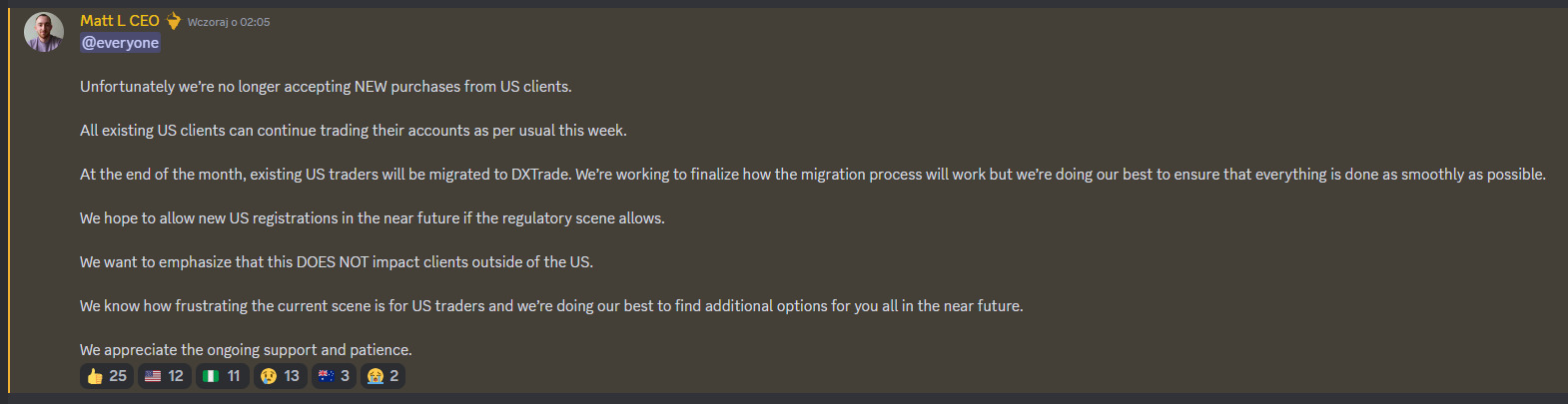

The CEO of Lark Funding, Matt L., has confirmed that the proprietary trading platform is no longer accepting purchases from US clients. According to a post on Discord, the company plans to migrate existing US traders to DXTrade.

Proprietary Trading Firms Exclude US Traders

Matt L. mentioned: "We hope to allow new US registrations in the near future if the regulatory scene allows. We want to emphasize that this DOES NOT impact clients outside of the US. We know how frustrating the current scene is for US traders, and we are doing our best to find additional options for you all in the near future."

In a post on X that was later taken down, Matt L said that Lark Funding was not solely depending on ThinkMarkets and was actively exploring partnerships with other brokers to diversify options for traders. He emphasized the importance of having multiple brokerage options to ensure resilience and flexibility in the firm's trading operations.

Matt L mentioned: "ThinkMarkets has reassured us several times over the last few weeks that operations on their end and their relationship with MetaQuotes is solid. But, of course, we're not going to rely on just one broker. We're already in discussions with other brokers to see who we can work with and provide additional options to traders."

Currently, proprietary trading firms are navigating challenges posed by MetaQuotes' alleged crackdown on MetaTrader usage and the subsequent restrictions on US-based clients. As a result, many platforms are integrating alternative trading platforms such as cTrader, Match-Trade, and DXtrade.

Proprietary Trading Faces Regulatory Hurdles

Recent events have caused MetaQuotes, although not publicly acknowledged by the firm, to terminate licenses for trading platforms like True Forex Funds. This has led to a disruption of services for proprietary trading firms.

Brokerage partners like Purple Trading and Blackbull Markets have been affected by MetaQuotes' actions, leading to terminations of services for prop firms due to regulatory compliance issues regarding US clients.

In response to this crackdown, many proprietary trading platforms have ceased services to US-based clients, with some, like The5ers and Maven Prop Trading, offering alternatives for affected traders.