The unexpected decision by MetaQuotes to withdraw support for proprietary trading landed on the industry like a bolt from the blue. It caused huge turmoil, leaving many questions unanswered and truly dark clouds hanging over the future of prop firms. Let's say that the word "challenge" has, in the funded trading space, a whole new meaning.

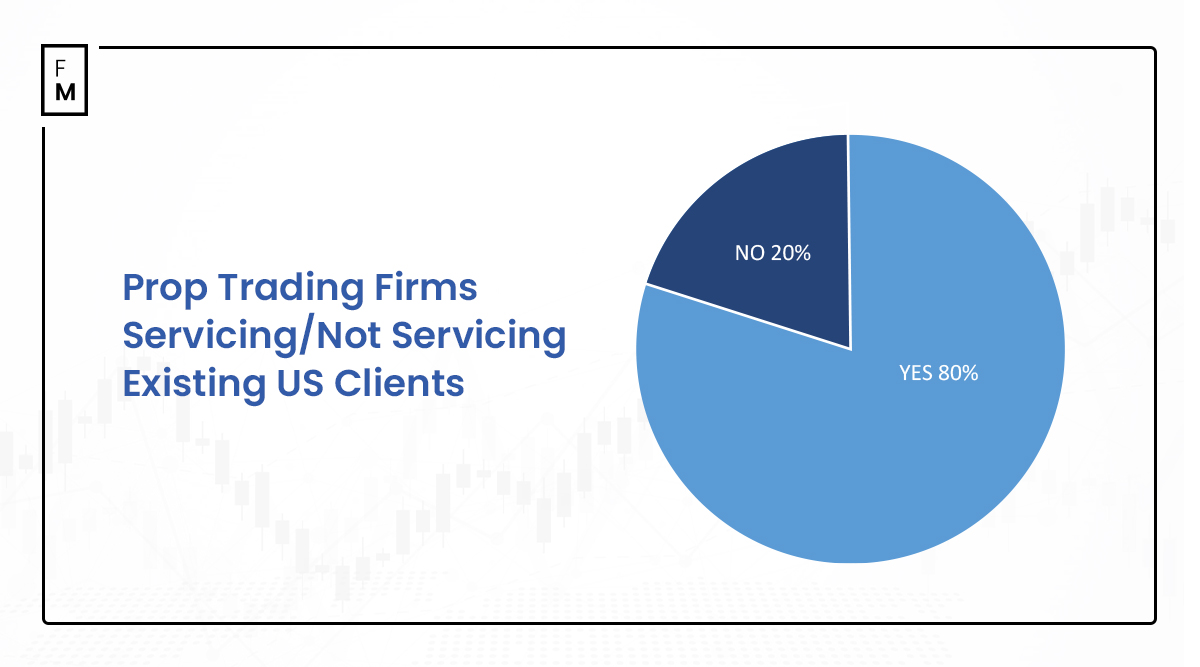

The situation is changing daily with new information about subsequent prop firms unable to service US-based clients or desperately trying to find alternative solutions.

To help you stay up to date, Finance Magnates has gathered all the essential information in one place.

Who's Operating and Who's Out? Finance Magnate's Prop Firms Table

In the table below, you will find information about which prop firms are currently operational, which are suspended, and which accept clients from the USA. The information is updated regularly.

To see our comprehensive Table click here and be directed to the full version of the article.

Have you learned about a prop firm that suspended operations or stopped accepting US-based clients? Feel free to let us know in the comments section below!

What Happened? Prop Turmoil, Explained

It all started on February 14th when one of the popular trader funding firms (TFFs), Funding Pips, abruptly closed trading and stopped services for all traders.

As it turned out, MetaQuotes suddenly started cracking down on prop trading companies that relied heavily on the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5 ) platforms. The CEO of Funding Pips, Khaled Ayesh, issued the following statement:

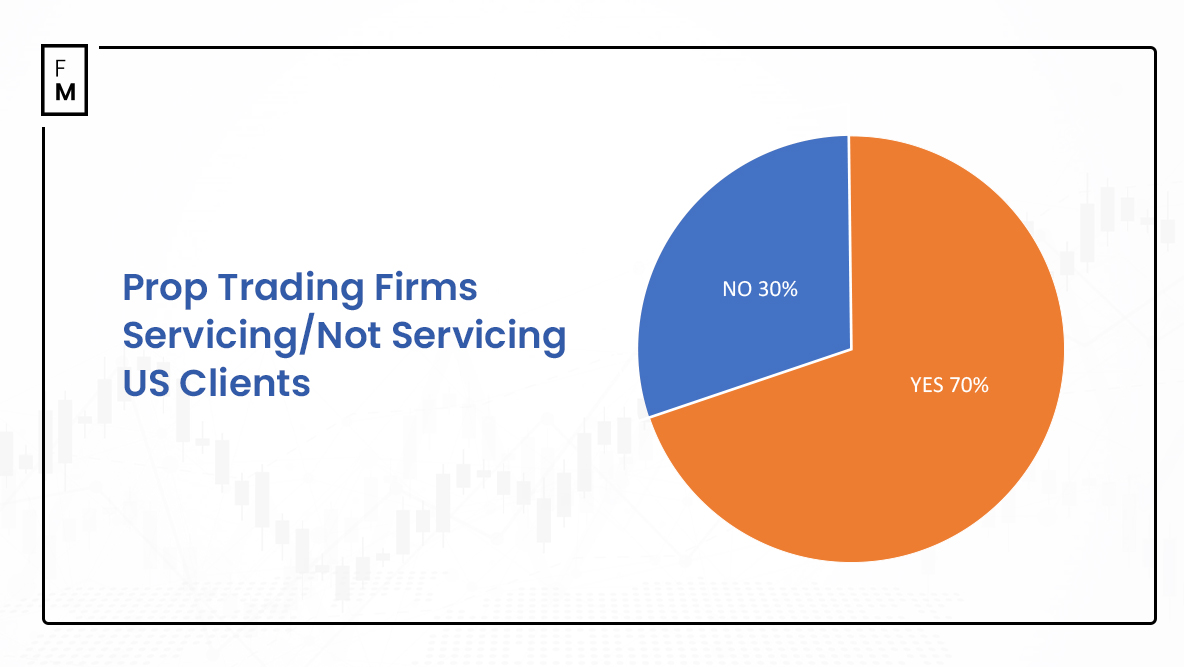

As Finance Magnates discovered, it's about licensing issues. TFFs offer their services to US-based clients, which requires additional authorization. As you might guess, they usually don't have them.

Some firms circumvented this through an intelligent approach by using other entities' licenses. An example is Blackbull, which grey-labeled its own MetaTrader license to prop trading companies like Funding Pips. Meanwhile FTMO, the "grandpa of prop trading" on Twitter, gained attention, but MetaQuotes eventually finally decided to curb this process.

The whole case is thoroughly explained in the video below by Boris Schlossberg, the Managing Director at BK Asset Management. As he explains, MetaQuotes is not doing this in bad faith but simply looking after its interests.

"They don't want to be in the prop space" because it carries the risk of violating the strict US regulations that the company wants to a void. Especially, after its mobile app was thrown out of the American Apple's App Store over a year ago.

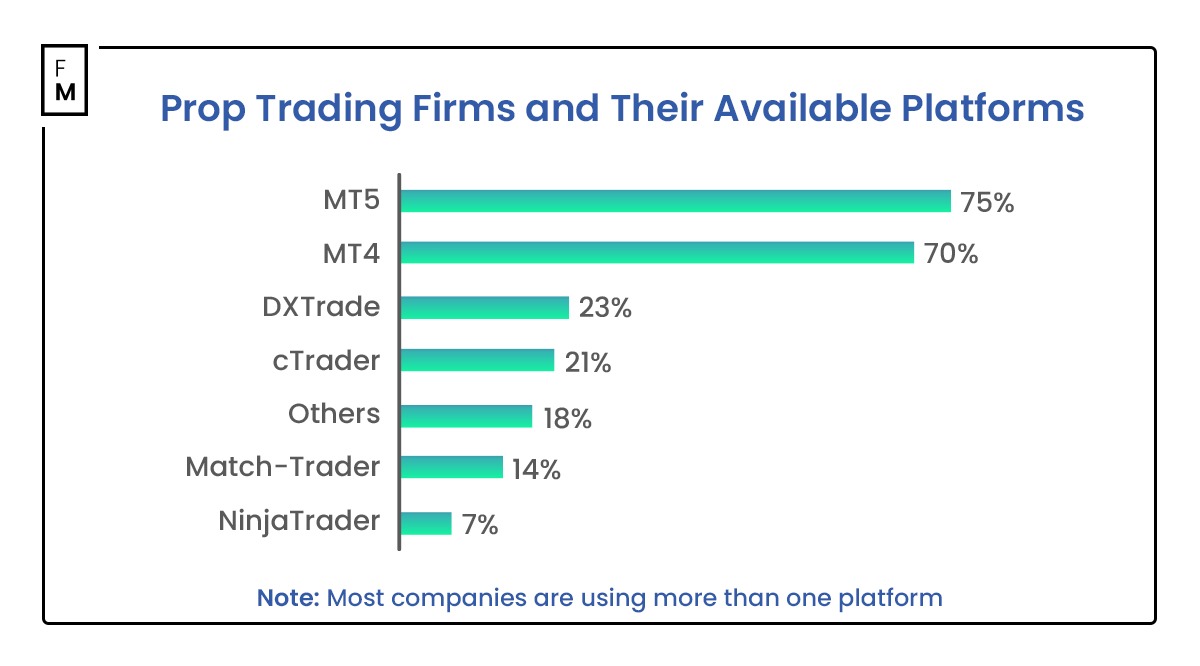

What was the effect? Mayhem. Within just one week, prop firms' US-based clients (and sometimes other jurisdictions too) lost access to their accounts, and the industry began a panic attempt to migrate to alternative solutions offered by the likes of Match-Trade Technologies (Match-Trader) and Spotware Systems (cTrader).

DXtrade's Evgeny Sorokin has penned a thoughtful piece about the reasons other technology providers are after the funded trader business that MetaQuotes has abandoned. Some companies, on the flip side, have predicted that this is the end of the current prop trading model that worked for years.

Prop Firms FAQ

What Happened with MetaQuotes and Prop Firms?

MetaQuotes, the company behind the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, abruptly started cracking down on prop trading companies that were using their platforms without proper licensing. Many of these prop firms were servicing US-based clients without authorization from US regulators. MetaQuotes decided to halt services to these companies to avoid potential legal issues.

What Does MetaQuotes’ Decision Mean for Prop Traders Using MT4/MT5?

MetaQuotes' recent policy changes mean that prop trading firms using MetaTrader 4 and MetaTrader 5 platforms may have to halt operations or migrate to alternative trading platforms if they service US clients.

Can US-Based Clients Still Participate in Prop Trading?

US-based clients face restrictions from many prop trading firms due to regulatory concerns and MetaQuotes' crackdown, though some firms are finding alternative platforms to continue servicing US clients.

What Alternative Platforms Are Prop Firms Moving To?

With MetaQuotes pulling support, prop firms are migrating to alternative platforms like cTrader from Spotware and Match-Trader from Match-Trade Technologies. Some firms like Crypto Fund Trader have their own proprietary platforms as well.

How Can Traders Stay Updated on Which Prop Firms Are Still Operating?

Finance Magnates continuously updates a live table of prop firms, showing which ones are still in business and their current platform availability. Checking with individual prop firm websites is also recommended.

What Should I Do If My Prop Firm Account Was Suspended?

Check with your prop firm directly for guidance. Many are working as quickly as possible to migrate accounts to new platforms. You may need to complete new account opening formalities. Ensure you withdraw any available account balance if possible while waiting.

What Are the Implications for Non-US Traders?

Non-US traders may see minimal immediate impact, though the platform changes and the overall industry shift could influence the availability and terms of prop trading opportunities worldwide.