On Wednesday, retail broker Pepperstone announced that it had launched a new set of products to trade in - single stock CFDs.

The Australian firm is the latest in a series of brokers to add CFD share trading to its platform.

The product is not especially new, and a number of brokers have been offering the service for years. But with regulatory pressure increasing across the globe, retail trading firms have been pushed to make new additions to their offering.

“Your standard, Forex -only MT4 broker is going to start struggling,” an executive at a technology provider told Finance Magnates. “Firms that don’t start adding share trading, whether real or CFD-based, they are going to fall behind everyone else.”

Exchange headaches

Of course, adding single stock CFDs is easier said than done. Last week, Finance Magnates reported on the difficulties brokers face when adding stockbroking to their platforms.

Adding CFD share trading is not as problematic, but it’s not a simple process either. And as with stockbroking, one of the big hurdles to adding the product is dealing with exchanges.

“When a company enters the CFD equities arena, a lot of their processes have been put into place without taking into account - at all or even nearly sufficiently in the majority of cases I have seen - the market data licensing required,” said Rafah Hanna, a market data consultant.

“Exchanges do not make it difficult to access data, that is a misnomer. What is very complex, and can be daunting, is the licensing process, policies, understanding reporting requirements, licensing compliance and so on.”

High demand for everyone, low volumes for some

All of these compliance and licensing costs are expensive. In fact, for many brokers, the costs are high enough to preclude them from actually adding the product to their trading offering.

More frustrating for some of those who do choose to add the products is how clients actually use them. Finance Magnates spoke to several brokers who said their customers repeatedly asked for shares but then barely traded in them.

“We saw a high demand for CFD equities trading from traders,” said Wei Qiang Zhang, the CEO of London-based brokerage ATFX. “But the actual volumes are low compared to other products we offer.”

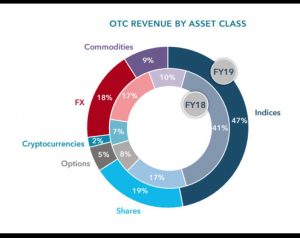

IG Group OTC Revenue Breakdown for 2019

This isn’t true across the board. IG Group, for example, reported last month that 19 percent of its OTC revenue in 2019 came from trading in shares.

That was more than the company made from any other OTC product except for indices, which, contributing 47 percent of revenue, continue to make up the bulk of the group’s retail trading revenue.

Beating low volatility

Aside from being an additional revenue stream, adding equities can also help brokers to better handle periods of low volatility in other business areas. The currency markets, for example, experienced a prolonged period of low volatility towards the end of 2018 and throughout the first quarter of this year.

That directly contributed to drops in revenue for some brokers over the past twelve months, with Plus500 citing it as a reason for declines in trading income in its last two financial reports.

An over-reliance on one type of OTC product isn’t just bad for brokers’ bank accounts. It also means traders can’t access the markets that they want. That could lead to them going elsewhere to trade.

That being the case, there is a synergy between both what brokers’ clients want and the products they provide. Offering CFDs on shares is beneficial to traders that want access to those markets and to the brokers that will make money from the trading.

“We are constantly looking to diversify our offering and not be over-reliant on FX market volatility,” said Craig Mischel, a product manager at FXCM.

“Single stock CFDs are highly requested by customers of virtually every demographic. Our clients are interested in speculating on the price movements of companies they have a strong sentiment towards but would like lower capital requirements when compared to physical stock trading.”

MT4 limitations

Wei Qiang Zhang, CEO, ATFX

If they do decide to try and add single stock CFDs to their set of products, brokers, once they’ve overcome any exchange-related hurdles, are also likely to be faced with a platform problem.

Most brokers continue to use MetaTrader 4 as their Trading Platform of choice. That’s not necessarily a bad thing, but the platform does limit the number of instruments a broker can offer to their clients.

“If brokers want to compete with [their competitors], they have to have their own platform or upgrade to MT5,” said Zhang. “This is what we are working on.”

Assuming they can afford to do it, offering CFDs in equities is likely to become the norm in the retail trading industry.

Client demand, regulatory pressure and a need to diversify into different markets mean every broker that can adopt the products will probably do it.