MyFundedFX has completed integrating cTrader following weeks of turmoil in the industry. According to a statement on X, the proprietary trading platform will be "stress testing it and ensuring it is bug-free."

MyFundedFX mentioned: "Later next week, we aim to go live with CTrader powered by Purple Trading SC. We have also been handed over our MatchTrader server license and have begun the integration work for that. Thank you for your patience as we provide more options for everyone!"

Adjusting to the Transition

On February 19, MyFundedFX announced that it was restricting US traders effective immediately. The platform exclusively restricted users in this region to trading DXtrade challenges.

Besides that, the firm asked US traders to prepare for a migration of their accounts from MetaTrader to DXtrade. This migration was a response to ongoing regulatory pressures and a shift in the industry.

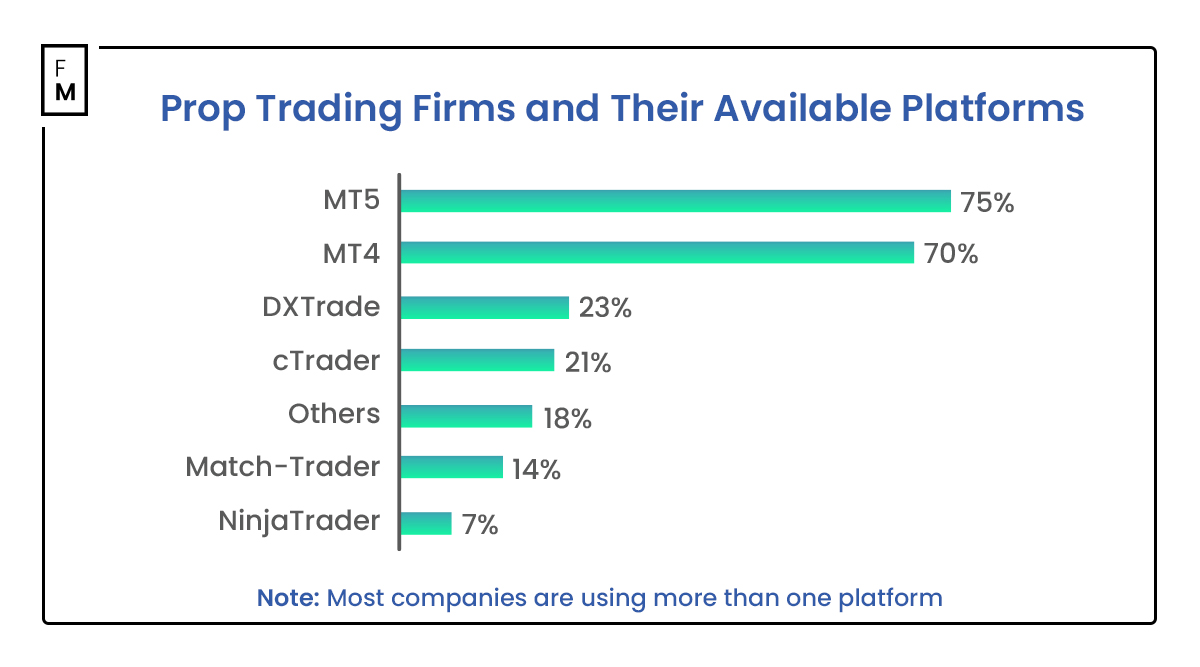

Currently, most proprietary trading firms are completing their migration to new platforms driven by MetaQuotes' tightening regulations, especially concerning US compliance .

These changes affecting the industry began when major brokerage firms like Blackbull Markets and Purple Trading terminated partnerships with proprietary trading platforms due to compliance concerns.

Blackbull Markets' decision to sever ties with Funding Pips, a Dubai-based trading firm, underscored the severity of the regulatory challenges faced in the industry. MetaQuotes' actions have resulted in a broader diversification trend among proprietary trading platforms, as they integrate alternative trading platforms, such as cTrader and Match-Trader.

Adapting to Regulatory Pressure

Some platforms, including The5ers and FTMO, have halted services to US-based clients altogether, reflecting the broader industry response to the restrictions.

Currently, many firms are dealing with this challenge, either ceasing operations or finding an alternative solution. At Finance Magnates, we have created a live table to track the changes by major proprietary trading companies.