It has been many years since we saw a major change to the platform offering of what a broker has become, which is synonymous with multi-asset trading. Yes, we are talking Saxo Bank and its new kid on the block, SaxoTraderGO. The Danish bank was one of the first brokers delivering services to retail and institutional clients to provide a vast array of assets

SaxoTraderGO comes in a couple of versions - an HTML5 web-based platform (which is the subject of this review), and for mobile and tablets users wrapped in a native iOS and Android App

Focusing on the HTML5 web-based version, we have to begin with the fact that Saxo Bank was one of the first Online Trading companies to develop a multi-asset platform.

As time went on and as we have seen more and more offerings on the market, the native .net application offered by the Danish brokerage, SaxoTrader, has become somewhat of a clunky user experience.

Back to the new SaxoTraderGO HTML5 user interface, we have to mention here that the offering is also available via App Store for iPhones & iPads and Google Play for Android mobiles & tablets.

Overview

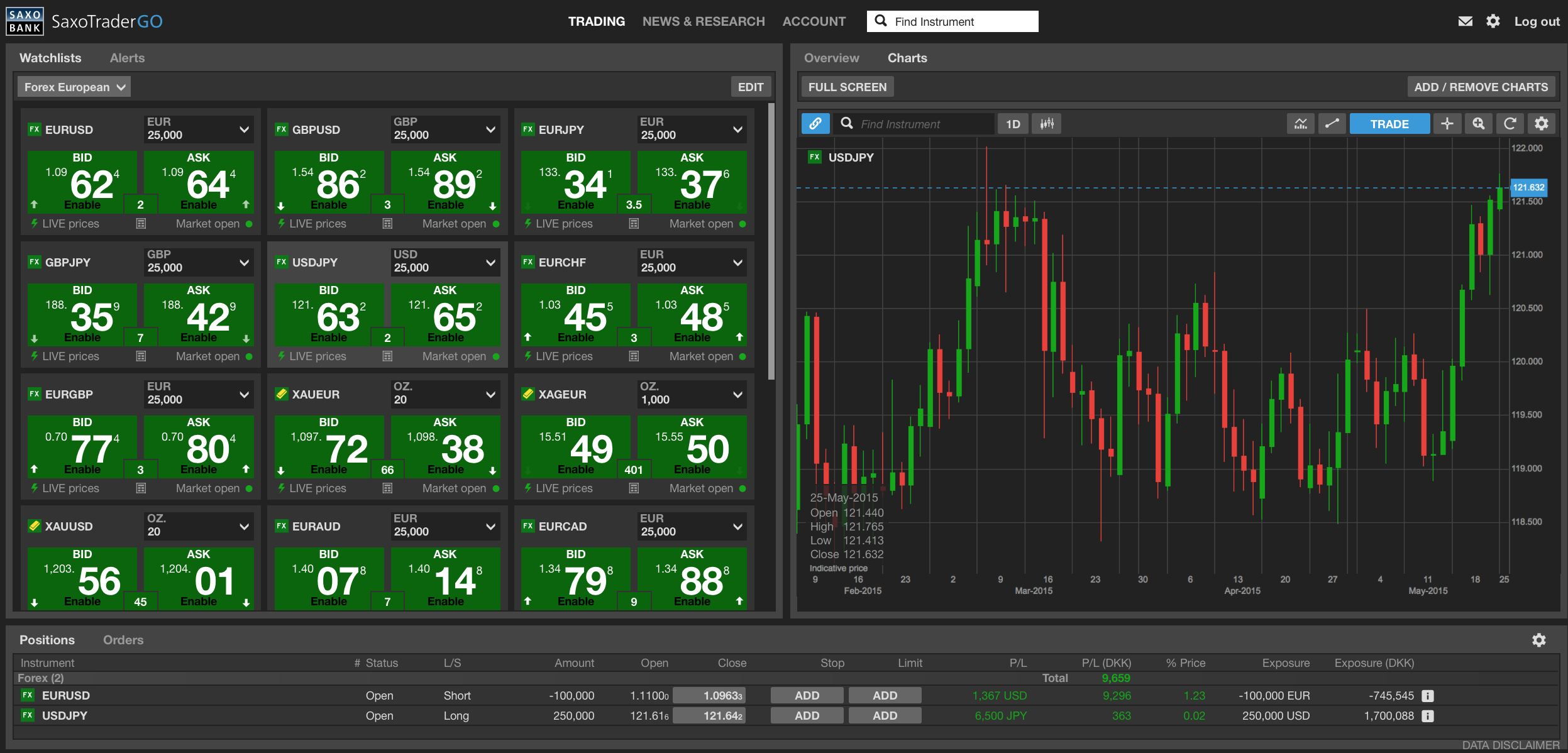

Without further ado we delve into the platform itself. The biggest change obvious from the first glimpse at the screen is that Saxo Bank has parted with the multiple windows experience. The offering is now designed to fit into a single screen irrelevant of the asset classes that a trader chooses.

The traditional watch lists control a number of features on the screen of SaxoTraderGO. Different layouts are present for different users - trade boards, quotes lists, news and charts - everything is designed to blend into a single screen and it works seamlessly.

The contrasts with the SaxoTrader platform which are native to Windows are huge - non-professional traders will definitely feel more at home with the simplified and intuitive versatility of SaxoTraderGO. The moment the user chooses an asset, the components of the platform display the different aspects to it.

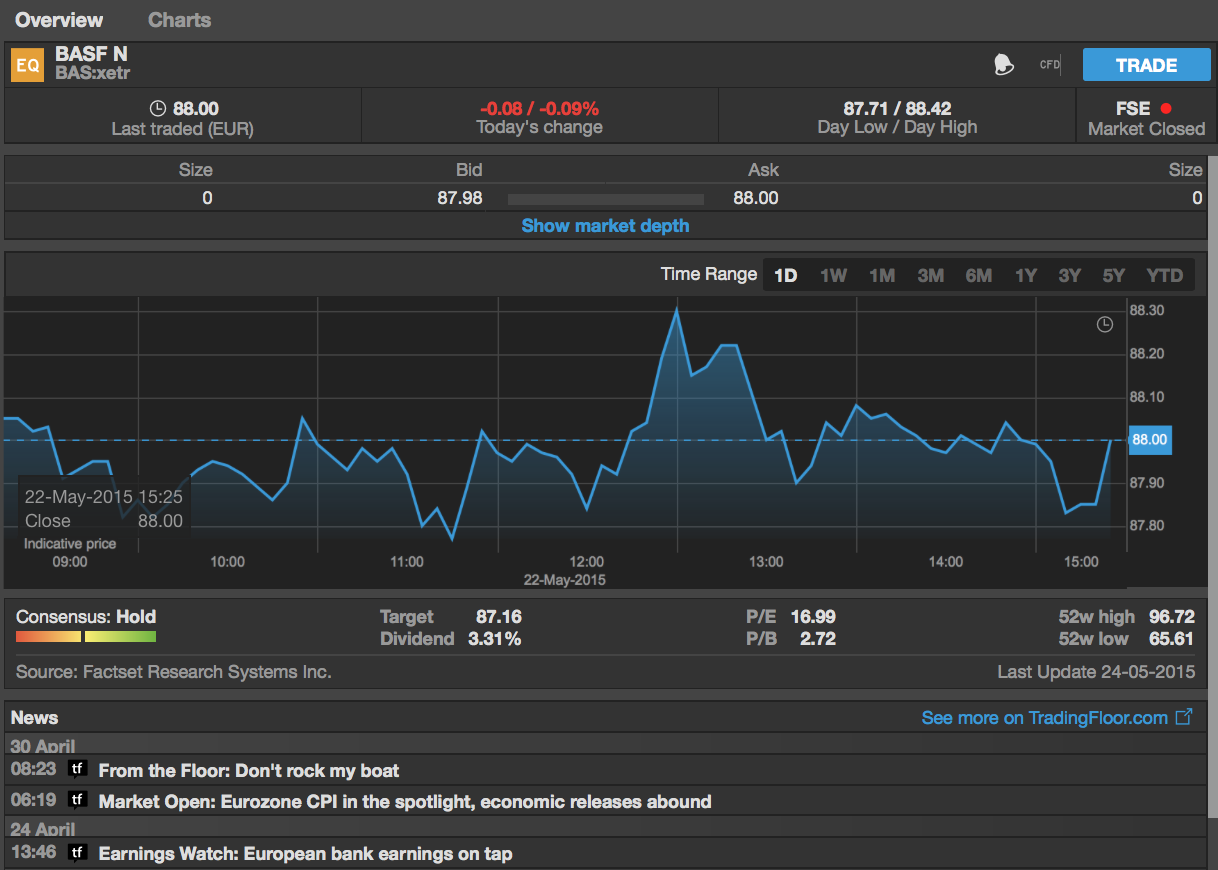

As with the native platform of Saxo Bank, SaxoTrader, equities and CFDs traders have access to full depth of the order book if they sign up for Level 2 data on the instrument. The information includes a graph and it also displays consensus estimates from a number of analysts of the given stock. For convenience, once a trader has chosen the asset that he/she wants to trade, a quick switch between equities, CFDs and options is available.

Speaking with Finance Magnates, Saxo Bank’s Head of Trading Platforms, Christian Hammer, shared that the equity research tool with which clients of the Danish brokerage are already familiar with, is going to be integrated into SaxoTraderGO in the coming months.

With this information at hand we asked whether we were to expect some dramatic new features, and some of the traders who use alternative data might find what Mr Hammer had to say as interesting.

“We will share with our clients our accumulative FX order book - long and shorts positions and a cumulative ratio. We will try to put out all the extra information that we can in the coming updates,” he said.

Charts

The charts on SaxoTraderGO are completely revamped. The HTML5 package which SaxoTraderGO offers is completely revamped from the SaxoTrader platform. Best of all - it is fully synchronized with mobile devices, just like watch lists - the changes which clients make from platform to platform will be reflected seamlessly into the Apps for Android and iOS.

The current setup on SaxoTraderGO features all major indicators, with the majority of the clients’ needs addressed. That said, over the coming months, Saxo Bank will be adding more to bring the offering in line with the availability on the native Windows application SaxoTrader.

Trading from the chart is now available with users being able to drag and drop their entry, stop, limit orders on the chart as they see fit. Multiple chart windows can be linked to a single instrument without any difficulty. A convenient feature to mention here is that the parameters of every study can be changed on the fly - the user sees the curves changing with the new input.

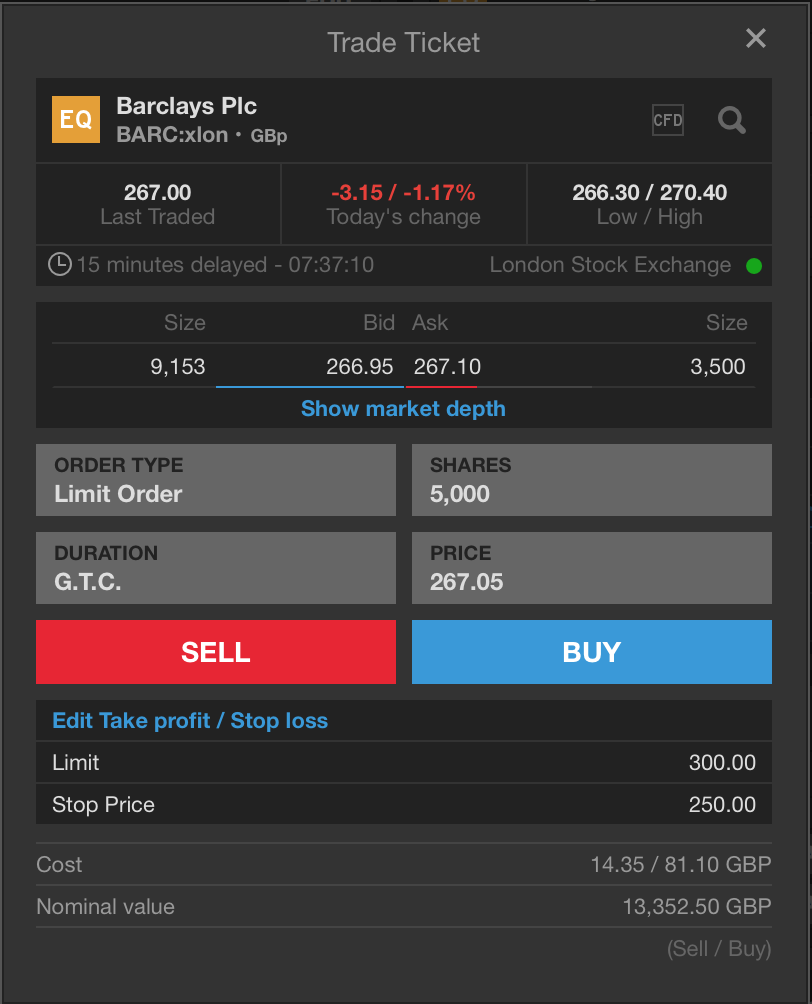

Trading tickets are very intuitive and easy to use - users again get the usual Market Depth for listed instruments. The client can add related orders with stops and limits defined in percentage or in nominal terms. If we choose to trade FX options, we get all the Greeks directly in the trade ticket.

Alerts on SaxoTraderGO come in two forms - the iOS and Android allow for push notifications, while on the desktop there is a standard offering carried over from SaxoTrader. Mr. Hammer has also added that in the coming iterations we will see alerts on trend lines and indicators.

Pre-Trade and Post-Trade Modules, Open API

The pre-trade universe which the platform offers is tightly integrated with the company’s rather successful content and news hub tradingfloor.com. A simple news calendar adds to the list of features with the news feeds wrapping up the offering with plenty of pre-trade information.

The “My Account” section typically shows the overview of all accounts of the user in a convenient and detailed way, trading conditions, fees, spreads of all of the instruments offered by Saxo Bank.

By the end of the year, Saxo Bank aims to make the Open API available to external developers and white labels. They will be able to integrate all of the back-end and front-end functionality which Saxo Bank’s new platform offering has to deliver.

They can re-build every aspect of the platform, including the pre-trade environment with their own portal. Every company will be able to tweak the platform to a level where users will not be able to recognize whether they are using a white label of Saxo Bank’s.

The platform will roll out across all the jurisdictions in which Saxo Bank is operating in May and June, while white labels will gain access in the third and fourth quarter of 2015.