The Japanese financial regulator is discussing a new proposal that is aiming to limit retail Forex Leverage , Finance Magnates can confirm. Multiple sources from the Japanese industry are expressing worry about the prospective impact on the market.

Not only could Japanese yen crosses suffer a decline, since retail traders are generally shorting the domestic currency, but the broader impact on the industry may have a real impact this time around.

[gptAdvertisement]

Japan’s retail forex traders are already using the lowest leverage in the world, at 1:25. The Japanese Financial Services Agency, which is the overseer of the market, cut leverage in two steps following the Great Financial Crisis (GFC) of 2008.

The first measure included a cut to 1:50, with the second round of retail forex leverage cuts capping the rate at 1:25. The Tokyo Financial Exchange is said to be exempted from the cuts since it is not providing over-the-counter products.

From Private into Public Hands

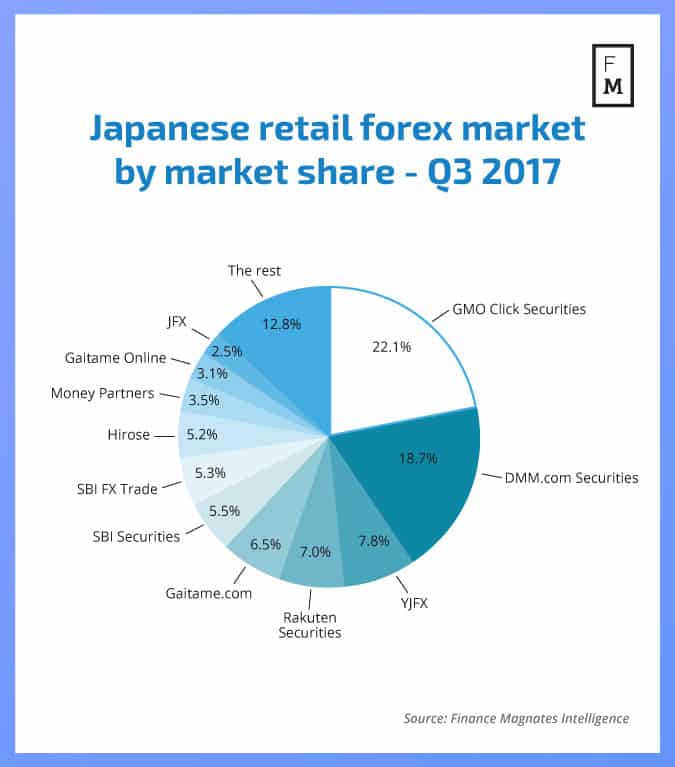

The exclusion of the Tokyo Financial Exchange and its Click 365 product signals that Japanese authorities are making a protectionist move for state-owned enterprise. The move is likely to cause a significant response from the Japanese retail forex industry.

The news could be a significant deterrent to Japanese forex traders. Previous cuts in leverage were weathered rather well by the industry, something that is not a certainty with the move to a leverage cap of 1:10.

The new rules are said to be considered for implementation from the middle of 2018. The government’s proposal risks pushing Japanese forex investors, commonly referred to as Mrs. Watanabe, to seek alternatives outside of Japanese regulation.

Industry Insiders Comment

Japanese FX trader Hiro Pie comments: “It can be said that Mrs Watanabe's buying support for the dollar is a strong partner for the Bank of Japan and the government. Rather than making restrictions on all users, such as restricting currency pairs that can be handled, it is more likely to be a stepwise process for individual investors. Depending on the capital of the FX broker firm and the scale of retained earnings, it is reasonable to look for a compromise with the Japanese Financial Services Agency".

Industry veteran Nori Muzuki adds: “We were presented with various hurdles such as high capital adequacy requirements. We overcame those with joint efforts from each company and as a result, we were able to strengthen our balance sheets.”

“It is unfair to protect the public trading venue and punish the private sector and the move will not protect investors. If the leverage becomes 1:10, then honestly, the market will shrink. In the last 20 years or so, the foreign exchange market has been widely expanded by individual investors. Until now, we have balanced investor protection and the degree of openness of the forex market,” he explains.