Following the publication of its financial results for 2023 and trading update for the first three months of 2024, we assess the operational performance of Plus500 (LON: PLUS), which offers a range of trading products including CFD, shares and futures trading. The broker's revenue for the year reached $726.2 million and the company acquired almost 91,000 new customers last year, raising active customer numbers to just over 233,000.

Unlike some other brokers, Plus500 does not break down commission income. Total customer income includes commission from the group’s futures and options on futures operation and from Plus500 Invest - its share dealing platform – as well as customer spreads and overnight charges.

Very Strong Per Client Revenue

Average revenue and average deposit per active customer at $3,116 and $10,300 respectively were up 5% and 29% from 2023. In common with many of its competitors, high interest rates enabled Plus500 to make a decent return from the $2.4 billion it held in customer deposits, although interest income of just under $52 million was modest compared to the £80 million earned by IG over the same period and the whopping $2.8 billion earned by Interactive Brokers.

All brokers recognise the value of technology development. For example, in its latest annual report Interactive Brokers refers to continued investment in software development and information technology services. However, Plus500’s investment in product development - approximately $50 million was committed to R&D between 2021 and 2023 – appears to be having a significant impact on customer engagement.

Plus500’s revenue per client in 2023 was approximately $3115, almost twice that of Interactive Brokers and well in excess of the roughly $570 per client earned by Saxo.

Earnings before interest, taxes, depreciation, and amortisation of $340.5 million in 2023 were down by a third compared to 2022. However, the EBITDA margin of 47% for 2023 compares very favourably to its competitors despite falling below the firm’s average annual margin of 56% since its IPO in 2013.

Other areas of the business proved more challenging last year. Revenue was down almost 15% year-on-year and new customer acquisition was down by more than 15,500 from the previous 12 month period, while the number of active customers fell by almost 48,000 over the same period.

To put the revenue figures in perspective, Interactive Brokers’ income for 2023 was up 42% to $4.3 billion, while Saxo was up 11% and IG recorded a 5% increase for the 12 months to June 2023. Interactive Brokers’ client accounts grew by 22.5% compared to 2022, down from 24.8% in the previous year but still favourable compared to Saxo’s 14% increase.

Plus500’s business remains geographically dispersed, with the majority of its revenue (91%) generated outside of the UK where it is listed. Interestingly, the market with the sharpest fall in revenue in 2023 was the UK, while earnings outside Europe and Australia were largely unchanged.

International Expansion Was a Focus

The firm’s efforts to expand its international business during 2023 included the introduction of a localised trading platform for the Japanese retail market, while the launch of a new proprietary trading platform for retail customers (the ‘Plus500 Futures’ platform) boosted its retail business. Obtaining a licence from the Dubai Financial Services Authority enabled Plus500 to offer FX and CFD products to traders in the UAE and other Gulf Cooperation Council countries.

At the end of last year the firm became a primary member of the Futures Industry Association to help it exploit growth opportunities in the US futures market. In the firm’s Q1 2024 trading update, CEO David Zruia noted that in the US futures market, Plus500’s B2B (institutional) business would soon launch a new technological offering. In January 2024 it secured a clearing membership with Eurex Clearing and Plus500 also launched an upgraded version of its ‘trading academy’ in Q1.

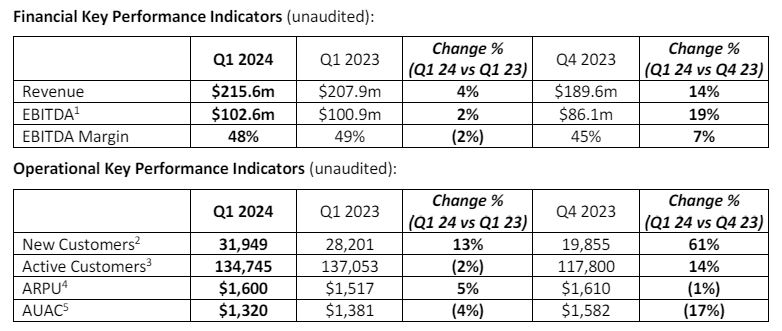

The firm’s trading update for the three months ended 31 March 2024 suggests that last year’s downturn in revenue could be reversed in 2024. Income for Q1 reached $215.6 million (up from $207.9 million for the same period last year and from $189.6 million for the previous quarter).

Haven't checked out the Plus500 Futures platform yet? What are you waiting for? Head to https://t.co/ObezhZBCoM to find out more!

— Plus500 (@Plus500) April 21, 2024

*Not all financial instruments are offered by all Plus500 regulated entities. Futures Trading is offered by Plus500US pic.twitter.com/9F646rk42h

Strong Customer Metrics

With 134,745 active customers this comes to average revenue per customer of $1,600 in the quarter - which would equate to $6,400 per customer if these figures were replicated over the remaining quarters of 2024.

Active customer numbers were up 14% from the previous quarter and the average deposit per active customer increased by 27% from Q1 2023 to $5,400.

In a trading update issued in advance of its annual general meeting in early May, the company said it was confident that it could sustain positive momentum through the rest of the year and that the strategic and operational progress made during 2023 had continued during the early months of this year.

"This outstanding performance was enabled by the strength of the group's multi-channel marketing approach, its industry-leading proprietary technology, intuitive trading platforms and robust financial position," the Israeli broker said in its trading update. "Based on Plus500's recent progress, and the strategy that it has in place, the board remains confident in the outlook for the group in 2024 and beyond."

Markets have reacted favourably to Plus500’s performance in 2023 and its figures for the first quarter of this year with the firm’s share price rising from £1,663 at the end of last year to £2,220 as of 31 May.