As a result of the recent wave of regulatory tightening in the US, and the increased efforts of financial regulators to combat fraud, the Commodities Futures Trading Commission (CFTC ) reported totals from its enforcement division which resulted in a record $1.7bln in monetary sanctions for its fiscal year 2013, which ended on September 30th, 2013, according to its official announcement today.

Through the agency's division of enforcement, civil monetary penalties totaled more than seven times its operating budget for the fiscal year (FY) 2013, also reported were more than 290 new investigations opened during that period and adding to numerous previously opened cases, according to the announcement. This included, obtaining orders that imposed more than $1.7 billion in sanctions, orders for more than $1.5 billion in civil monetary penalties and more than $200 million in restitution and disgorgement.

The Division noted that while the number of actions filed are among the highest annual figures in program history, that total is down compared to FY 2012. David Meister, the Director of Enforcement at the CFTC , who recently announced his departure from the agency and is scheduled to step down at the end of October, has contributed to much of the success that the agency is reporting, in Forex Magnates' opinion.

New Records As The CFTC Steps Up Its Game

Mr. Meister previously served as a white-collar criminal attorney at prominent law firms, a role that may have served him well (with regards to investigations) as approximately 93% of the CFTC’s major fraud cases filed during FY 2013 involved a parallel criminal proceeding, with violators sentenced up to 50 years imprisonment. CFTC Chairman Gensler has appointed Gretchen L. Lowe, who is currently the Division’s Chief Counsel, as Acting Director of the Division of Enforcement and who is set to replace the role held by Mr. Meister.

Source: CFTC FY2012 Annual Performance Report

As far as technology provisions, in the previous period of FY 2012, the Commission invested $66 million for development, modernization and enhancements to its surveillance and enforcement systems and general operations, and maintenance to its infrastructure, which appears to have since made a positive return on investment. For the year ended September 30, 2012, the Agency's balance sheet reflected total assets of $220.3 million or a 64% percent increase from FY 2011, according to its most recent annual performance report.

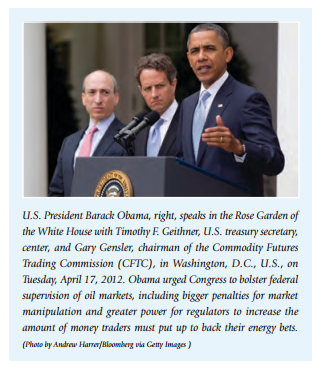

US President Barack Obama suggested bigger penalties for market manipulation when he spoke at the White House Rose Garden on April 17, 2012, with CFTC Chairman Gary Gensler and US Treasury Secretary Timothy Geithner, with regards to commodity markets (specifically oil). This encouragement may have laid the groundwork to bolster the CFTC efforts as intended by the President's urge to Congress.

Cross Agency Collaborations

“We measure success principally by the impact of our cases: positively influencing market behavior, penalizing and deterring illegal conduct, and requiring orders of restitution for victim losses,” said David Meister, the Enforcement Division’s Director at the CFTC, commenting in the announcement today.

“As we have begun to enforce our new Dodd-Frank authority on top of the laws that have been on the books for decades, the cases we bring and the sanctions we have obtained reflect the Division’s unwavering commitment to protect market participants and promote market integrity. On a personal note, as I will be departing the CFTC later this month, I want to thank the Enforcement staff for giving me their support over the past nearly three years – it has been an honor and a privilege to lead such a dedicated team of public servants,” concluded Mr. Meister, according to the press release.

The agency has also actively collaborated with federal and state criminal and civil law enforcement authorities, by sharing information in just under 300 investigations and prosecutions, which is reflective of the high priority that the CFTC places on supporting criminal prosecution of willful violations of the commodities laws, according to the statement today.

Highlights of Selected FY 2013 CFTC Enforcement Actions included the following areas:

- LIBOR and other Interest Rate Benchmarks

- Protection of Customer Funds (MF Global, Peregrine and Others)

- Other Manipulation and Trading Violations; Pre- and Post-Dodd Frank Authority

- Designated Contract Market Violations

- Futures Commission Merchant and Introducing Broker Supervision Violations

- False Statements under Dodd-Frank

- Precious Metals Fraud Charges under Dodd-Frank

- Ponzi Fraud -- Trial Victory

The full CFTC announcement can be seen on the agency's website.