The Financial Commission (FinaCom PLC) today inked a partnership agreement with VerifyMyTrade to offer its clients discounts on all products offered by the independent provider of post-trade Execution analysis.

The partnership allows clients of the commission’s brokerage members to comply with sweeping regulations designed to make markets more transparent, including those specified in upcoming MIFID II legislation. In addition, it allows brokers’ clients to use the VerifyMyTrade analysis tool to check whether their trades were fairly priced or not, which reduces the number of execution-related disputes that occur before they progress into formal complaints filed with commission.

[gptAdvertisement]

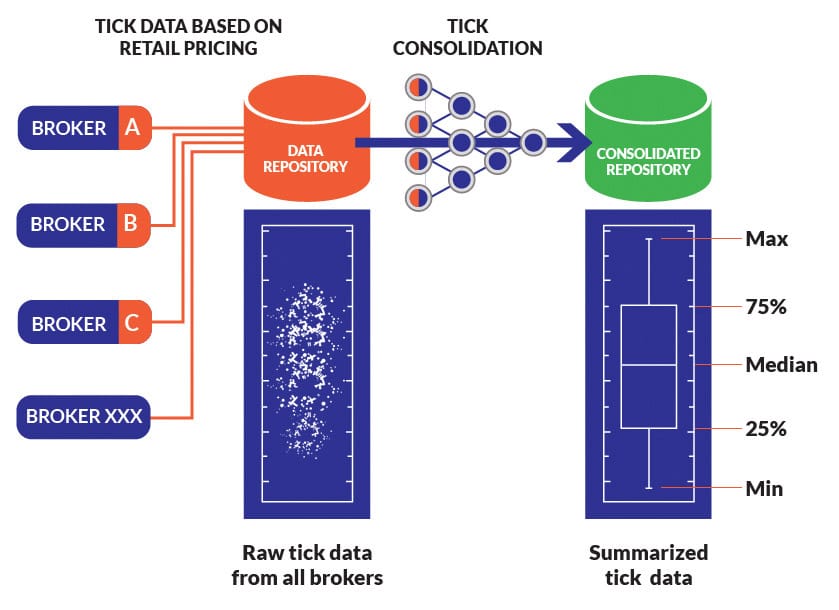

VerifyMyTrade consolidates price feeds from dozens of retail Forex brokers to produce statistical box plots, which are a representation of the minimum, maximum and percentiles of the ticks received for every second of the day.

When a client provides his trade details, the VerifyMyTrade analysis tool maps the execution price to the boxplot for that time of day in order to assess the effectiveness and quality of the broker’s execution. And in case the client claims that he is consistently getting poor execution, the analysis results will facilitate handling execution-related trade disputes.

The VerifyMyTrade execution analysis tool complements FinaCom’s in-house capabilities and serves as additional verification in cases when poor execution quality arises. The tool may also help reduce the instances when a trade that was properly executed unnecessarily escalates into an unresolved complaint that must be then filed with Financial Commission for remediation.

Jeremy White, CEO, VerifyMyTrade, commented: "Regulations such as MiFID II are forcing the industry to be more transparent about execution and how this information is communicated to all stakeholders. We are very happy to partner with the Financial Commission who share the same transparency vision and look forward to working with the FInancial Commission memer brokers."