The Bank of International Settlements has today released its full report on the macroeconomic assessment of OTC derivatives regulatory reforms and the impact that these are likely to have on the structure of the industry and its participants.

In this particular study, a full set of criteria is taken into account subsequent to the Over-the-counter Derivatives Coordination Group (ODCG) having commissioned a quantitative assessment of the macroeconomic implications of OTC derivatives regulatory reforms in February this year.

This assessment was undertaken by the Macroeconomic Assessment Group on Derivatives (MAGD), chaired by Stephen G Cecchetti of the Bank for International Settlements (BIS).

Stephen G Cecchetti

In its report, the MAGD focuses on the effects of mandatory central clearing of standardized OTC derivatives, margin requirements for non centrally cleared OTC derivatives and bank capital requirements for derivatives related exposures.

Think Tanks Set Up Following Financial Crisis

The United States government reacted severely to the 2008 financial crisis by instigating a series of very detailed market reform policies, such as the Dodd-Frank Wall Street Reform Act, covering all aspects of the financial markets structure in the United States.

The method by which OTC derivatives can be provided to customers and be traded has been subject to a complete ground-up overhaul, subject to the general view taken by the MAGD that counterparty exposures related to derivatives traded bilaterally in OTC markets helped propagate and amplify the global financial crisis that erupted in 2008.

Many of these exposures were not collateralized, so OTC derivatives users recorded losses as counterparty defaults became more likely or, as in the case of Lehman Brothers, were realized. Furthermore, since third parties had little information about the bilateral exposures among derivatives users, they became less willing to provide credit to institutions that might face such losses.

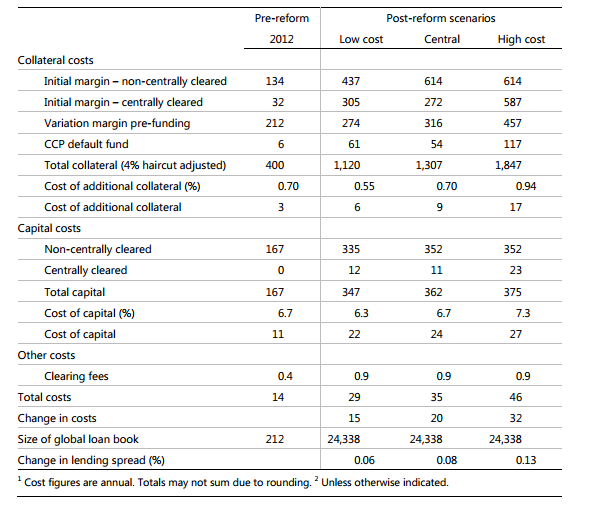

Increased capital charges for centrally-cleared transactions related to trade exposures and to exposures to the central counterparty default fund will also increase costs post-reform.

By contrast to the collateral calculations, the data to calculate future capital charges are limited and therefore, more approximate calculations should be relied on. Using the available information, the BIS has estimated that additional capital requirements compared to the pre-reform period will be between €179 billion and €207 billion.

Collateralization of Foreign Exchange Exposure

Within the 79 page report, the BIS presented a series of regulatory reform scenarios, which were based on the structure of the OTC derivatives markets as of the end of 2012. The reform procedures have focused quite considerably on central counterparty clearing and how to mitigate exposure whilst at the same time providing a means of allowing regulatory authorities to pull prices and transaction details from reports upon request.

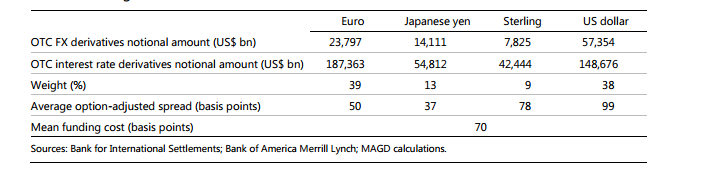

At the end of last year, roughly 40% of the $480 trillion notional amount of outstanding OTC derivatives was cleared centrally. The market value of these contracts was nearly $25 trillion, which generated $3.6 trillion of counterparty exposures.

Therefore, netting reduced counterparty exposures to 15% of market values on average. In the pre-reform baseline, it is assumed that multilateral netting associated with central clearing is often more effective at compressing counterparty exposures than bilateral netting. In particular, it is assumed that it is about four times more effective for derivatives dealers and banks, which are counterparties to the majority of outstanding positions.

Collateralization of exposures is also assumed to rise considerably following the reforms, according to the report. In part, this reflects the increase in central clearing, and also the BCBS-IOSCO (2013) margin requirements for positions that remain non-centrally cleared.

In order to outline this, the post-reform scenarios extend requirements for daily variation margining and initial margins that cover potential future exposures (other than the first €50 million of exposure per counterparty) to all financial institutions.

Non-financial institutions are assumed to be exempt from all of these requirements, and exposures related to physically settled FX forwards and swaps are assumed to be exempt from initial margin requirements.

The cost of funding collateral is assumed to vary across the post-reform scenarios. Compared with the baseline, it falls by 15 basis points in the low-costs scenario, is unchanged in the central scenario and rises by 24 basis points in the high-costs scenario.

To compare the baseline and the three scenarios, imagine that a dealer has OTC derivatives contracts with a notional amount of $20 billion and a market value of $1 billion. In the baseline, $400 million of this amount is centrally cleared and $600 million remains in bilateral contracts.

Across all of the dealer’s counterparties, the $1 billion of market value reduces to $150 million of counterparty exposure. Because multilateral netting is assumed to be four times more effective than bilateral netting, the $400 million is reduced by a factor of almost 20 to $21 million, while the $600 million falls by a factor of almost 5 to $129 million.

Given the collateralization assumptions in the baseline, the dealer receives $99 million ($21 million x 100% + $129 million x 60%) in collateral. Post-reform, the $150 million of counterparty exposure becomes $118 million in the central scenario, $102 million in the low-costs scenario and remains unchanged at $150 million in the high costs scenario.

Cost of Funding Collateral

Underlying Effect On Liquidity

The Group’s analysis assumes sufficient collateral will be available to fulfill the requirements of all (and not only OTC derivatives-related) regulatory reforms currently planned. This assumption is based on BCBS QIS data and studies and recent work undertaken by the Committee on the Global Financial System (CGFS 2013), which suggests that concerns that Regulation will lead to aggregate collateral scarcity, appear unjustified.

The other side of the coin relating to this matter is that it does not rule out the possibility of temporary collateral shortages in some jurisdictions or for individual institutions. For example, temporary shortages may arise in countries where the amount of government bonds outstanding is low or when government bonds are perceived as risky.

The different regulatory requirements and associated compliance costs in different jurisdictions may lead to structural changes in the OTC derivatives activities of dealers, particularly in less liquid markets. Given the high concentration of the market, any changes in market-making practices precipitated by the requirements could have a significant impact on the pricing and liquidity of OTC derivatives markets.

This could have particularly important effects in regional or local markets where fewer liquidity providers are present. Reductions in market liquidity and fragmentation of exposures would attenuate some of the benefits of the reforms.

In conclusion, the BIS detailed that the overall exact macroeconomic effect of the reforms within all aspects of the OTC derivatives structure will come to light once every aspect has been finalized, and that despite the cost, the end result of complete market transparency should go a long way to ensure that no 'nasty' surprises emanate as per the 2008 crisis.

The United States often leads the way in terms of demonstrating how best to implement lengthy and detailed procedures, and is working with international bodies currently, as this takes shape in this ever-evolving world of electronic trading.

Cost Scenarios - (In Billions Of Euros)