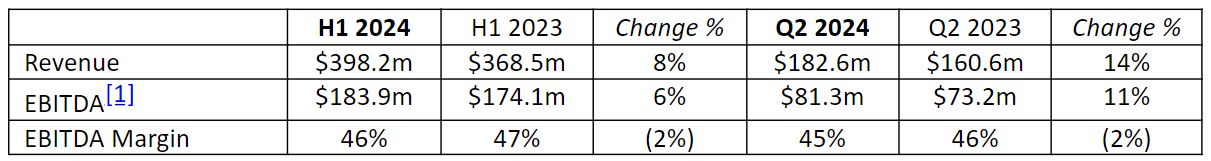

Plus500 (LON: PLUS) generated revenue of $182.6 million in the second quarter of 2024, which increased 14 per cent year-over-year. However, the figure dropped by 15.3 per cent when compared to the $215.6 million generated in the first three months of the year.

EBITDA also followed the same trend, improving by 11 per cent to $81.3 million year-over-year and declining by 20.7 per cent quarter-over-quarter. The quarter's EBITDA margin was 45 per cent, 2 percentage points lower than the corresponding quarter of the previous year.

The Impact of EURO 2024

Justifying the numbers, the London-listed brokerage pointed out that financial market activity was dull towards the end of the quarter due to the UEFA EURO 2024 Football Championship, which was expected given previous trends.

“During the first six months of 2024, Plus500 delivered excellent financial and operational progress despite difficult market conditions,” said David Zruia, Chief Executive Officer at Plus500.

“Revenue and EBITDA increased meaningfully year-on-year, highlighting the inherent resiliency and strength of the Group's differentiated business model. This underpins our continued focus on our stated strategy of expanding into new markets, developing new products, and deepening relationships with our customers.”

The trading update today (Monday) further revealed that the Israeli broker added 24,810 new customers between April and June, compared to 22,248 new customers in the corresponding quarter of 2023.

Furthermore, the company still boasts a healthy balance sheet with over $1 billion in cash.

A Strong Outlook

As for the outlook, the broker is anticipating its revenue and EBITDA for the ongoing financial year to be in line with the current market expectations, which are $697.8 million and $314.6 million, respectively.

“Plus500 remains well positioned to capitalise on both short-term market conditions and the longer-term growth trends in its end markets,” Zruia added. “In the short term, our increasingly diversified offering and intuitive trading platforms allow customers to access a wide variety of products, services, and features across multiple markets. Over the medium term, we will continue to invest in our strategic roadmap initiatives, which are enabled by our class-leading technology, deep customer engagements, and robust financial position.”