The Massachusetts state has presented a gift to the Bank of New York with an early treat, as it has accepted a settlement in relation to the Forex transaction debacle affecting the Massachusetts Pension Reserves Investment Management Board (PRIM).

In a statement issued by the Massachusetts Secretary of State William F. Galvin, Bank of New York Mellon will cut fees by $15.45 million. In addition, the bank will pay $100,000 for the cost of the investigation.

The PRIM acts to benefit key workers who are resident in the state, an extract from its website shows its core goals: “We work diligently for Massachusetts State Employees and Teachers along with local Retirement Systems throughout the Commonwealth in an effort to maximize returns while mitigating risk.” It has over $56 billion of assets under management.

The Massachusetts Pension Reserves Investment Trust (PRIT), the primary fund, has been outperforming the main industry benchmark used by funds and portfolio managers, the S&P500, its October 2013 performance summary states that over the last ten years, the fund is up 8% beating the S&P500 by 0.5%.

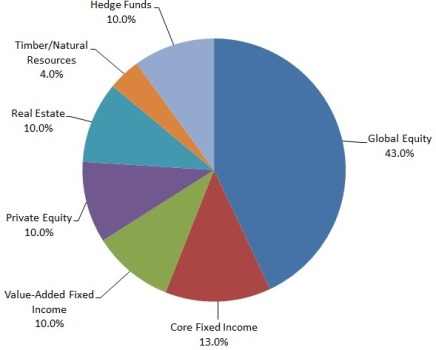

The PRIT invests in a range of asset classes, according to its website.

PRIT Asset Allocation

Bank of New York Mellon is joined by rival State Street in the pension funds FX case. Several state pension funds in the US have raised complaints against the way the banks have executed the funds FX transactions.

BNY Mellon provides specific content on its website about the range of services offered, under the section focusing on US Federal Governments, the firm states: “As a world-leading investments firm, BNY Mellon offers the U.S. Federal Government a full range of sophisticated solutions in both investment services and investment management. These are the solutions designed to power your success.”

The issue has highlighted the importance of Transaction Cost Analysis in the FX markets, a subject that has started to gain traction in light of the recent disaster and the increasing number of firms providing solutions to managers suffering at the realms of Sell-Side firms.