With the approaching Brexit referendum, a community of industry participants has developed an online tool which might prove to be very useful for clients of FX trading services. The best part of the initiative which is launched by TradeProofer is that the service is free of charge and available to all traders willing to verify their execution rates.

TradeProofer is a community where traders can upload their market data and their trading history and use the server side benchmarking on the website which reveals whether a certain trade has been executed in line with the rest of the market.

The company will provide its members-only TickRadar service on a public URL during the Brexit event, so all traders can proof their trades against the rates of over 50 brokers' aggregated quotes and/or follow how quotes behave during critical periods of Volatility .

The service can help identify whether poor trade execution was due to general market conditions or issues with the execution engine of a specific broker. Traders can actively assess their trade history, which could be very useful for periods of very high volatility such as the upcoming calamity around Brexit.

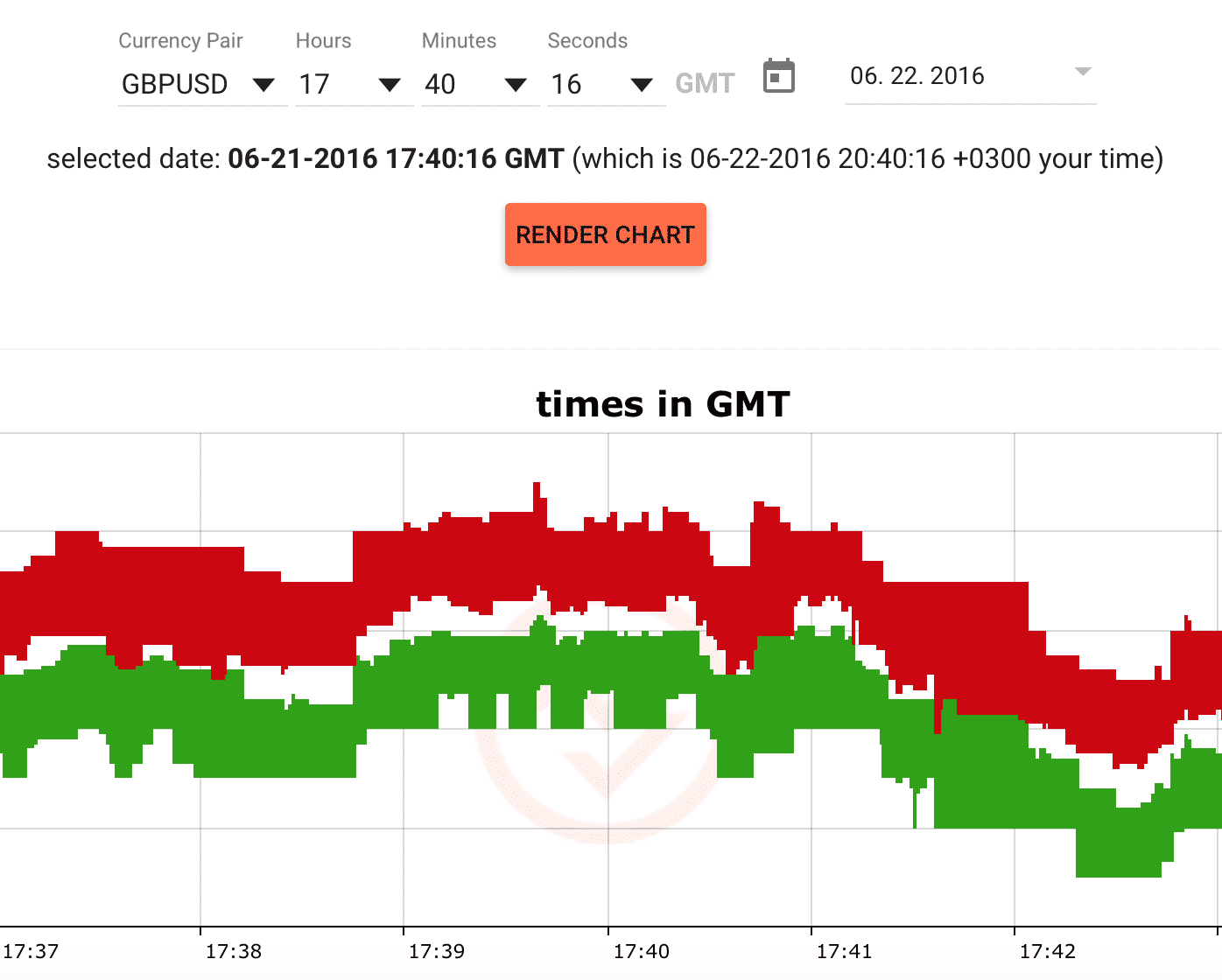

The live tool is effectively a chart rendering engine where traders can input their trade details. The solution renders a chart which displays bid and ask rates. The trader types in the instrument and the precise time of the trade.

TradeProofer is a community of industry professionals who have launched the tool with Brexit in mind. The effort could be very useful for traders that have interest to compare their execution rates to the rest of the industry.

The online tool will be available in the coming days for the use of retail and institutional traders on the following link.