The Cyprus Securities and Exchange Commission (CySEC) has imposed a hefty €740,000 fine on Exelcius Prime Ltd, the operator of the 1Market trading brand, for a series of regulatory breaches. The decision addresses violations spanning from unauthorized service provision to inadequate client protection measures.

Regulatory Breaches Cost Exelcius Prime €740,000 in CySEC Penalties

The total fine of €740,000, one of the highest imposed by CySEC recently, comprises as many as 9 different violations. For example, CySEC's investigation revealed that Exelcius Prime offered investment advice without proper authorization, a violation that resulted in a €45,000 penalty. The regulator also identified significant governance issues, including insufficient time commitment from board members and a lack of collective experience at the director level, leading to an additional €60,000 fine.

Organizational deficiencies formed a substantial portion of the sanctions. A €240,000 fine was imposed for failures in compliance procedures, product review processes, and outsourcing risk management. The company also failed to provide the required records to the regulator.

Client protection emerged as a critical area of concern. CySEC fined Exelcius Prime €120,000 for inadequate conflict of interest management and €110,000 for failing to act in clients' best interests. The firm also faced penalties for misleading client communications and inappropriate product recommendations.

The regulator's decision also highlighted the company's failure to properly assess product suitability for clients and its premature establishment of a branch in the Czech Republic without full disclosure to CySEC:

- €240,000: Poor organization, including bad policies and failure to review products.

- €120,000: Not managing conflicts of interest between employees and clients properly.

- €110,000: Failing to act in clients' best interests.

- €100,000: Giving unclear or misleading information to clients.

- €60,000: Problems with the company's board and management structure.

- €45,000: Offering investment advice without permission.

- €25,000: Not checking if products were right for clients.

- €20,000: Failing to assess if services were appropriate for clients.

- €20,000: Opening a branch in the Czech Republic without telling CySEC everything required.

Exelcius Prime has not yet issued a public statement regarding the fines or any potential appeal of the decision. Interestingly, the fine was imposed at the beginning of March, but CySEC has only now decided to announce it.

Earlier, at the end of July, the regulator reported a significantly smaller fine imposed in June of €3,500.

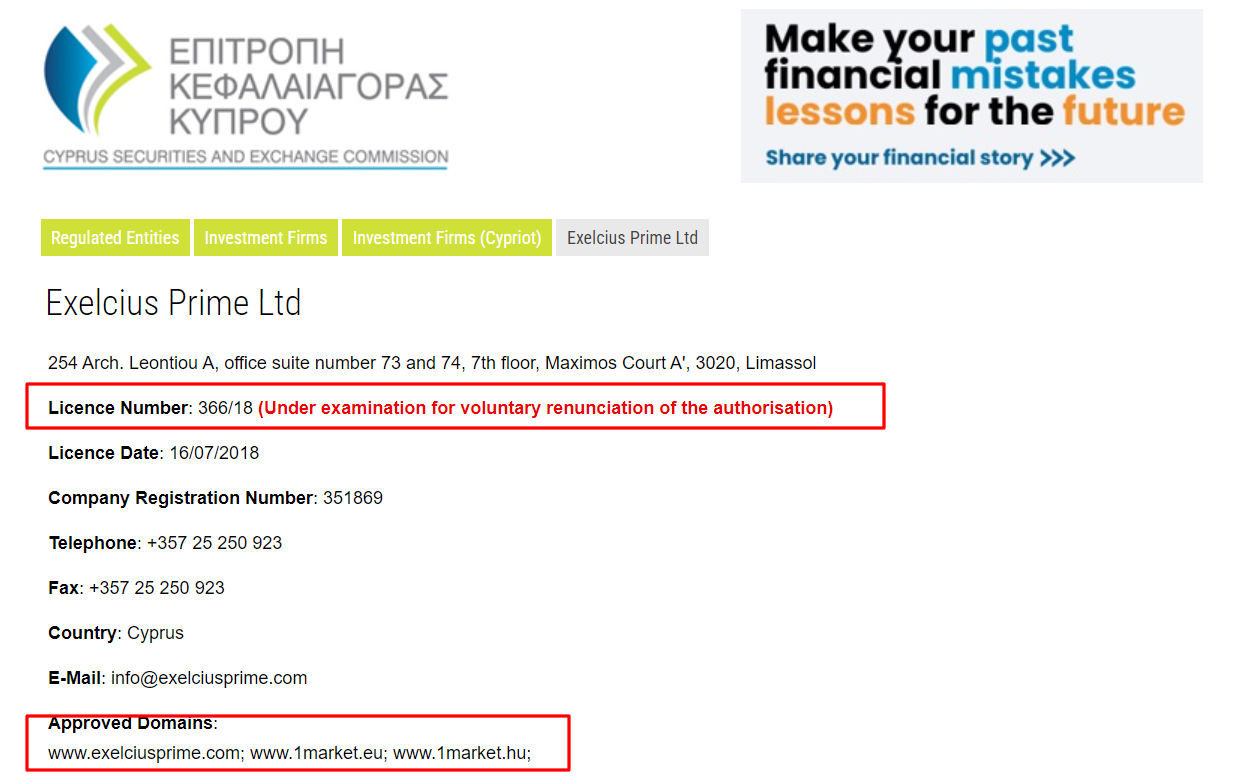

It's important to note that Exelcius Prime, licensed by CySEC since 2018, is currently “Under examination for voluntary renunciation of the authorization.” Moreover, the 1Market domains under which the company provided its brokerage services are no longer available, just like the exelciusprime.com website. There are indications that the company has not been conducting active operations for some time.

CySEC Imposes Increasingly Higher Fines

Considering that in 2023 CySEC imposed a total of €2.2 million in fines on financial firms, the penalty received by the 1Market operator represents one-third of this value.

Recent actions, however, show that CySEC is “gaining momentum” and imposing more substantial financial penalties for serious violations, similar to regulators from other jurisdictions.

An example is the €200,000 fine imposed on IC Markets in mid-July, which the regulator claims violated its license by offering financial leverage of 1000:1. The case has not been resolved, as the broker disagrees with the decision and intends to appeal.

CySEC also published today (Wednesday) its latest report summarizing the compliance activities of regulated firms. The regulator identified several areas where regulated entities, including local investment firms and crypto service providers, need to improve their anti-money laundering and counter-terrorist financing (AML/CFT) practices.