Launching at the Finance Magnates London Summit earlier this month was Tapaas, (also known as Trading Analytics Platform as a Service). Working with technology provider OneZero, Tapaas has developed a new Risk Management and reconciliation solution for online forex brokers that uses both visual data and alerts to assist brokers in handling their order flow.

Presenting the product, Tapaas Founder and CEO, David Hall, explained that the idea behind the creation of Tapaas was to “bring tick data analytics that had been typically only available to the biggest banks and making it available to retail brokers.” Doing this, Tapaas targets two main areas of risk analysis required by forex brokers; monitoring reconciliation of trades sent for straight-through processing (STP) and reviewing customer order flow when warehousing risk (market making).

Go to 1:07 mark to go directly to the presentation or click here

[embed width="560" height="315"]https://www.youtube.com/embed/g5vGWs6shso [/embed]

When it comes to trade reconciliation, in a perfect world all customer trades are automatically hedged with external Liquidity providers. However, due to network disconnections and rejected trades, brokers will often find that certain orders haven’t been properly hedged. Through automated reconciliation tools, firms are able to be alerted when STP trades aren’t properly hedged.

In terms of market making, Hall explained that in theory, warehousing is a profitable endeavor for brokers as over the long-term “the house wins”. But, the reality is that there might be toxic traders that are eating into a broker's profits that need to be identified.

Hall explained that for many MetaTrader brokers, monitoring order flow and reconciliation is the act of downloading reports from the MetaTrader Manager and uploading them to Excel. However, the fault of this system is that it isn’t based on real-time monitoring and is time consuming.

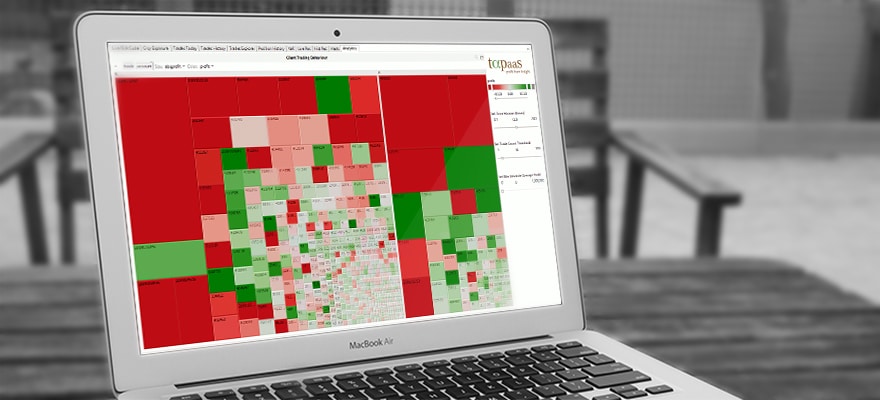

To provide a solution, Hall explained that Tapaas connects directly to the data centers in order to create a real-time platform for analyzing order flow. The result is a visual display of hedged trades and monitoring of warehoused trades. On the surface, the platform draws from the simplicity of Excel, using the familiar rows, columns, and cell structure. But, Hall stated that early broker users have referred to Tapaas as “Excel on Steroids” for its ability to display data in real-time.

In creating Tapaas, the product has two main components which work together but can be displayed independently; reconciliation and risk exposure. For reconciliation, the system matches data from MetaTrader with executions from liquidity providers. The alerting engine then lets brokers know if there is an error with hedging risk as well as displaying the data visually.

Non-hedged order flow is also analyzed to provide real-time calculation of risk and exposure. Customers can customize exposure levels to receive alerts when risk limits are breached. In addition, the platform displays customer positions and overall risk exposure visually, with brokers being able to click on any cell box for a deeper explanation of the risk and positions.

Among other features, Hall demoed the historical analysis features available with Tapaas. Examples include being able to review select time periods to review how often customers were trading and what were the most profitable securities being traded. Filters can also be made to analyze specific client sets, such as those who trade ten a day or during a specific period. The data is useful for brokers to better understand their clients in terms of where their risk is occurring from and who best to STP.

Beyond the risk side of things, the visual data could also be used by marketing teams to review customer trading habits. The information could then be used to provide more alerts to customers around popular trading periods, such as news releases or promote less active securities.