For brokers operating a true ‘No Dealing Desk’ model, handling client risk isn’t much of an issue. What is a critical issue is Trade Reconciliation. In an article about Risk Management practices that was published in the Forex Magnates Q1 Industry Report, we discussed problems that brokers and dealers from the smallest shops to the largest global financial concerns face. While firms mentioned the importance of monitoring arbitrage, network latency, and market volatility, trade reconciliation was a universal item that companies needed to address. Trade reconciliation refers to the tracking of executions to ensure that trades and orders are being reported correctly in both client and broker accounts. For STP order flow, reconciliation entails knowing that all of those trades that are being sent to the market actually reach their destination, and a broker is taking no risk on those trades.

Explaining the importance of proper reconciliation, we wrote in the Q1 report “In situations where there is a technology fail that leads to a trade failing to be executed with counterparty, it causes a broker’s risk exposure to become tainted. Rather than having no exposure, as trades are being sent to the market, a broker order will cause a broker’s aggregated client positions not to match those they have with their Liquidity providers. If left unrealized for large periods of times, the mismatch could lead a broker to incur heavy losses, while believing their books are completely hedged. Trade reconciliation monitoring is especially important when operating platforms such as the MT4 environment that weren’t created as pure ECN programs and require third party programs to facilitate STP trading and execution monitoring.”

Assisting brokers is reconciliation-software that connects to broker, client, and counterparty accounts to monitor order-flow. Systems can either be third-party products or are integrated solutions that are part of a trading platform’s features. Among third party providers, a new entrant to the field of broker tools is CurrentDesk.

Led by Ron Singer and Travis Dahm, CurrentDesk is a BVI based firm that will soon be launching an end to end broker technology service called CurrentBusiness. Singer explained to Forex Magnates that while developing their product, CurrentBusiness, and speaking to brokers, they found that there was a gap in trade reconciliation products in the market, which in turn led them to create CurrentRisk. Singer said “we spoke to brokers and found there was a need for this product. Trade reconciliation was a feature that we were developing for CurrentBusiness. Therefore we decided to provide it as an independent offering even before launching our complete platform, CurrentBusiness.”

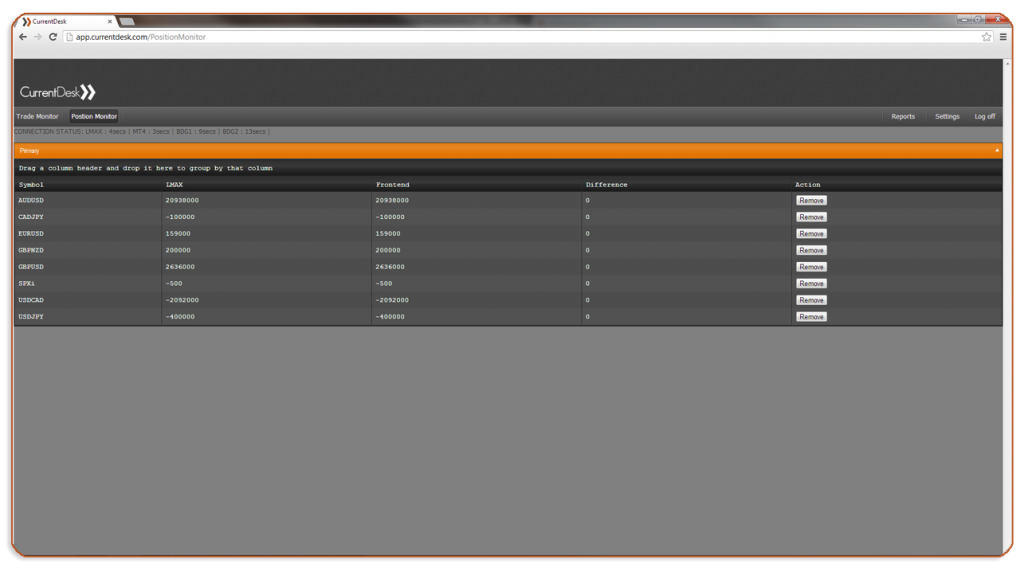

Singer explained that their product is platform and broker agnostic and works by “grabbing data from prime brokers, liquidity providers, bridge providers, and trading platforms, such as a broker’s MT4 Manager.” CurrentRisk then combines the feeds in a single interface that monitors order flows in real time as well post trade among the different parties. In situations where there is a mismatch among accounts, or if a network connection goes down, CurrentRisk sends an alert message. The alert appears on the user interface with the ability to have an email also sent to the risk management and trading teams. In addition to trade monitoring, the product also offers robust report features. The reports monitor aggregated trade totals, slippage and execution times. About them, Dah, commented that the report features “empowers brokers when handling clients to know whether client claims are accurate or not. They also allow brokers to understand how well they are being executed by their liquidity providers and whether there is latency.”

Singer added that while CurrentRisk can provide value to any broker that has hedged order flow, they are currently targeting STP brokers. The product also meets MetaTrader requirements as it doesn’t require plugins and is available as a fully hosted, no installation offering. CurrentDesk’s end to end CurrentBusiness offering is expected to be launched this summer.