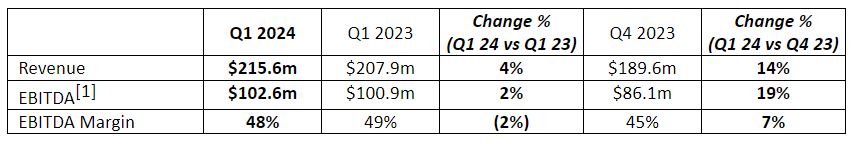

The revenue of Plus500 between January and March totaled $215.6 million, an increase of 4 percent year-over-year(Y-o-Y) and a 14 percent jump quarter-over-quarter(Q-o-Q). Among the total, its customer income amounted to $169.6 million, while customer trading performance was at $30.6 million. The rest was generated from interest income.

A Strong Quarter for Plus500

According to the unaudited trading update today (Tuesday), the company's quarterly EBITDA was $102.6 million. The EBITDA gained 2 percent from the first quarter of the previous year, while it uplifted 19 percent from the previous quarter. The latest EBITDA margin was at 48 percent, down from 49 percent in Q1 2023 but up from 45 percent in Q4.

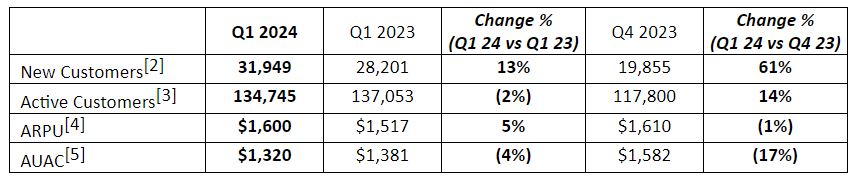

Furthermore, there was a substantial increase in the number of new customers on the platform. It added 31,949 new customers in the quarter, a positive change of 13 percent and 61 percent Y-o-Y and month-over-month, respectively.

However, the total number of active customers on the Israeli broker dropped by 2 percent from the corresponding quarter of the previous year to 134,745. The Q-o-Q figure, on the other hand, improved 14 percent.

The average revenue per user on the platform totaled $1,600, while the average user acquisition cost (AUAC) was $1,320. Notably, the company improved its AUAC.

“Thanks to our established competitive advantages, continued strategic progress, and robust financial position, Plus500 generated another set of strong operational and financial results during the period,” David Zruia, the CEO of Plus500, said. “We continued to deliver against our strategic roadmap: expanding into new markets, developing new products and deepening relationships with our customers.”

The Focus Will Be on Expansion

As for the outlook, Plus500 will keep its focus on key growth opportunities, including new products, services, and markets, as well as the expansion of its core OTC product offering, share dealing, futures, and options on futures products, and by deepening its customer engagement and retention initiatives.

“As a diversified, global business with a clear and proven strategy, Plus500 is well positioned to continue delivering strong results and attractive returns to its shareholders,” Zruia added.