Proprietary trading platform For Traders is nearing completion of its integration with DXTrade as new developments in the proprietary trading space unfold. This step mirrors similar moves in the sector, where companies have forged new partnerships to navigate regulatory challenges.

Previously known as Billions Club, For Traders is based in the United Arab Emirates under its CEO, Jakub Roz. According to propfirmmatch.com, the firm has partnered with Purple Trading and has account sizes ranging from $5,000 to $200,000.

Licensing Issues and Regulatory Concerns

On February 14, Funding Pips, a prominent proprietary trading platform, abruptly ceased operations, causing widespread uncertainty in the proprietary trading sector. MetaQuotes' crackdown on proprietary trading companies that rely on its platforms, MetaTrader 4 and 5, has left many firms facing challenges.

The key issue revolves around licensing discrepancies, particularly for firms catering to US clients without proper authorization. MetaQuotes' action reflects its reluctance to engage with the regulatory complexities of the US market, aiming to safeguard its interests.

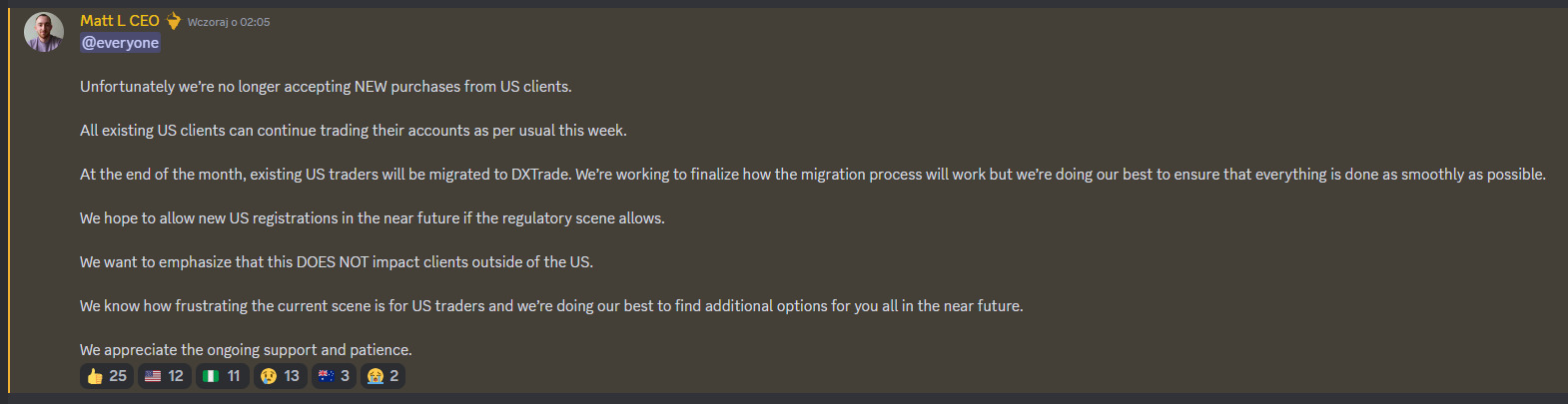

Proprietary trading firm Lark Funding recently ceased purchases for US clients due to regulatory changes impacting the region. The firm plans to migrate existing US traders to the DXTrade platform. Following the regulatory crackdown, Lark Funding's CEO, Matt L., recently confirmed the platform's decision to halt services for US traders.

The unexpected decision by MetaQuotes to withdraw support for the proprietary trading firm sent shockwaves throughout the industry, leaving many prop firms searching for solutions. As the dust settles, it's becoming clear that the landscape of proprietary trading is undergoing a significant transformation.

For Traders Shifts Strategy

According to propfirmmatch.com, For Traders employs a two-step evaluation process. In Phase 1, traders must meet a profit target of 8%, followed by a target of 5% in Phase 2. The firm offers a range of trading instruments, including forex pairs, commodities, equities, indices, and cryptocurrencies.

During the Challenge Phase, For Traders' users have access to higher leverage , with forex trading offering a leverage of 1:125, while indices, stocks, and commodities provide a leverage of 1:20. As traders progress to the Funded Phase, leverage ratios undergo adjustments. Forex trading leverage reduces to 1:40, while indices, stocks, and commodities maintain a leverage of 1:20.