During a recent Trade and Transaction reporting conference in London, a presentation by Ana Fernandes, who is the manager of the Financial Conduct Authority’s (FCA) Markets Reporting Team, shed some insight into the UK regulator’s thinking on transaction reporting.

A slew of insightful data from Ms. Fernandes describes the success of the regulator’s implementation of transaction reporting and highlights the areas of focus for the FCA’s surveillance and investigations.

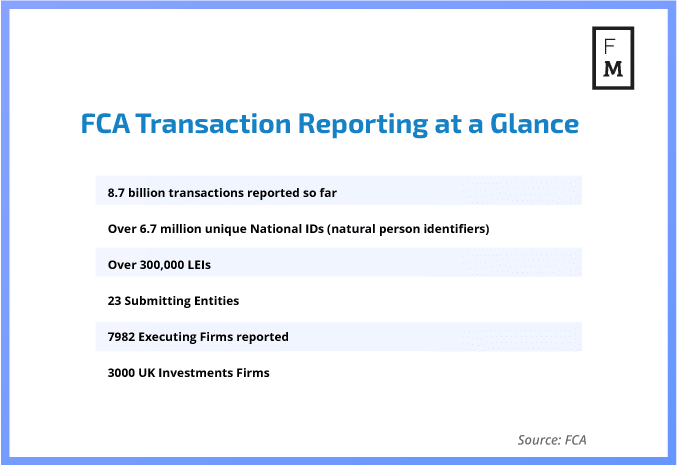

FCA Transaction Reporting Stats, Source: FCA

According to the presentation shown by Mrs. Fernandes, a total of 8.7 billion transactions have been reported so far, with over 6.7 million unique National IDs (natural person identifiers).

Over 300,000 Legal Entity Identifiers (LEIs) have been submitted through 23 submitting entities with 7982 executing firms reported, 3000 of which are from the UK.

FCA Signaling Vigilance

While the FCA is closely monitoring the data it receives from companies, it has identified that only 384 firms have submitted a total of 1335 ‘Errors and Omissions Notification Form’. According to the regulator’s representative at the conference, this figure is seen as very low.

The London-headquartered watchdog is expecting more firms to be submitting the form, undertaking back reporting exercises and making regular corrections as these low figures raise questions on some systems and controls which investment firms use.

In addition, only 405 entities have requested and downloaded a sample of transaction reports from the FCA MDP Entity Portal since January 2019. The regulator has a team in place to use analytical tools and thematic investigations to identify potential reporting errors and omissions and has been in touch with more than 130 firms to follow up on investigations.

Ms. Fernandes also joked that it seems like a lot of 119-year-old people are trading. This was obviously due to a default DOB of 1900 being commonly used, as well as LEIs being used such as ‘NOLEIFORTHISCLIENT99’.

Up until now, the FCA has been relatively quiet in regards to the data it receives from the MiFIR transaction reports, especially compared to other major FX & CFD regulators like CySEC and ASIC (albeit under a different reporting regime) but it looks like this is about to change.

Broker Recommendations

Quinn Perrott, co-CEO of TRAction Fintech

Aiming to find out what brokers can do to tackle reporting challenges, we reached out to the co-CEO of TRAction Fintech, Quinn Perrott. Commenting on the matter, he suggested that firms look at their client acquisition process and make sure they have strict controls to ensure they capture, record and pass on, Names, Nationality, Date of Birth and National IDs in an accurate and complete manner.

“Investment Firms should regularly compare and reconcile the transaction reports held at their NCA against their internal back office systems. TRAction suggests checks be made daily with an end to end reconciliation carried out at least once a month,” Perrott elaborated.

The co-CEO of Traction also advises companies from the industry to be mindful of regulatory updates and subscribe to the relevant news feed from the local NCA or TRAction Fintech’s updates.