Following the announcement that the UK Financial Conduct Authority (FCA) is proposing a cap on Leverage limits for retail traders, top industry representatives from the UK are uniting into a CFD providers association. GAIN Capital's City Index unit, CMC Markets and IG Group are forming the new UK industry body, sources with knowledge of the matter shared with Finance Magnates.

Finance Magnates

A lobby organization can be beneficial for the UK industry as brokers can take a united position and jointly discuss with the regulator their worries. The retail trading industry has seen substantial challenges lately with CySEC mandating a default leverage level of 1:50, while the UK FCA is proposing an outright cap at the same level.

The feedback that brokers and clients provide to the UK Financial Conduct Authority will influence the conviction of the FCA to introduce the leverage cap. While some traders are looking for capital preservation, others are aggressive speculators and it would be fair for them to be able to choose higher levels of leverage should they be well acquainted with the risks associated with trading on margin (i.e. negative balances).

The UK FCA is an established regulator for a reason - the watchdog has implemented procedures that ensure that not only brokers but also traders can submit their feedback in response to the proposals that are submitted for discussion.

For all those traders that are keen to share their opinion on the proposed changes to the regulatory framework in the UK, they can fill the form on the following link until the 7th of March 2017.

Clients of Forex and CFDs trading as well as spread betting services can voice their concerns to the regulator if they have any and comment on all points of the proposed changes.

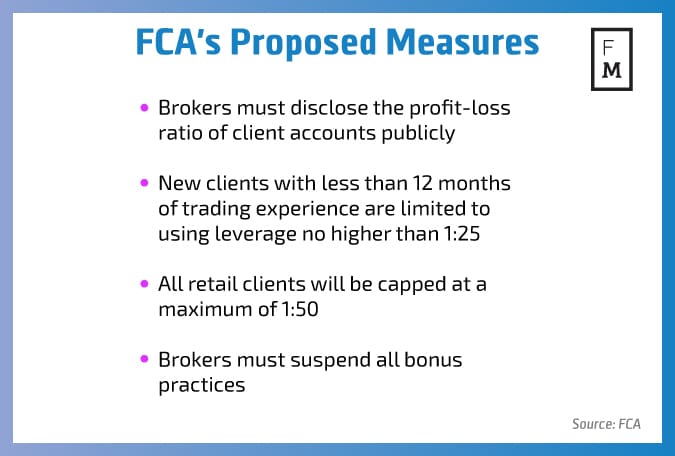

The measures which the FCA is proposing include a mandate to disclose the profit-loss ratio of client accounts publicly in order to adequately demonstrate the risks associated with trading.

The UK watchdog is also proposing that new clients that do not have over 12 months of trading experience be capped to use leverage no higher than 1:25. In addition, all retail clients should be capped at a maximum of 1:50. The regulator is highlighting in its announcement that some clients are receiving over 1:200 leverage by their providers. Lastly the FCA is proposing to suspend all bonus practices regardless of whether they are related to trading or account opening.