Lately, the Cyprus Securities and Exchange Commission (CySEC ) has been making the news a lot - to the extent that it has hired a PR agency. After issuing fines and reaching settlements worth over €1.3 million in November, and apparently intending to announce even more, it has also informed binary option brokers that it discourages one of the instrument’s most speculative features.

But it was the decision to activate the Investors Compensation Fund (ICF) that touches on a little discussed, yet immensely important topic for the local industry.

A CySEC license allows Cyprus Investment Firms (CIFs) to operate throughout the European Union. Much like its European counterparts, it carries certain obligations towards clients, one of which, and arguably the most important, pertains to compensation in the case of insolvency.

While a lot has been written about the British Financial Services Compensation Scheme (FSCS) in the aftermath of the Alpari UK bankruptcy, the ICF has not attracted too much media attention.

With clients of certain brokers still waiting for their withdrawals, and European regulators forcing CySEC to act more diligently, a big question for the ICF is whether it can meet clients' demands in the case of a big brokerage failing to meet its client obligations.

Since CySEC took the first steps in what is to be a systemic approach to supervising regulated brokers more actively, clients of regulated CIFs who have been affected with several compliance issues wonder what would it take to trigger a payment from the ICF.

Organizational structure and broker contributions

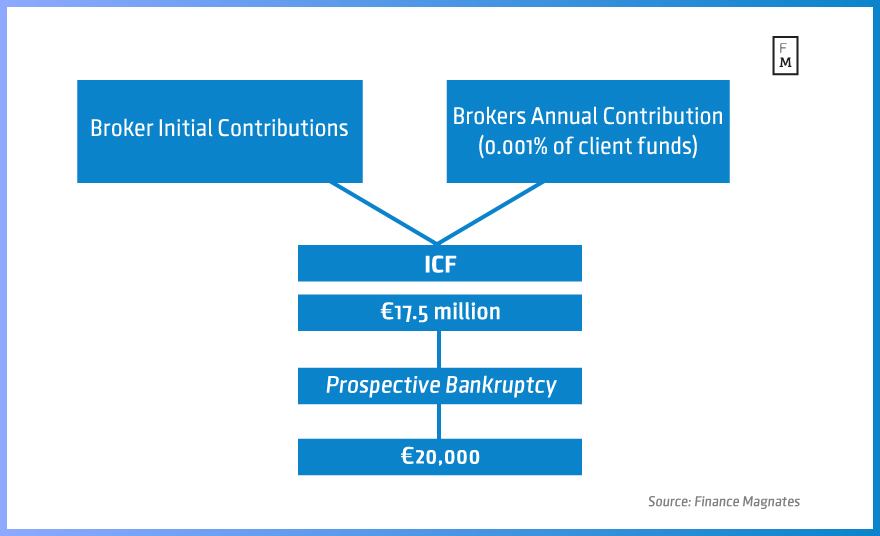

Xenia Kalogirou, a senior member of Cyprus-based AGP Law Firm, has helped to shed some light on the details of the scheme, explaining how brokers contribute to the fund’s resources.

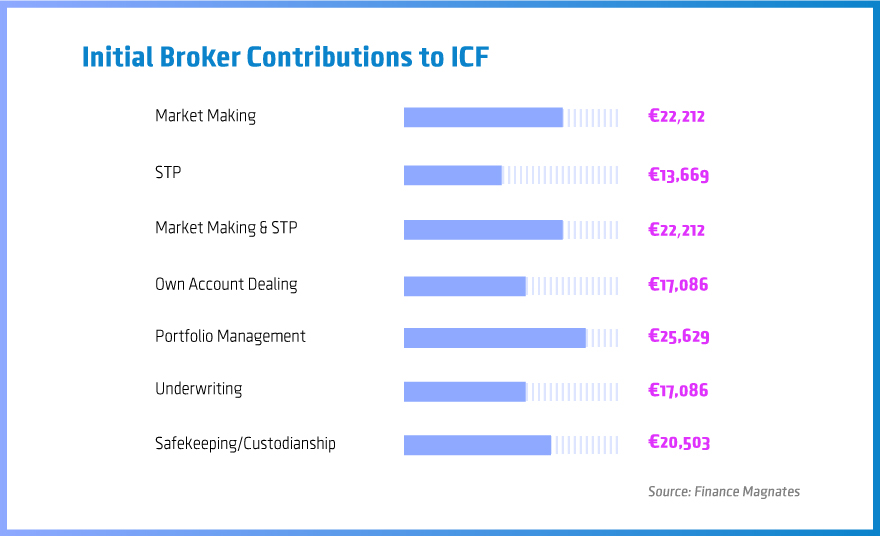

Brokers that operate as Market Makers pay an initial fee of €22,212, while companies that only provide straight-through processing of client orders pay €13,669. If the broker operates both models, the company pays as a market maker.

In addition, if the brokerage deals with its own account it pays an additional €17,086 fee, while if it manages portfolios it must provide an additional sum totaling €25,629. If the brokerage also underwrites financial instruments and/or places financial instruments on a commitment basis, it has to pay an additional €17,086.

Initial ICF contributions by brokers can vary depending on the specific needs of their business

For CIFs offering the service of safekeeping and administration of financial instruments for client accounts, including custodianship and related services such as cash/collateral management, the additional fee is €20,503.

Separately, each CIF is required to pay up to one per mille of the eligible client funds which it holds.

As far as compensation for traders is concerned, maximum levels are much lower than in other regulatory jurisdictions, with a €20,000 ceiling. While this should satisfy most clients’ demands, how CySEC evaluates the conditions under which clients are entitled to compensation remains a mystery, as the fund has rarely been used up until now.

How is an ICF payout procedure triggered?

CySEC and Cyprus courts have the authority to trigger an ICF payout event

According to Ms. Kalougirou, there are two ways in which a payout from the ICF can be triggered. The first is based on a CySEC decision, determined either by the board of CySEC or upon a request submitted to it by a covered client or a member of the ICF.

The second way is if a competent supervisory authority or any other person with a legitimate interest, such as the Official Receiver or the liquidator of the bankrupt brokerage, files a case according to the provisions of the Company Law in Cyprus.

What if ICF funds are insufficient?

Finance Magnates understands that the funds currently held at the ICF in Cyprus total close to €17.5 million ($19.3 million). Looking at the figures of some CySEC regulated brokers, it is quite clear that a scenario where client demands might exceed the fund’s resources is not unrealistic.

According to provisions in the law, if the ICF does not hold sufficient finds to meet all client claims, there are several ways for CySEC to fill the gap. The regulator may call on members of the ICF to commit extraordinary additional resources, or borrow funds from banks in Cyprus or abroad and ask the ICF members to pay up a supplementary contribution to fill the gap afterwards.

A third option is conditional on an insurance company having insured the ICF for up to a certain amount in case a policy event is triggered. Finance Magnates understands that at present this seems to be the least likely option, as CySEC has not disclosed whether the fund is insured with a specific company.

Disclaimer: This article and the opinions expressed in it do not constitute a legal opinion.