Client Assets, or CASS as designated by the newly established Financial Conduct Agency (FCA) have been subject of much scrutiny by regulators recently. CASS refers to the segregation and correct handling of client monies by investment and financial firms.

Britain’s new regulator is keen to demonstrate its effectiveness having taken over the responsibility of overseeing the nation’s financial sector from the Financial Services Authority this year after 28 years in existence.

The FCA has implemented a new penalty regime which applies to breaches commited from March 6, 2010, and has brought one particular firm to book in the first client asset prosecution conducted by the FCA under the new scheme.

In this case, the FCA cited that Xcap Securities PLC, a capital markets firm which also provides market-making facilities, failed to adequately protect Client Money and client assets, and therefore fined the company £120,900 for failing to comply with FCA Principle 3 on management and control of its business and Principle 10 on arranging adequate protection for client assets which includes both money and assets held on behalf of clients.

From a regulatory perspective, the FCA viewed the potential risk of such malpractice insofar as should Xcap become insolvent, its clients could face difficulty and delay in recovering their money and assets.

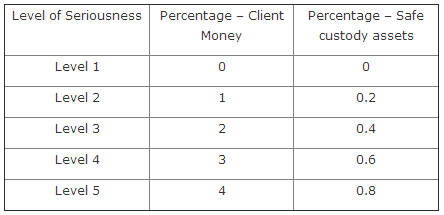

The new procedure for enforcing penalties against companies which demonstrate weaknesses in their CASS procedure comprises a tariff of percentage levels which are to be applied based on the seriousness of a breach, including the consideration of the duration of the breach along with other relevant factors.

Under this new approach, it is expected that cases involving breaches of CASS rules will result in increased penalties compared to similar cases dealt with under the previous penalty regime, according to the FCA’s detailed description of its future plans in this direction.

Xcap received a 20% discount on its fine for agreeing to settle at an early stage, thus reducing a total penalty of £151,136 originally served by the regulator, and whilst Xcap provides its services mostly within the stock trading sector, this serves as an example as to rulings which also apply to companies offering Forex and OTC derivatives.

Tracey McDermott, FCA director of enforcement and financial crime, made a statement on behalf of the regulator: 'This is the first case that the FCA has brought for breaches of the client assets rules using our new penalty regime. The new levels of penalty are expected to result in larger fines, demonstrating the seriousness with which we view these failures and serving as a stronger deterrent to firms.

'We have been very clear about our expectations of firms that have responsibility for investors’ money and safe custody assets. Xcap failed to meet the required standards from the very outset of its business and continued to have widespread failures for a number of months.'

Client money is on the agenda internationally, too. Australian regulator ASIC this year used its installation of British software company First Derivatives' Delta Stream surveillance system to bring an enforceable action against City Index in Australia for ill-handling of client monies.

The FCA's Percentage-Based Penalty Tariff