The world of prop trading has taken the US by storm, offering retail investors the opportunity to manage substantial capital with a small upfront fee. Despite recent controversies and market turmoil, prop firms continue to attract hundreds of thousands of clients. But what does their offering look like, and which firms have the most trust?

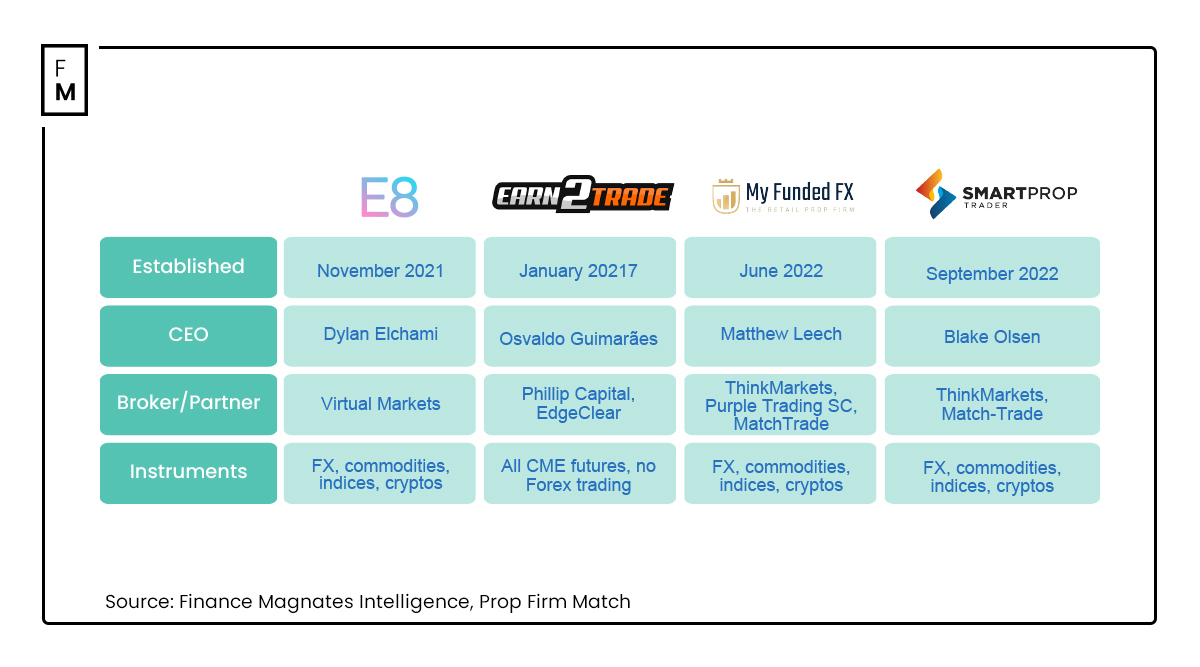

Join us as we dive into the prop trading market in the US and compare four prominent firms - E8 Markets, Earn2Trade, MyFundedFX, and Smart Prop Trader - to help you navigate this investment frontier

Prop Trading Market in the US

Prop trading is a significant and popular segment of the retail investment market in the United States, with many well-known platforms originating there. These firms' services typically follow a similar pattern: traders pay a fee to participate in a "challenge" on a demo account designed to assess their trading skills.

If they meet the set profit targets, they can advance to higher tiers, earning a share of generated profits (usually between 60-90%), and eventually become "funded traders,” receiving real funds from the firm to work with. This model attracts retail investors because they can manage capital ranging from $20,000 to $100,000 for just a few hundred dollars.

However, American prop firms and those serving US clients have come under regulatory scrutiny this year. As a result, MetaQuotes has preemptively revoked licenses for its MetaTrader platform from many firms, causing them to suspend services temporarily or permanently to clients in this region.

Nevertheless, several firms have emerged unscathed or experienced no issues at all. Among them are E8 Markets, Earn2Trade, MyFundedFX, and Smart Prop Trader. In the table at the beginning of the article, we provide a detailed comparison of these companies' offers. Below, we present some basic information about their operations.

E8 Markets Funded Account up to $400K

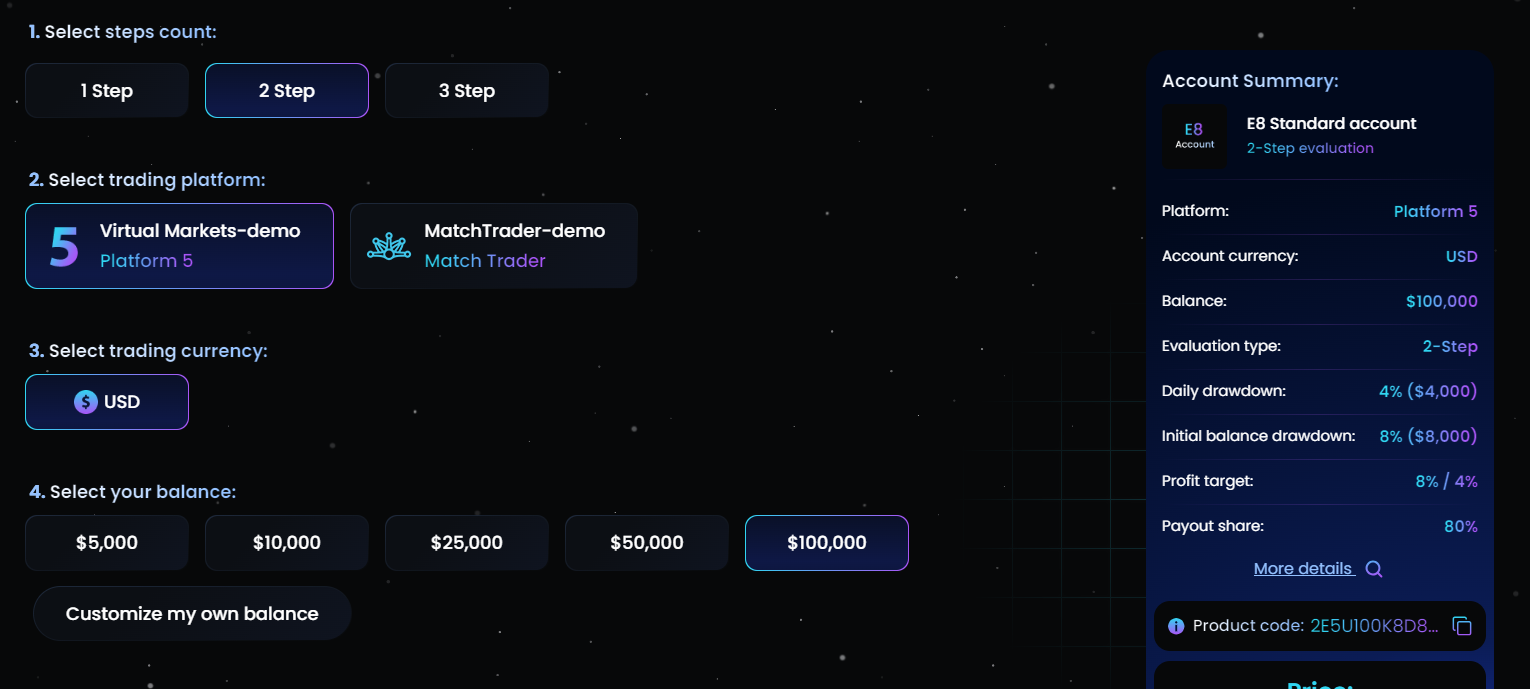

The first company in our comparison is E8 Markets, which gives traders the flexibility to choose challenges tailored to their strategy. You can opt for a one-, two-, or three-step evaluation process within an MT5 or Match-Trader demo account with account balances ranging from $10,000 to $400,000, maximum drawdowns from 6-14%, and payout shares from 40-95%.

The conditions the trader chooses will impact the final price of joining the challenge, which ranges from $34 to over $2,000. The upper challenges are among the most expensive in our comparison, but no other prop firm offers an account with such a large capital.

The platform claims that the average waiting time for a payout is 10 hours, and on average, profitable traders withdraw $4,500. On Trustpilot, it has nearly 1,700 reviews and an overall rating of 4.7.

The company also managed to navigate the recent turbulent period in the prop firm industry without being forced to make any major changes or suspend operations.

Simplified signup process is now deployed. Thank you for your valuable feedback! Customize your success. pic.twitter.com/IWAa8NM5xd

— E8 Markets (@E8Markets) May 22, 2024

Earn2Trade, over 7 Years of Experience

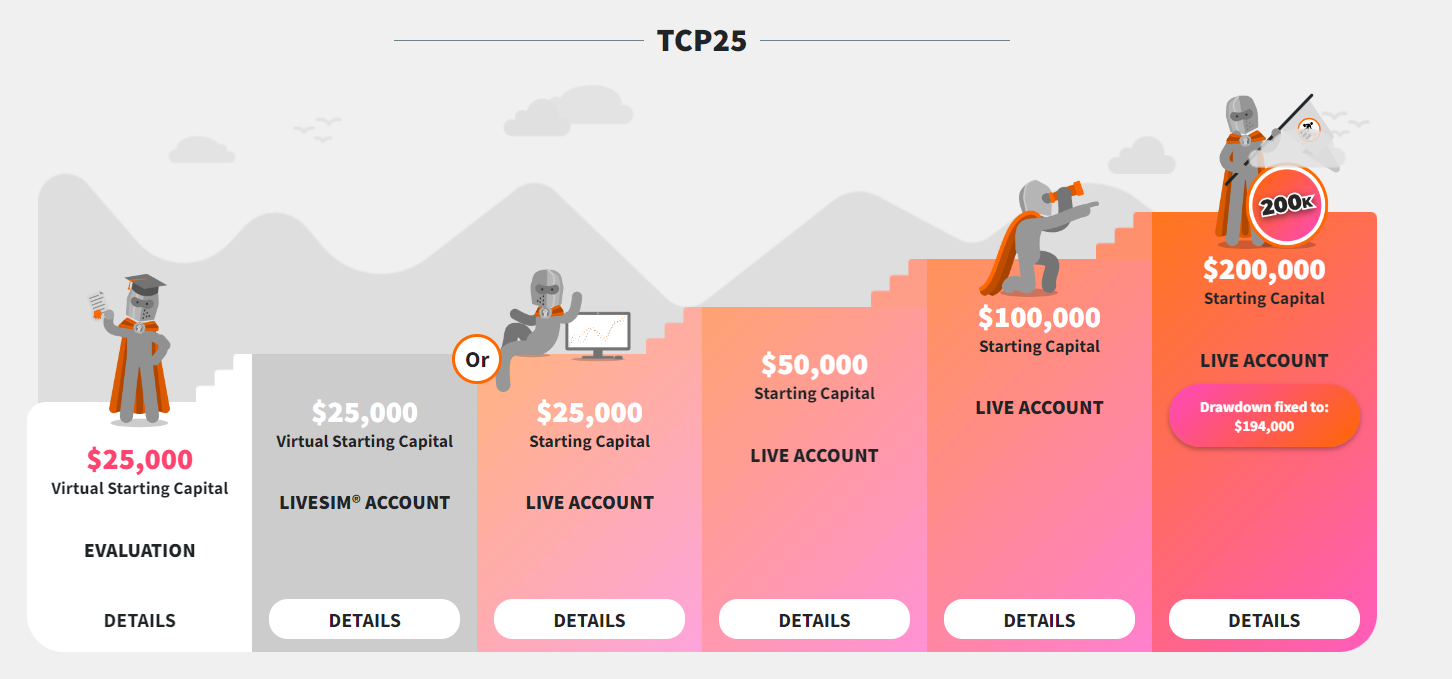

It is definitely the longest-running prop trading firm in our comparison and the only one that focuses entirely on futures trading available on the CME exchange without access to FX transactions.

It offers relatively cheap challenges, with a fee of $275 for a $200,000 account. Interestingly, profit targets and maximum drawdowns are not percentages but dollar values. For the cheapest $25K challenge, the daily capital drawdown cannot exceed $550, and the total cannot exceed $1,500.

Evaluation also takes place on demo accounts, after which Earn2Trade provides the opportunity to become a "Funded Futures Trader.” The company recently introduced a new evaluation path where the maximum account value is $400,000, with a maximum drawdown of $20,000.

Like E8 Markets, Earn2Trade also did not have any major issues in the recent chaos of the prop firm industry. It also has a high Trustpilot rating of 4.7 with 2,100 reviews. However, it does not use MetaQuotes platforms and focuses on futures trading rather than CFDs.

👣 Before switching to futures, John gained experience trading both small and large-cap stocks, as well as ETFs.

— Earn2Trade ® (@earn2trade) May 22, 2024

🔎 Currently, he specializes in trading E-mini Nasdaq 100 and E-mini S&P 500 futures.

🚀 His strategy is mainly based on breakout trading, where he identifies a… pic.twitter.com/4hrLx9aYON

MyFundedFX, The Cheapest Challenge

Although the price difference between the cheapest $5K challenge in E8 Markets and My Funded FX (MFF) is only $0.4, it has the cheapest evaluation process options in its offer.

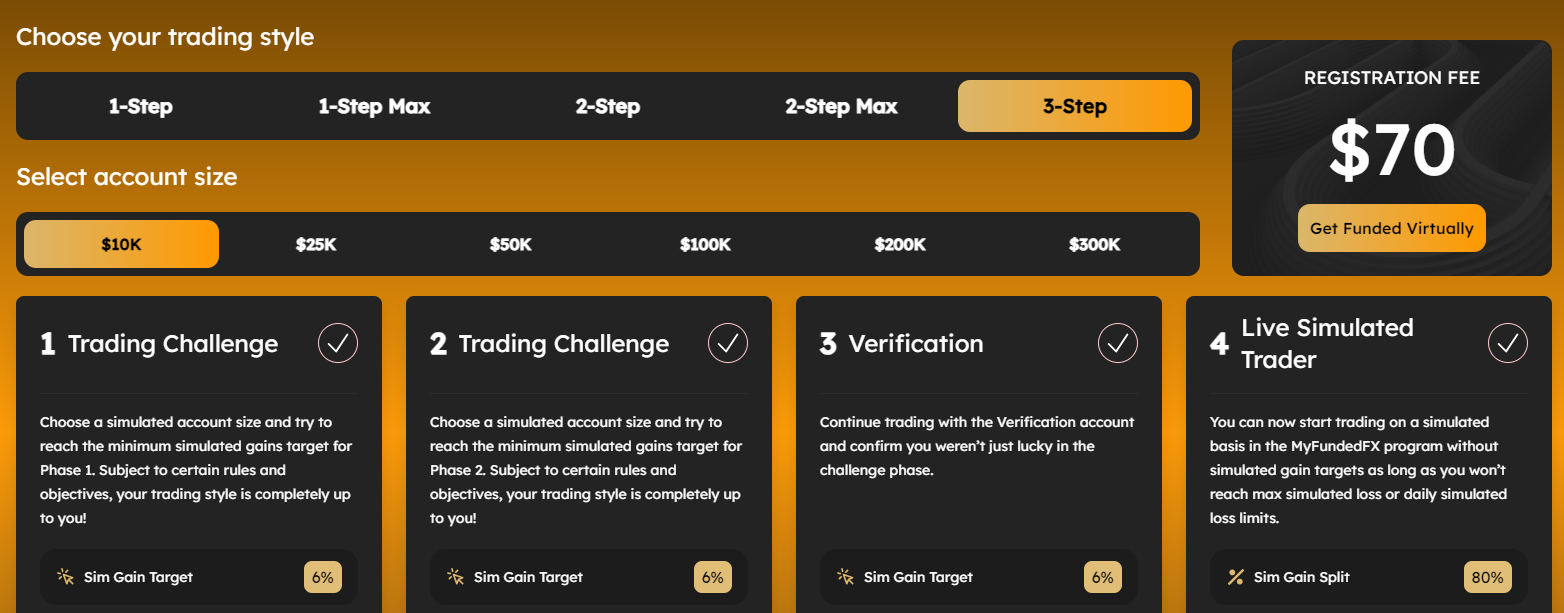

Similar to its predecessors, the investor can choose from several types of virtual accounts challenges, consisting of one, two, or three consecutive stages. Available accounts range from $5,000 to $300,000, and trading can be based on DXTrade, cTrader, and Match-Trader platforms, with MetaTrader 5 also available for traders outside the USA.

As an add-on to each challenge, the investor can choose the "profit boost" or "rapid withdrawal" option, but they increase the fee by 20% each.

The company claims that in 2024 alone, it made over $10 million payouts, with the highest single payout being nearly $75,000. On Trustpilot it gathered 1,500 reviews and a final score of 4.3.

Unlike its predecessors, it did not pass through the February turmoil unscathed. A few months ago, MyFundedFX announced that it had to suspend support for United States clients using the MT5 platform. However, just a week later, the company informed that it had started migrating accounts to an alternative platform, opting for DXtrade.

Welcome back to MyFundedFX Vietnam and Pakistan! https://t.co/UFPOYNMv6r

— MyFundedFX (@MyFundedFX) May 28, 2024

Smart Prop Trader Offers the Highest Leverage

Smart Prop Trader will certainly be an interesting option for retail investors looking for high financial leverage and the highest allowable drawdown. The maximum available leverage on FX pairs is 100:1, and the total drawdown with selected challenges can be up to 12%.

Like its predecessors, it has a high rating on Trustpilot, scoring 4.7 out of 2500 reviews.

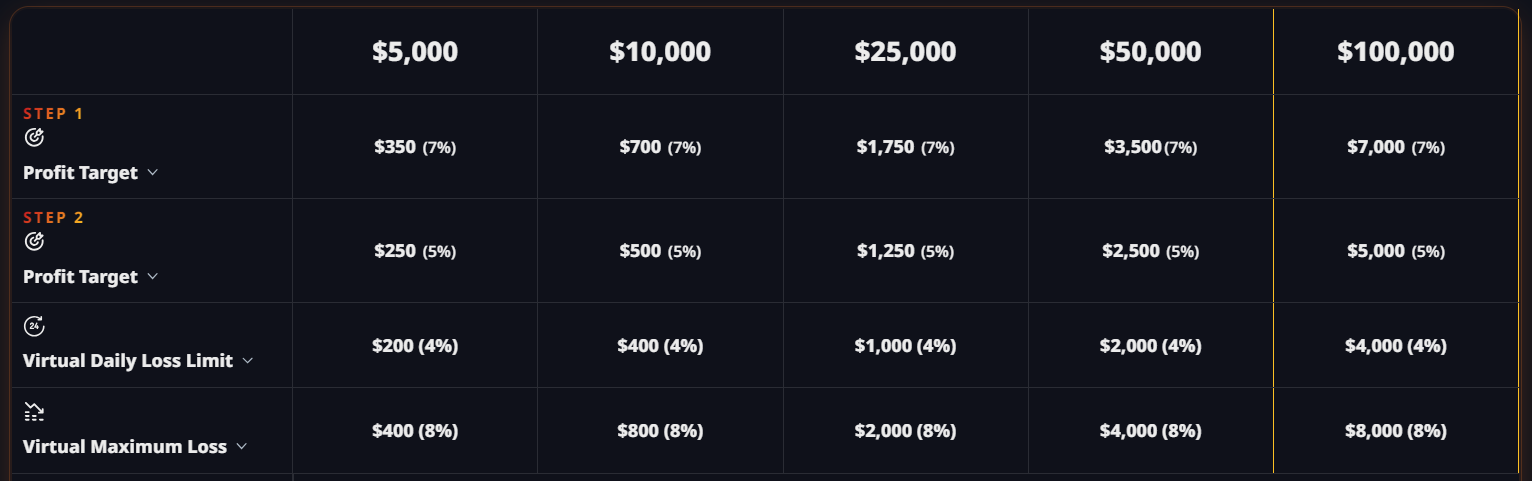

However, compared to the competition, the profit splits will be more modest, up to 75%. Smart Prop Trader also has the lowest maximum funded account value of all the compared companies, which is $100,000.

On the plus side, the company does not impose a minimum number of trading days to reach the challenge goal, whereas other companies require a minimum of one to several days.

Although Smart Prop Trader had some problems in mid-February due to the suspension of the MetaQuotes license, it quickly informed about changing the brokers it worked with and adding new platforms. In the migration, it focused on integration with cTrader from Spotware Systems.

We are still celebrating the launch of cTrader coupled with our Pro Challenge model! 🎯

— Smart Prop Trader (@SmartPropTrader) May 22, 2024

To continue the celebration, we will be awarding one lucky customer a free $100K cTrader Account based on a drawing from the next 100 purchases. Multiple entries allowed!

Use promo code… pic.twitter.com/LKQVjeJRYr

Which Prop Firm Should You Choose?

It is difficult to definitively state which prop trading firm offers the best, as each has unique strengths and caters to different types of traders.

For example, E8 Markets stands out for offering the widest range of account sizes, from $5K to $400K, giving traders flexibility in choosing the capital they want to work with. They also provide a high profit split of up to 95%, among the highest in the industry.

MyFundedFX also offers a wide range of account sizes, from $5K to $300K, with competitive fees starting at just $33.6. They support multiple trading platforms, including DXTrade, cTrader, Match-Trader, and MT5 for non-US clients.

On the other hand, Earn2Trade is unique in its focus on futures trading, making it an attractive option for traders specializing in this asset class. They offer a straightforward pricing structure, with fees ranging from $75 to $275 for account sizes between $25K and $200K.

Smart Prop Trader stands out for offering the highest leverage among the four firms. This can be particularly appealing to traders who employ high-risk, high-reward strategies. Smart Prop Trader also has a straightforward profit target structure.

If you want to explore other alternatives, check out the Finance Magnates’ review of four FX/CFD brokers that have also been offering prop trading services for several months. They provide greater security guarantees thanks to regulations.