As part of its goal of creating crowdsourced forex spread and Execution tools for retail Forex traders, TradeProofer has recently launched Tick Radar. The product allows retail traders to connect their account executions to receive transaction cost analysis (TCA) of their traders. The goal of the offering is to avail retail traders the ability to compare their actual executions to their broker’s stated bid and ask prices.

In addition, Tick Radar provides reports which indicate the average bid and ask prices being quoted at the same time from other brokers. This feature can be used as a benchmark for customers to analyze how their broker’s quotes compare with the rest of the industry during different periods of trading. This aspect is important for many customers with floating spreads, as even though their broker may have tight spreads 99% of the time, a trader’s strategy may lead to many executions taking place during the 1% wide spread period.

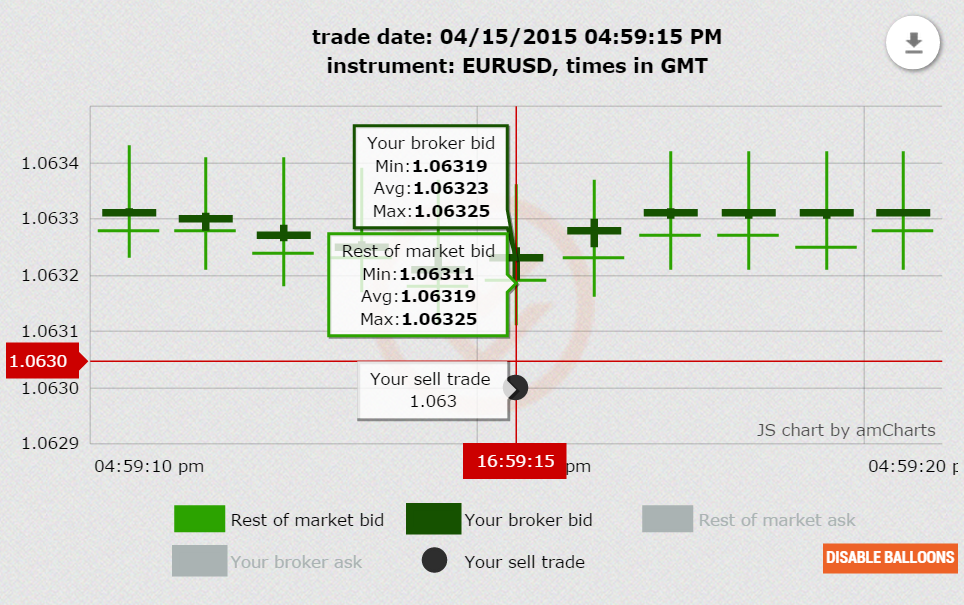

Tick Radar custom report for out of market executions

Offered as a freemium offering, Tick Radar is available as an Expert Advisor that automatically sends trader information for analysis. Separately, there is a free version, where traders can upload individual trades for TCA verification. For both, Tick Radar highlights outlier traders where there was poor execution from the broker. This information is then available in a downloadable statement (see above), of which traders can use to file trade complaints with their broker to receive price improvements in their account.

Overall, while TradeProofer is an evolving offering, they are gaining traction in their goal of crowdsourcing trader quotes and execution data to increase transparency for broker customers. Speaking to Finance Magnates about future plans, the firm's founders stated that they are currently active in raising seed funding to expand analysis features and increase the community's user base.