Nearly two weeks after migrating its services from MetaTrader to Match-Trader, Funding Pips has started targeting US traders again. According to a post on X (formerly Twitter), the proprietary trading platform has urged traders from the US to "stay tuned for a major comeback."

Recently, Funding Pips announced that MetaQuotes had ended its collaboration with the proprietary trading firm due to its services to US traders. Subsequently, Funding Pips' CEO, Khaled Ayesh, confirmed that the firm had completely migrated the existing servers and switched the service provider to Match-Trade Technologies, the operator of the Match-Trader platform.

Thus, Funding Pips completed its migration from MetaTrader to Match-Trader, a process that was spearheaded by the company's CEO. Moreover, the firm plans to integrate alternative platforms like Dxtrade, cTrader, and TradeLocker.

Funding Pips' Challenges

Funding Pips attributed the disruption of its services on February 14 to an unexpected maintenance. This resulted from its brokerage partner, Blackbull Markets, terminating its partnership due to MetaQuotes' directives.

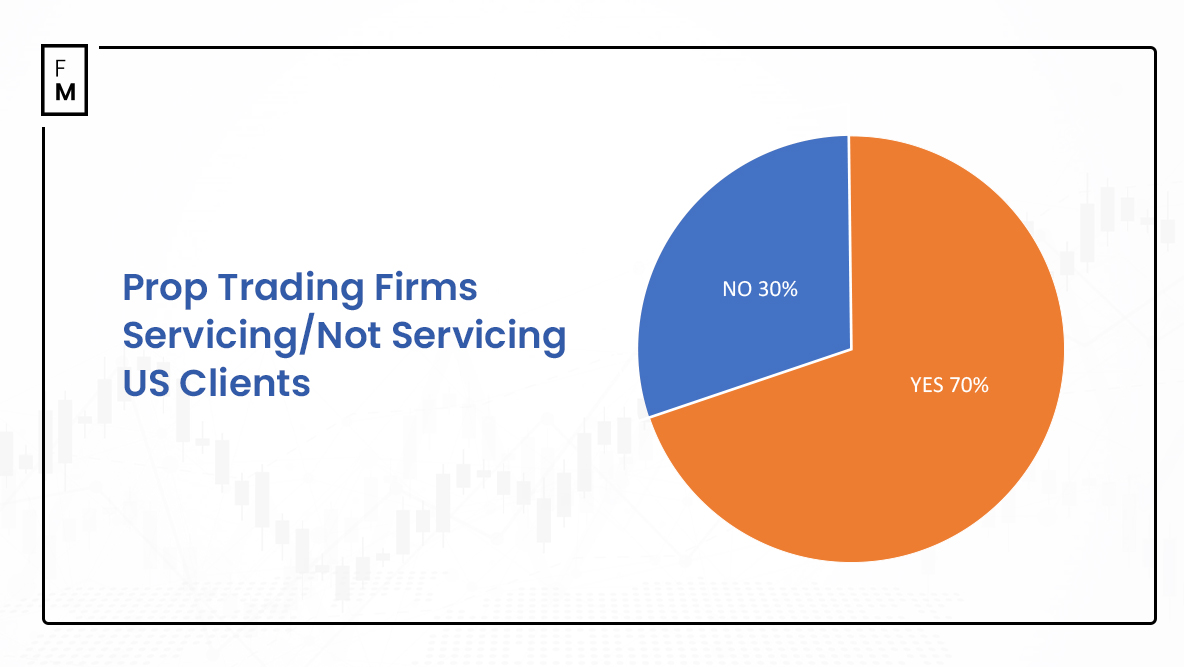

MetaQuotes' stringent licensing policies for proprietary trading firms compelled Blackbull Markets to sever ties. This step reflected a broader trend of regulatory scrutiny and licensing restrictions within the proprietary trading sector. While US regulations pose challenges, proprietary trading firms operate outside traditional oversight.

MetaQuotes' decision resulted from licensing issues experienced by proprietary trading companies offering services to US-based clients. Without authorization, many firms resorted to unconventional methods, such as using third-party licenses. This was a common practice until MetaQuotes intervened, halting the grey-labeling process and even affecting industry giants like FTMO, Finance Magnates reported.

Dynamics Reshaping the Prop Trading Industry

MetaQuotes' sudden withdrawal of support sent shockwaves through the industry, casting uncertainty over the future of proprietary trading firms. This decision disrupted operations and raised a concern about compliance and sustainability.

Currently, the situation remains dynamic, with daily developments shaping the proprietary trading landscape. Many firms are grappling with the aftermath, either ceasing operations or scrambling to find alternative solutions. At Finance Magnates, we have consolidated a live table to track the changes by major proprietary trading companies.