The5ers, a proprietary trading firm, has temporarily ceased onboarding new traders in the US amid regulatory pressure. The company's action is in response to the evolving regulatory concern surrounding the participation of US traders in the proprietary trading space.

Citing the need for clarity on the legal implications concerning proprietary trading in the US, the firm emphasized ensuring compliance with regulatory requirements. Besides that, The5ers reassured its clients in the US that efforts are underway to update guidelines to meet the needs of traders in the region.

Navigating Regulatory Uncertainty

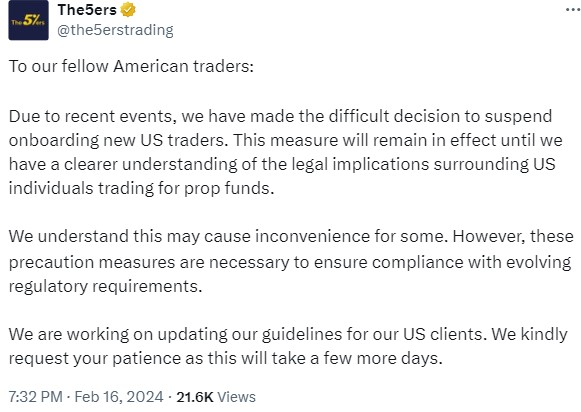

In a post on X, the company mentioned: "Due to recent events, we have made the difficult decision to suspend onboarding new US traders. This measure will remain in effect until we have a clearer understanding of the legal implications surrounding US individuals trading for prop funds."

The5ers has urged patience as it works to adapt to regulatory changes and provide clarity for its users in the region. The firm's decision reflects the ongoing efforts by proprietary firms to address the regulatory uncertainties in the sector.

Addressing possible misunderstandings among its users, The5ers clarified a concern by one of its clients about a communication shared earlier. It acknowledged the challenges in its decision due to the turbulent times in the proprietary trading sector.

US Regulatory Scrutiny Impacts MetaTrader Licensees

The regulatory scrutiny against leveraged trading services and CFDs has intensified in the US. A recent decision by MetaQuotes to enforce restrictions on proprietary trading firms using MetaTrader licenses has sent shockwaves through the industry.

Blackbull Markets, a brokerage offering grey-labeled MetaTrader services, was compelled to cut ties with Funding Pips due to its active accounts from the US. While not publicly acknowledged by MetaQuotes, this move reflected the company's stance on compliance with US regulations.

The termination of services to Funding Pips underscores the challenges faced by brokers operating in the grey label space. While Blackbull Markets facilitated simulated trading for Funding Pips via MT5 demo servers, the presence of clients from the US triggered the abrupt end of their partnership.

Similarly, Smart Prop Trader recently announced its plans to migrate to multiple new brokers and integrate the cTrader trading platform. This step happened amidst regulatory scrutiny targeting prop trading firms.

Proprietary trading, which allows traders to leverage company funds in live markets, has traditionally operated outside the scope of stringent financial regulations. However, recent developments, including the lawsuit against My Forex Funds by the US commodities regulator, have thrust proprietary trading into the regulatory spotlight.