With the fog of Brexit uncertainty still clogging up the City of London’s streets and alleyways, the Financial Conduct Authority (FCA) has - it appears - at last decided to do something to alleviate the fears of those working in the retail trading industry.

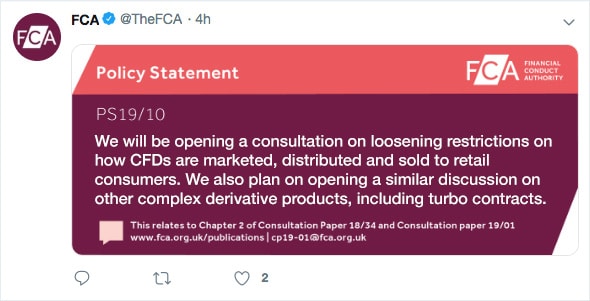

The British regulator issued a Tweet on early Monday morning, saying that it was considering reducing existing restrictions on the sale of contracts for difference (CFDs) to retail traders.

Speaking exclusively to Finance Magnates, Kalam Fadi, a senior associate in the FCA’s investment management supervision team, confirmed the news and said the regulator is likely to reduce Leverage restrictions on CFDs. Fadi added that the FCA might do the same for other derivatives products, notably turbo certificates.

The FCA's tweet from this morning

According to Fadi, for CFDs, leverage caps are likely to be lifted to 300:1, though that number may eventually be pushed down to 200:1. The FCA is unlikely to lift a ban on binary options, but retail traders may also get access to turbo certificates at leverage of either 50:1 or 100:1.

Out of the EU, out of ESMA's clutches

The decision to remove ESMA’s caps on leverage comes as Britain attempts to take advantage of its future position outside of the European Union. Though the UK is yet to leave the supranational political body, when it does, it will be outside of the European Securities and Markets Authority’s remit.

That will give the FCA the chance to flex its business-minded muscles. For the retail brokerage world, that means reducing caps on

Kalam Fadi, Senior Associate, FCA

leverage, bringing European-based businesses to London and making UK-regulated brokers a more attractive proposition for retail traders.

“To be honest, I’m surprised that this didn’t happen sooner,” said the chief operating officer of one major UK-regulated broker. “Brexit aside, London is still a major hub for the financial services industry and the UK is in the perfect position to take advantage of some of the EU’s harsher, overly bureaucratic laws. In fact, we’d be complete idiots if we didn’t.”

According to Fadi, the FCA’s decision was driven largely by economics. The regulator views the retail industry as playing an important role in the UK economy. Tax revenue, he said, is in the hundreds of millions and the sector is thought to, directly and indirectly, employ approximately 50,000 Londoners.

Beating Belize

On top of that, the regulator is looking to mitigate the risk posed by offshore brokers. Vanuatu and Marshall Islands-based hucksters have managed, since ESMA introduced its product intervention measures, to attract thousands of clients from Europe.

Providing high leverage means that the UK, with a respected regulatory regime and banking system, can easily out-compete brokers based somewhere in the middle of the Pacific Ocean.

News of the leverage reduction is likely to send shockwaves through the pubs of Essex, taverns of Limassol, and streets of Tel Aviv.

“It’s great news for us,” said the CEO of one Limassol-based broker. “Volumes have declined across the industry since last August. To know that there are still respectable regulators out there that we can work with is a real positive for the industry.”

The nightmare of Brexit is nearly over and having been bombarded with endless news stories, boring debates in the house of commons and a Theresa May prime ministership, those white cliffs at Dover are - at long last - glimmering again in the tranquil bay.

Or they would be if it wasn't April Fool's Day.