FXCM Group today reported its execution quality metrics for May 2019, which showed higher rates across its average spreads for cryptocurrency and certain FX instruments.

For the cryptocurrency pairs, the company averaged 28.2 pips on BTC/USD, up from only 25 pips in the first quarter. However, May’s spread was significantly lower when weighed against the 44 pips the company charged when it first reported spreads metrics for its bitcoin instrument nearly a year ago.

Cryptocurrencies printed fresh highs in May, extending a rally that has seen major coins more than double in value since the start of the year. Rumors that global top brokers and exchange will soon start crypto trading for institutional customers was also having a positive impact on price.

For the Ethereum and Litecoin instruments, FXCM charged on average 1.9 and 0.57 pips, respectively, also a touch higher from the months prior.

The FX broker introduced the new asset type earlier last year when it began testing the service with its already installed Bitcoin offering.

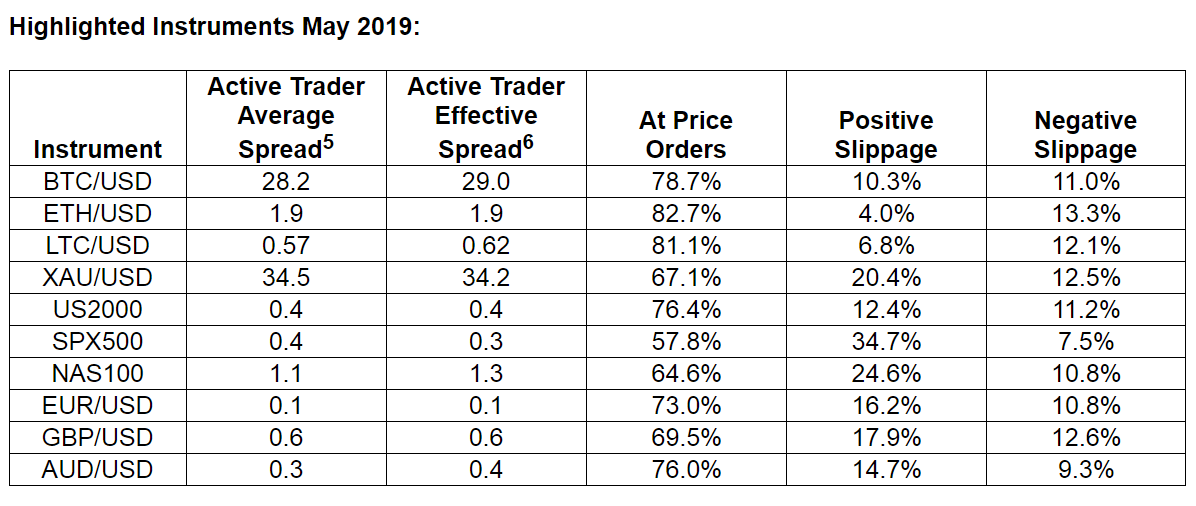

FXCM also published its price improvements/slippage statics for May 2019, which showed the following highlights.

- 67.4% of orders executed at price

- 21.9% of orders executed with positive slippage

- 10.7% of orders executed with negative slippage

The company also reported on its execution speed, which is measured from the time a customer’s order is received to the time of filling. The average order execution time was 24 milliseconds in May, compared to 21 in March. Although an important factor in determining where orders are routed, it is only one factor. Some brokers may provide a good speed of execution but fail to provide price improvement or Liquidity .

According to figures stated in the report, the average spreads on the EUR/USD, GBP/USD and XAU/USD pairs were 0.1, 0.6, and 34.5 pips respectively.

The following table shows the exact figures in March:

Additionally, the online brokerage disclosed its Effective Spread statics, which displays its quoted spread for its top FX pairs, and compares the figures with actual spreads, at which trades were already filled, with the difference being displayed in a table key.