Launching a new forex brokerage, firms more or less use one of two options; taking the MetaTrader 4 (MT4) ) approach and marketing themselves like crazy through affiliates or web advertising, or offering a unique platform or service to differentiate themselves. While the former is easier to get off the ground but more competitive, the latter is far from a sure thing with retail forex traders being comfortable with MT4.

Entering the market, but taking the latter approach of launching with a unique selling proposition, is Silicon Markets. Unveiling its platform at the Finance Magnates London Summit earlier this month, Silicon Markets is aiming to distinguish itself as the ‘fintech’ broker. The heart of its platform is what it calls the availability of institutional level services such as strategy building and algorithmic trading, made accessible to retail traders.

Presenting its product, Matthew Kirkham, Co-Founder of Silicon Markets, explained that while many retail traders are using MT4, very few of them are able to code on their own. The result is that they are either buying Expert Advisors (EA) from third parties over which they have little or no control, or hiring developers to build EAs for their algorithmic trading using MT4.

We want to provide exciting and disruptive technology, that is free and easy to use. The industry is crying out for it

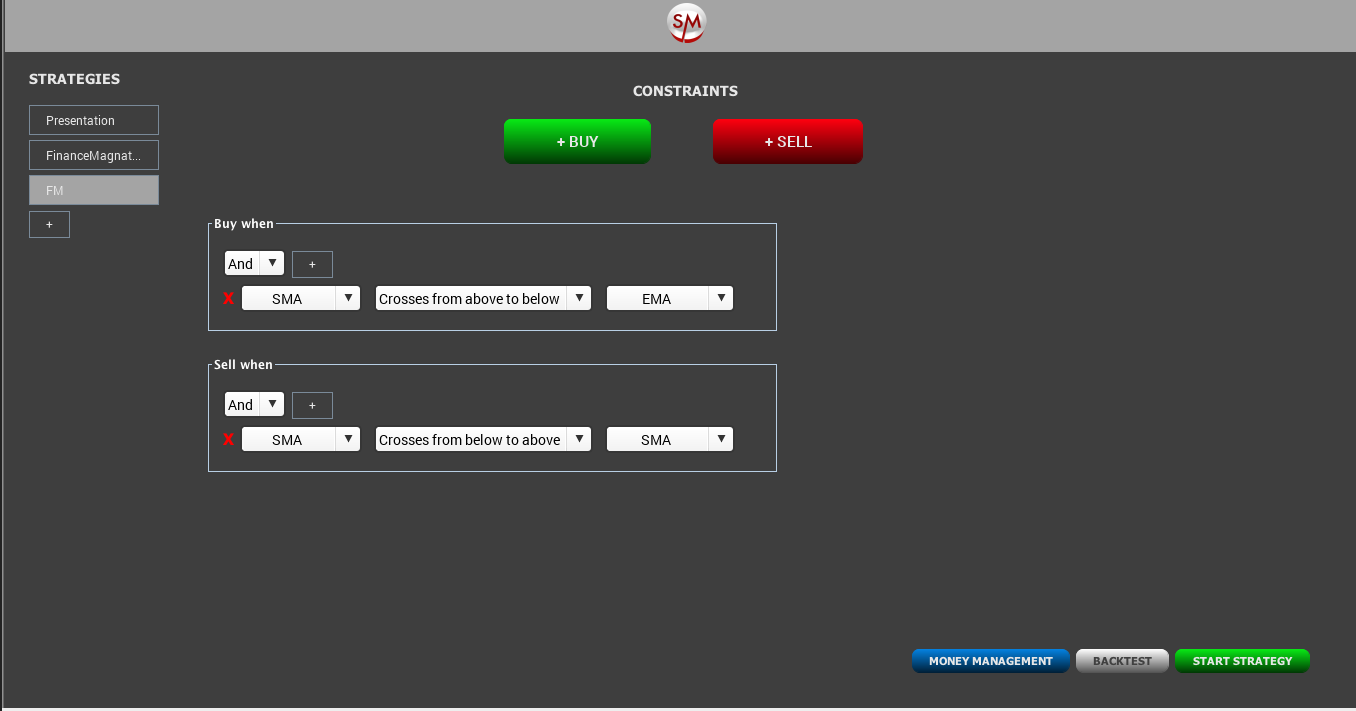

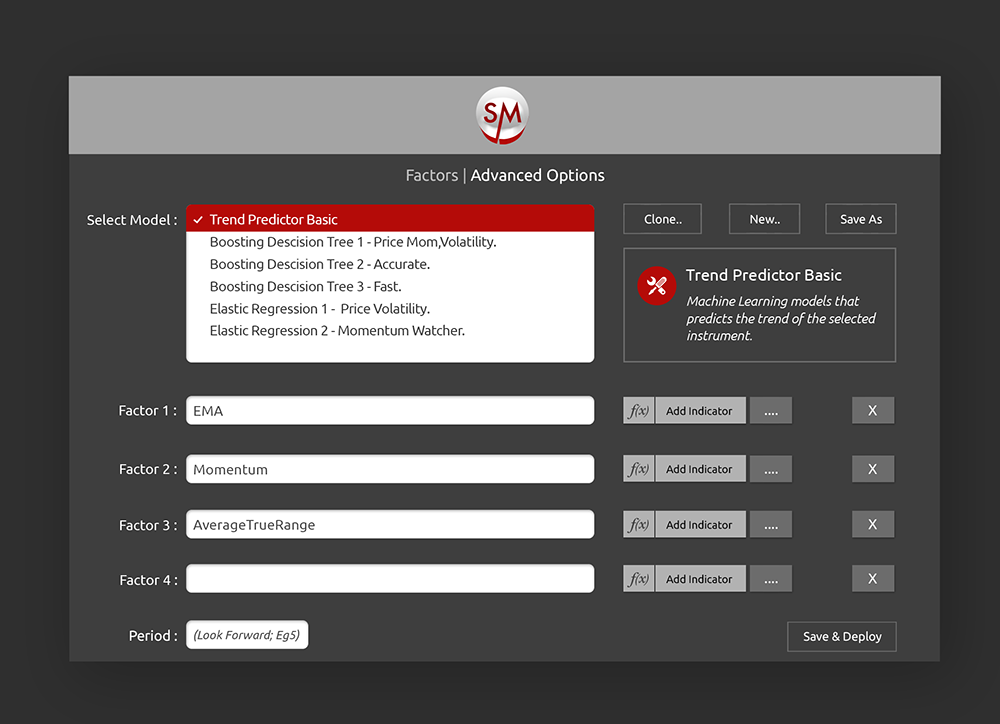

As a solution, Silicon Markets has created both a strategy builder for traders to automate their trades which doesn’t require prior programming experience as well as a strategy creator. According to Kirkham, the strategy creator uses machine learning technology to review market conditions and develop potential trading strategies that can be automated. The goal is to provide traders with the ability to both automate their existing strategies as well as to find new ones.

Explaining part of the thought process behind focusing on technology, Kirkham added: "We feel it is important to focus on adding value to the trader; through elegant and powerful software solutions. Silicon Markets have no interest in being 'just another broker'. We want to provide exciting and disruptive technology, that is free and easy to use. The industry is crying out for it."

Operates on Tradable

Perhaps one of the more interesting facets of Silicon Markets was its choice to develop its technology around the Tradable platform. According to Kirkham, this was due to the open nature of the platform compared to that of MetaTrader, which allowed its technology to better integrate with Tradable.

Since launching in 2013, Tradable has garnered a lot of hype with its ‘app-based’ and ‘open’ platform. This has resulted in its ability to attract many developers who have created products for the platform. However, while Tradable has grown its user base, it has yet to make any dent in MetaTrader 4’s market share.

Although Silicon Markets also offers MT4 as a Trading Platform to customers, by developing its unique strategy solution for Tradable, it is also speculating that its platform will be well-received by customers. According to Kirkham, early results have shown strong interest from traders for the system with the open beta for the platform scheduled in January.

Looking ahead, it will be worth watching if other brokers follow its lead and also take the initiative to develop proprietary solutions to distinguish themselves using Tradable as the underlying platform.