Deciding between investing in managed versus passive funds is a long-standing debate. On one hand, settling for investing in passive index funds means that, at best, one tracks the market minus fees. Actively managed funds on the other hand offer the potential of trouncing the market by investing in the correct stocks and sectors. But, like everything in life, it’s never as simple as it sounds, with research showing that 80% of managed funds underperform market indexes they are supposed to beat over long periods of time.

So should we give up on actively investing? Simply Wall St says no.

A newly launched stock investing site, Simply Wall St believes that investors can maximize their long term wealth creation by sticking to purchasing high quality stocks at attractive prices. The theory that investors can beat the market by focusing on attractively priced growth and quality stocks isn’t a new one. Variances of the idea are behind hedge fund manager, Joel Greenblatt’s “The Little Book that Beats the Market” who introduces his “Magical Formula to Investing,” as well as Peter Lynch, Fidelity’s iconic fund manager’s growth at a reasonable price (GARP) approach. What Simply Wall St aims to do, is to make it easier for investors, both beginner and experienced alike to easily understand the stocks and their potential values.

Snowflakes

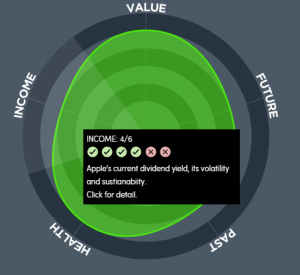

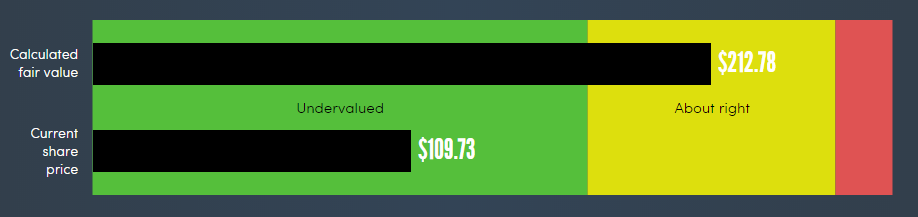

At the foundation of Simply Wall St is its Snowflake rating system. Stocks are rated by their financial health, dividends, past operating performance, future profit expectations, and current price to fair value. Snowflakes are presented in a highly visual form to make it easy for investors to quickly see the potential of any stock.

Following the visual display model, scrolling down or clicking on any of the various components of the snowflake lead to an illustrated explanation of a stock's fundamentals. For those new to stock investing, the visual interface provided is educating and easy to understand. Even experienced investors who prefer to spend time researching stocks to build their own portfolios will find value in the snowflakes and illustrations. One can think of them as a visual Yahoo Finance.

In addition to the visuals, what is probably the most useful component of Simply Wall St for more experienced users is the comparable stocks, or as the site calls them "competitors." Competitors and similar stocks are a normal addition for stock research pages, but Simply Wall St’s addition of the visual snowflake’s to easily see comparable firms is a definite value add.

Conclusions

So who should use Simply Wall St? The site is catering to investors who at the very least are deciding to put a portion of their funds in individual stocks. Specifically new investors will find Simply Wall St easy to understand and educational. I can see the site becoming a natural extension for users of the just launched RobinHood no commission brokerage. Investors research for attractively priced stocks on Simply Wall St and buy them using RobinHood.

At the moment, the site is free to use, which combines well with any free stock or heavily discounted brokerage. Connecting with Al Bentley, Founder of Simply Wall St, he explained to Forex Magnates that the business model is similar to Linkedin “with a free version to suit the majority of users, but also with a ‘Pro’ version with more premium features that includes brokerage.” Bentley also added a coming feature that could be attractive to the growing single stock CFD industry as he commented that, “We also have an enterprise version that allows for white labelling and distribution.”

The bigger question though is whether there is value in retail brokerage customers selecting stocks on their own or just putting their money in a low cost robo-investing brokers like Wealthfront, Betterment or Nutmeg. These firms passively manage funds in index ETFs with a long term investing strategy.

Bentley stated that “Wealthfront and Betterment aim to match the index performance, they also do charge fees for this.” He added that with the alternative of actively managing funds you get a 50/50 distribution of portfolio managers underperforming versus outperforming the market. However the actual results are that after taking fees into account, 85% of actively managed funds underperform.

According to Bentley, “The aim of Simply Wall St is to allow users to get into that 50% which outperform the market.” This is done by “A) Giving them more information than the average investor. B) Encouraging them to be non-emotional by not focusing on short term share price movements and looking at the underlying value of companies instead. C) Staying in the market for the long term. D) Building their own diversified portfolio, via regular contributions every 1-2 months over their lifetime.” Bentley concluded by explaining that they “do not see it as a one off stock picking service, [they] see it as a way of making it easy for users to build their own portfolio of high quality companies over a number of years.”