The CFD brokerage more than any other industry needs a constant influx of new customers in order to sustain profitability. However, just like any other industry the market can quickly become saturated or stalled due to regulatory or economic reasons. CFD brokers constantly search for new markets and opportunities for growth. Finance Magnates wants to make this task easier for brokers, by introducing our reports in a new section entitled, ‘Heat Map’.

New Heat Map Aimed to Help CFD Brokers and Firms

With our new section, we aim to help CFD brokers and related firms decide which regions and countries are worth consideration when planning business expansion.

We are creating our indicators based on the analytical data which measures the number of viewers from each country entering the websites of the biggest brokers listed by Finance Magnates volume rank. Starting with the Quarterly Intelligence Report for Q3 2023, we present our most recent findings.

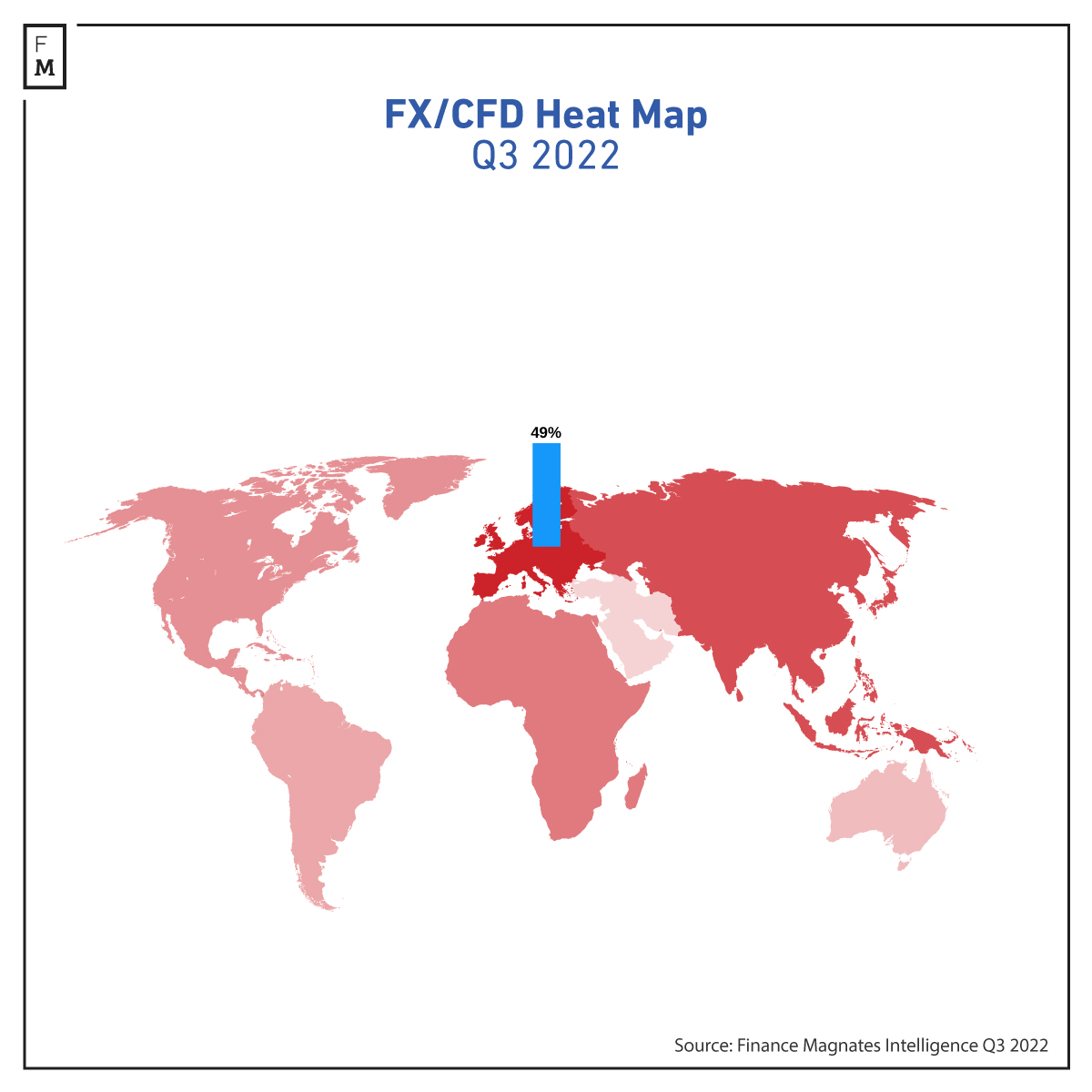

There are several promising regions for the CFD Industry to explore. Since the whole process of the expansion was started mostly in Europe where Cyprus has been home to the majority of FX/CFD brokers, Europe still remains strong despite being somewhat saturated. Our most recent ‘Heat Map’ shows, that 49% of views of the websites in the top 15 leading brokers come from Europe.

The second place belonged to Asia in Q3. Africa was third in terms of interest from CFD clients. We will monitor changes in the situation in the next QIR editions. Does the data mean there is no more room for expansion in Europe as it is already so saturated?

Widespread Adoption of CFD Platforms

Alessandro Capuano, the Head of Europe at Capital.com is still positive about doing business in Europe. He told Finance Magnates that he can see room for the market to expand: „Europe remains one of the regions where people still access markets through traditional banking platforms or old technology. The European market has yet to benefit from widespread adoption of online CFD platforms, which offer greater flexibility and where the average user experience is far better than what European clients can find through more traditional brokerage channels.”

To get the full article and the bigger picture on the map of the FX/CFD industry, get our Latest Quarterly Intelligence Report HERE.