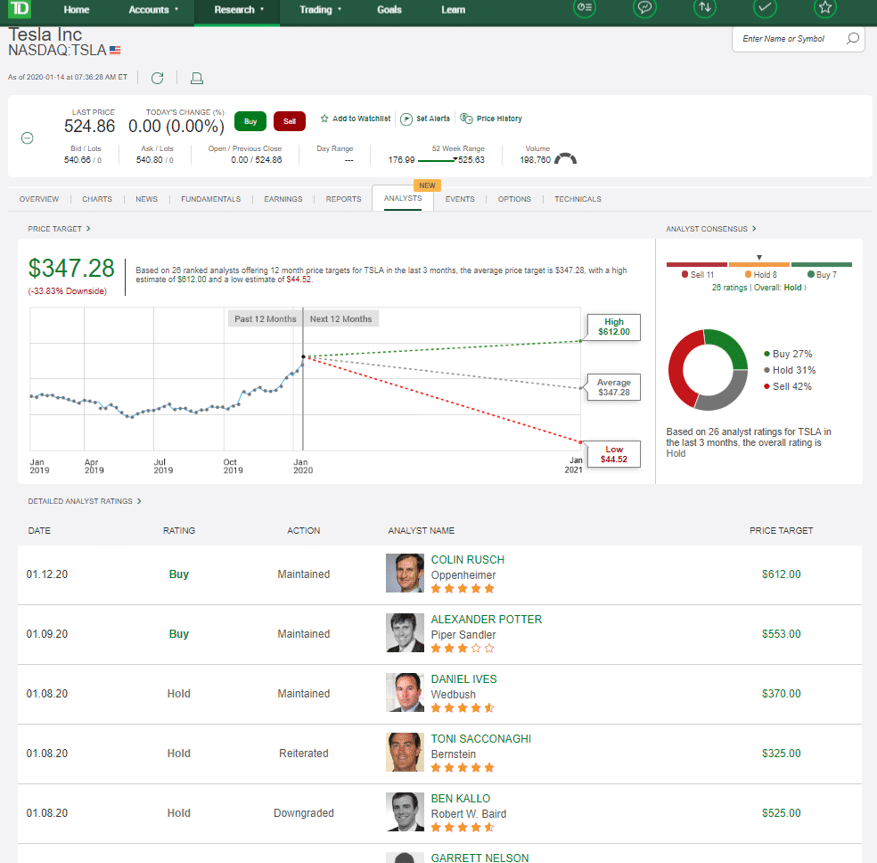

Canadian bank-owned brokerage TD Direct Investing has completed the integration of TipRanks’ rating tools, which ranks financial analysts and bloggers based on their picks’ performance analysis. As the first to bring this offering to the Canadian market, the new product will provide self-directed investors with new research capabilities. The toolkit offers stock ratings and price targets from a collection of ranked analysts as well as analyses of the latest news sentiment. “Using datasets from Crowd Wisdom, News Sentiment and Global Research analysis, TipRanks' proprietary algorithms analyze and track the recommendations and transactions of over 40,000 financial experts, providing users with the ability to design a customized investing approach,” the company said in a statement.

TD Integration

TD Direct Investing’s clients will obtain all the information they need to know to make educated investment decisions. TipRanks virtually creates a ‘financial accountability’ engine that collects the digitally published stock recommendation and ranks analysts by the performance so that investors can see their success rate. TipRanks allows traders to see the track record and measured performance of any stock analyst, blogger, hedge fund, or corporate insider dating back to January 2009. The company's offering shows the performance of anyone who provides financial advice simply by searching for his name, which allows users to see what analysts consistently outperform the markets, get real-time recommendations, and more.

TipRanks aggressively expanding the footprint

There are a few platforms that offer similar services to their clients, like Covestor. Still, the Tel Aviv-based company says it is the only one that tells investors how reliable the rating is by calculating how profitable ratings from this analyst have been in the past. This allows newcomers to follow the lead of others who are obviously more knowledgeable. TipRanks has been pursuing several partnerships already in 2019, most recently extending the use and market penetration of its product to a number of venues, including Bloomberg and others. Nasdaq and Santander also assimilated the service into their respective offerings, giving TipRanks access to its largest client base to date. "The Canadian launch of our product is a significant milestone in our global expansion strategy. Our ability to tailor the best research tools in Canada and simplify them for the needs of individual investors is game-changing. Our goal is to level the playing field for individual investors by offering them access to institutional-level tools," said Uri Gruenbaum, CEO of TipRanks.