Thomson Reuters has introduced its Watchlist Pulse app, consisting of data set analyses which can provide users of the Eikon product line with a tool to quickly monitor and review events impacting performance of companies in their portfolios or watchlists. The tool provides some additional information about the patterns of stock performance and trends.

The move comes after recent efforts by the major heavyweights in this space - back in March, Bloomberg introduced a sentiment analysis app by Singapore-based developer, InfoTrie named FinSentS, while in February, Thomson Reuters added Twitter feed analysis to Eikon.

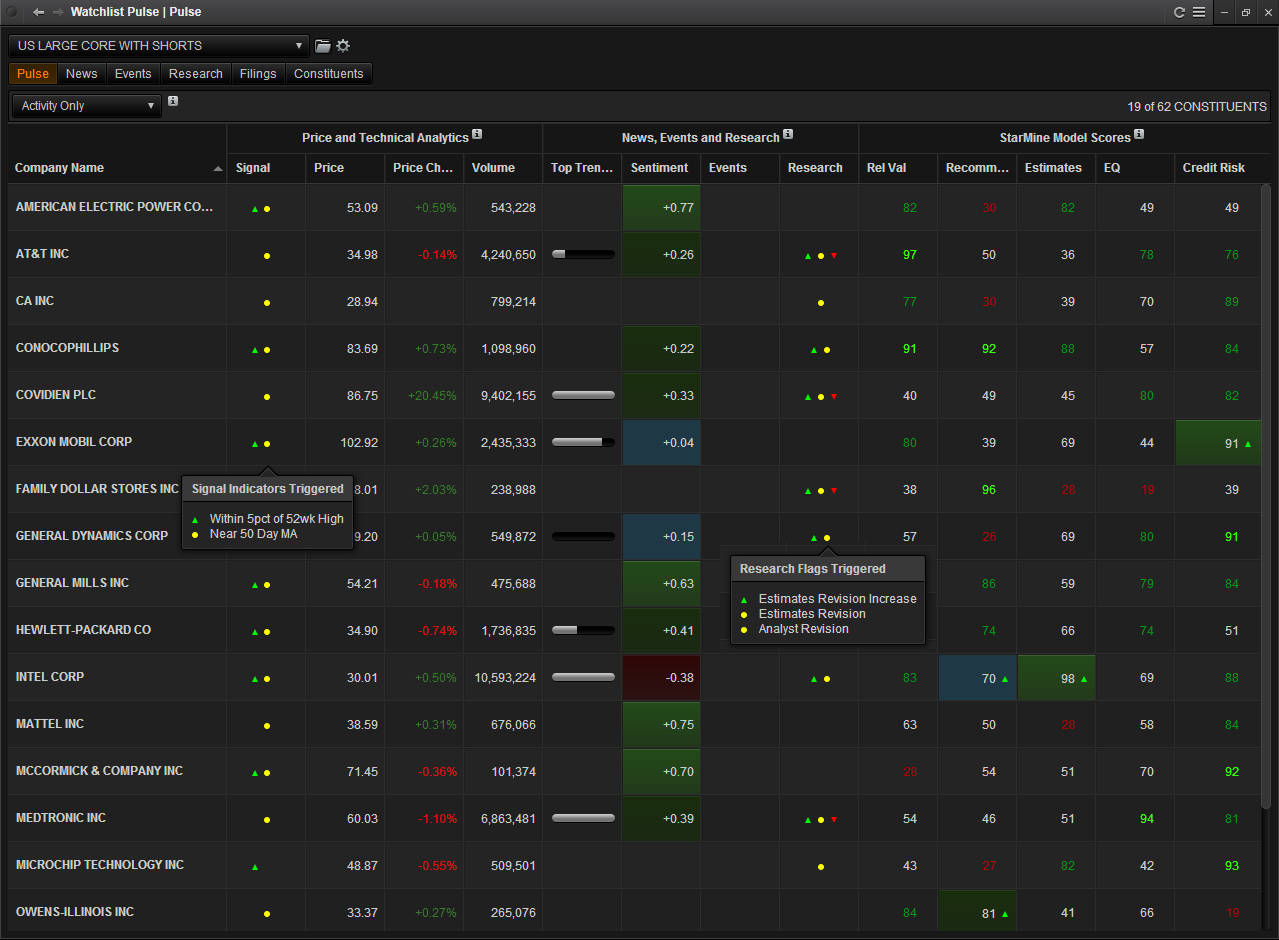

The tool uses proprietary content and technology from Thomson Reuters, aiming to attempt to identify what events will have an impact on the coverage list. The outline provides the customer with a quick view of news affecting each company and provides information as to the volume of news affecting the company through the "Top Trending" column.

Watchlist Pulse in Action

The news sources Thomson Reuters encompasses are more than 400. The tool also provides a sentiment tracker, assessing the mood of the news on the market about the stock. Next information set is provided by the research column, which provides analysis from the customers' preferred brokers (if any) over the past 24 hours, initiation reports, M&A activity or management changes, recommendation changes, revisions to estimates or target prices.

According to the head of market structure and technology research at Greenwich Associates, “The financial markets are quickly becoming more transparent, but with that transparency comes an overwhelming quantity of data that financial markets professionals are forced to consume in order to be successful.”

He goes on to explain, “A consolidated, actionable view of news, research, price signals and market moving events provides a true information advantage for portfolio managers and research analysts alike.”

While we cannot disagree with the above statement, the merits of Big Data usage to predict future moves of share prices remain unexplored. Many companies, including one of the most prominent hedge funds in the last decade, Bridgewater Associates, have been using the so-called sentiment analysis tools and big data to analyze economic trends, however the plain analysis of raw news data about companies or price targets by various analysts.

There is no true account of the record of these analysts, and many of them are too early to call a bottom and too late to call a top, which provides investors with a set of challenges - it’s just like with rating agencies which have been covering Greek bonds. Most analysts are simply too late, and the market is a forward-looking discounting mechanism, so the merits of a tool which looks at raw current data about a firm, instead of its business, are for now questionable.

All that being said, the Watchlist Pulse app still deserves attention. It’s up to the customers of the product to find out exactly how they can use this information set for their benefit, as every new tool needs some time for “figuring out”.