Being an experienced trader has put me through a lot of challenges as I was making my first steps in the foreign Exchange industry. Having an economics background and a lot of curiosity about the markets turned out not to be quite enough to succeed 10 years ago. At the time every other broker was winningly and purposefully finding many ways to scam its clients out of their money. And this went to be truth not only for minor unknown entities, but for rather respectful publicly listed companies today. One had to carefully hand pick a reliable broker and since the forums dedicated to the matter were few, the most truthful and reliable way to find out who is one dealing with was to simply go ahead and open an account with a company which you would deem to be trustworthy. The process was exhausting and did cost vast amounts of funds. Now we are facing a similar situation - the number of brokerages is humongous and the trading conditions are not always reliable. The stream of information about brokers is so wide, that it is very difficult to filter out proper feedback and reviews from paid affiliated networks which are promoting a low quality product. The Platform Here is where ONYX Trader can fill a gap. The platform is at an early beta testing stage now, but its is aiming to solve one of the prelims mentioned above by aggregating multiple accounts and brokerage feeds into one place. Another case in which this comes handy is simply when one has multiple accounts to take care of. It can all potentially happen from a single web-based platform.

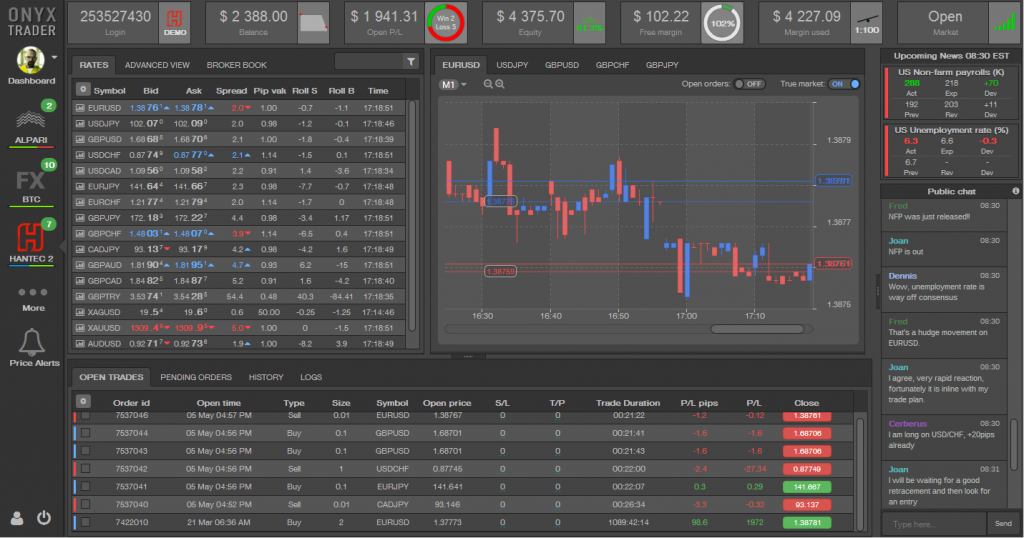

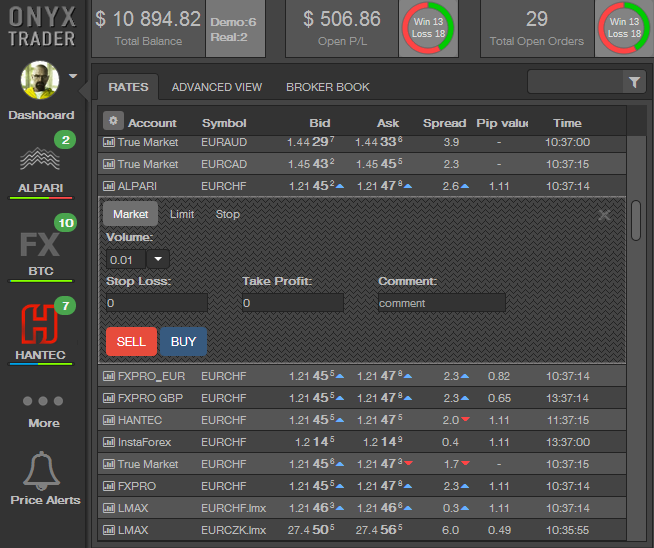

For now it is supporting MT4 brokers with FXCM, cTrader and FIX support planned for a later stage. The display features a quick overview dashboard with status bars informing traders about P/L, margin call status and a badge informing the trader about the total number of open trades.

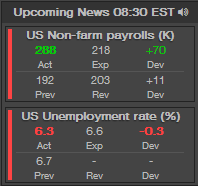

With the main focus being on the multi brokerage support, let’s have a look at some additional features which can be deemed interesting by the trading community. As the platform aggregates data from multiple brokerages, there is a feature called “true market price” which is designed to help traders identify if there is a discrepancy in the pricing mechanism between the broker which they are using and the market price. It is calculated on the basis of the multiple feeds which are aggregated by the platform. Additional Panels Real time news alerts are featured in platform providing a follow up calculation of the difference between expected and actual numbers. This could be handy tool for all of those who are keen to trade news releases aggressively.

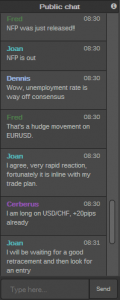

The last characteristic feature of

the platform is a public chatroom. Traders have open access to it and can input their comments at any time to share information with the trading community. The merit from this is not clear, as surrounding news events this feed could be changing too quickly, while during a slow day there won’t be many updates. That said the company will need to put in a lot of effort to filter out spam messages which are always common with similar types of products. The goal which the company has set for itself is rather ambitious and as it is expanding its reach across different platforms and brokerages some challenges will be presented, it reaims to be seen whether the firm will be able to overcome those to deliver a solid product and provide its customers with a fast enough Execution and enough superior grows it will be facing.