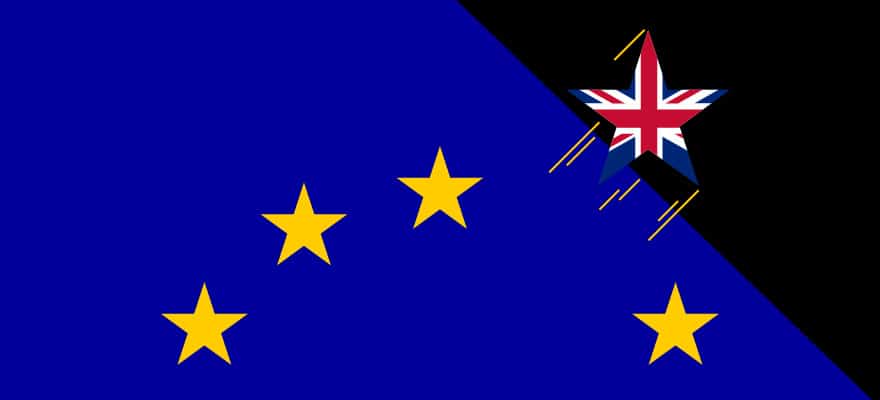

Sources familiar with discussions between regulatory bodies in the EU are sharing that the UK Financial Conduct Authority (FCA) could be at odds with the supranational regulator, the European Securities Markets Authority (ESMA). The news reveals that the discussion between regulators is still close and that brokers and clients still have a hand to play a week before the official close of comments on the matter.

Discover credible partners and premium clients at China’s leading finance event!

The measures publicised by ESMA in December have prompted a reaction on the part of national regulators that are more involved with the retail trading industry. The UK FCA was the first national regulator to propose a leverage cap of 1:50 in December 2016. Earlier in January, ESMA issued a communique that flirted with tiered leverage.

[gptAdvertisement]

ESMA’s call for a 1:30 cap on leverage is one of the points that industry insiders are most concerned about. The measure could prompt a drive of business offshore and a massive client reclassification effort.

An official statement from the FCA received by Finance Magnates outlined: "As we have repeatedly said in our public statements, the FCA supports ESMA in its consideration of potential EU-wide product intervention in relation to the sale, distribution and marketing of CFDs and binary options to retail clients."

Brokers Urging Clients to Comment

Many brokerages from the industry have actively been encouraging their clients to submit comments to ESMA. When a similar over-reaching limitation was introduced in Japan in 2011 when the JFSA capped Leverage at 1:25, clients did move some business offshore.

From platform messages to emails to their clients, brokers are looking into ways to mitigate the impact of the drastic regulatory action that ESMA is contemplating. The sustainability of the retail trading industry’s business model is the most significant source of concern for clients and consequently regulators, as any over-reaching limitations might drive traders towards loosely regulated and unregulated brokers.

Customers that are using higher levels of leverage may be forced to take their business outside of the EU or become professional clients. The latter move would leave them more vulnerable to losses as they lose access to the investor compensation funds that are being maintained by national regulators across the EU.

The efficient mechanism that is behind the UK Financial Services Compensation Scheme (FSCS) warranted a quick reimbursement of clients of Alpari UK in the aftermath of its post-SNB collapse.

Final Week for Comments to ESMA on Proposed Forex Regulations

The supranational European financial regulator, ESMA, is a week away from closing the comment submissions period on its new proposed retail trading regulatory regime. The central authority that is supervising national financial regulators has provided a list of material changes to the framework that is governing the provision of margin forex and CFD trading in December.

If you are an EU-regulated brokerage or a client from the region and would be keen to share your opinion on the matter of regulating the retail trading market, now is the time to act. The main points that brokers are listing with ESMA are related to driving clients to riskier intermediaries located offshore and providing them with more choice when it comes to the use of leverage.

An ESMA representative declined to provide comments on the matter of the evolution of the regulatory framework of retail forex and CFDs trading in the EU.