The United Kingdom-registered entity of Exinity, a brand controlled by Andrey Dashin, generated a revenue of more than £2.07 million in 2023, a year-over-year jump of 23 percent, the latest Companies House filing by the company revealed.

Another Profitable Year

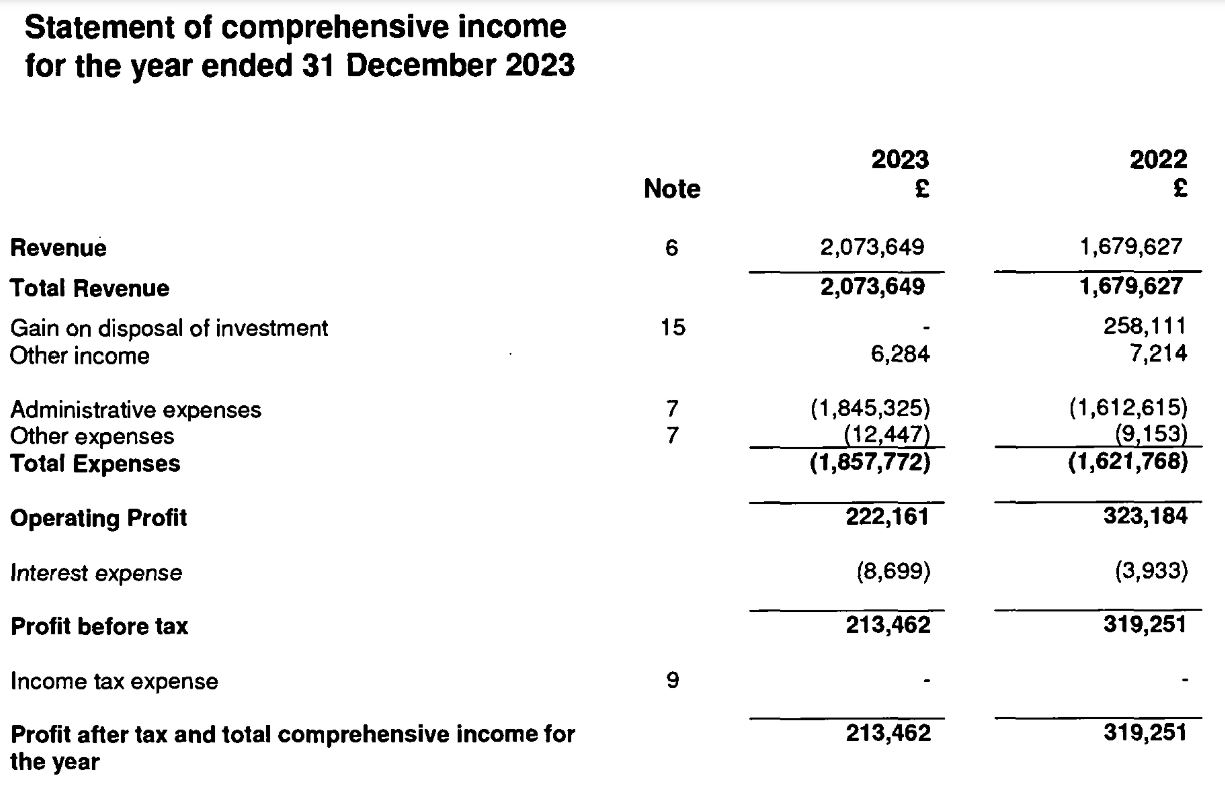

Exinity UK Limited, which operates with a license obtained from the Financial Conduct Authority, closed the year with a profit of £213,462. However, the profits dropped from the previous year’s £319,251. Notably, the pre-tax profits and net profit of the company were the same, as it did not have any tax liability.

Despite the revenue rise, the profit of the company dropped as it did not have any “gain from disposal of investment,” a stream from which it earned £258,111 in 2022. Furthermore, the administrative expense of the company also jumped to over £1.8 million from £1.6 million.

While most companies benefited from the higher interest rates, Exinity UK had an interest expense in the last couple of years, although not significant. In 2023, it had an interest expense of £8,699, climbing from the previous year’s £3,933.

Addition of New Accounts

Exinity UK operates as an online financial services provider and “acts as a matched principal broker in the retail CFD markets.” It is part of Dashin’s broader trading services empire, which also includes the FXTM brand. The numbers filed with Companies House only show the performance of the UK unit and not the other global entities.

“The revenue of [Exinity UK Limited] derives from retail brokerage service charges received from an associated company, Exinity Limited (previously from Forextime Limited), under an agreement between these companies, as all client trades of the company are matched with Exinity Limited in its capacity as the company’s liquidity provider,” the Companies House filing stated. “Revenue is recognised from fees charged to Exinity Limited.”

In 2023, the company opened 347 new accounts, out of which 190 had received funds deposited by clients before the end of the year.

Recently, Exinity onboarded Punit Ghumra as the new Group Chief Financial Officer, a role based in Dubai.