Following up on our popular recent feature global binary options regulations overview, we are proud to present you with a detailed breakdown of leveraged currency trading regulations around the world.[gptAdvertisement]

The importance of getting a Forex license today cannot be underestimated as traders are more aware than ever about the risks associated with unregulated firms. Brokers on their part are strongly emphasising, even in countries where it is not required, how many jurisdictions they are licensed in and trying to get more established signs of approval.

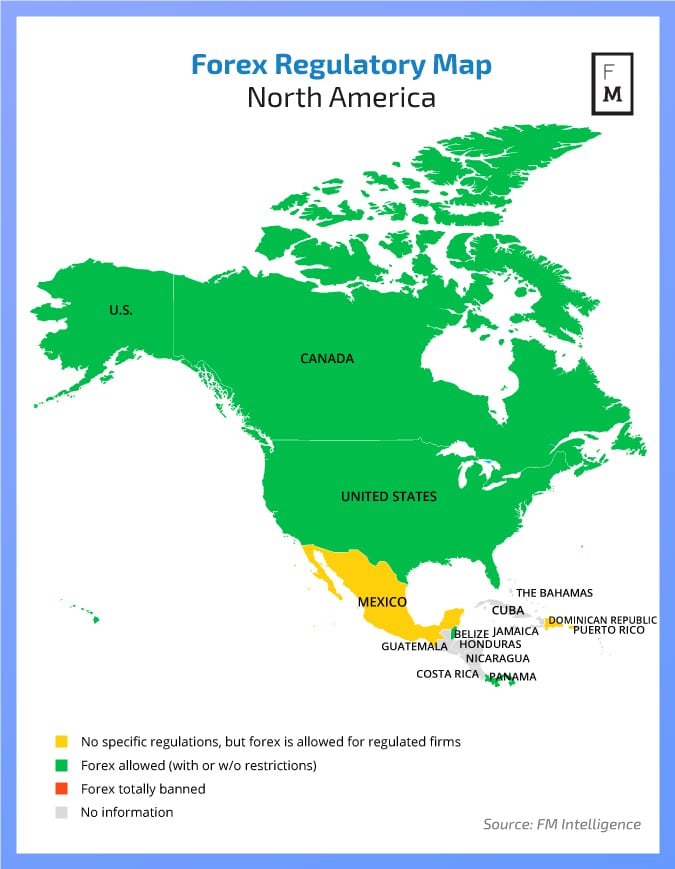

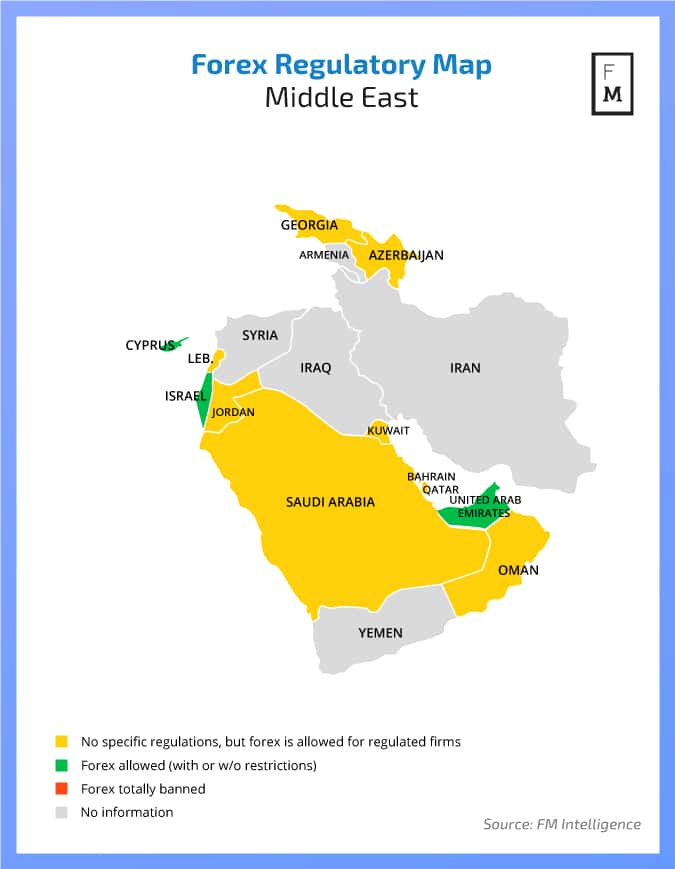

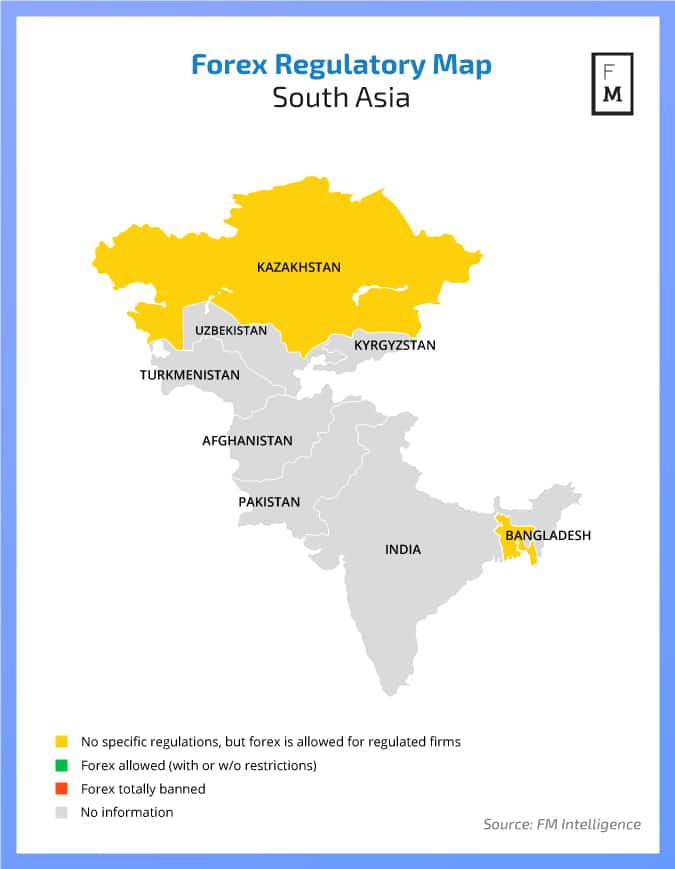

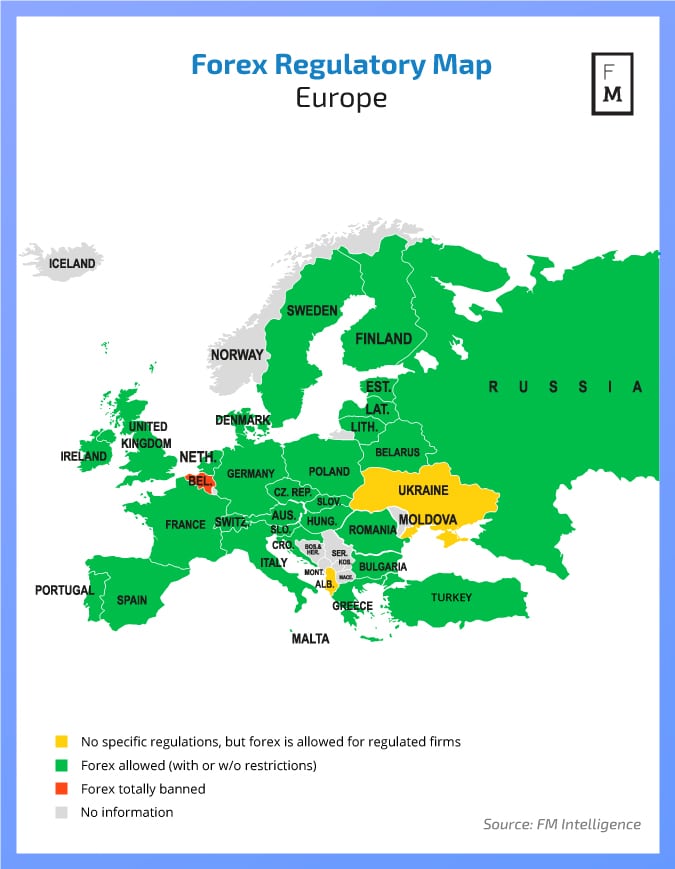

Finance Magnates Intelligence analysts have mapped out regulations relevant to forex brokers and traders by country and we visualised it in the form of regional maps.

In North America, home to some of the biggest forex brokers in the world, trading is highly regulated and regimented. The high costs associated with getting approved to offer services make the market very hard to break into. It has been consolidated to a degree unseen in markets of its immense size with just a handful of companies remaining to legally serve North American clients.

In South America, Chile offers a Forex Trading license for firms approved by the SVS (Superintendencia de Valores y Seguros). Brokers are reporting growth throughout the continent which is developing as a new high target market.

One of the most advanced and developed markets on the continent, South Africa offers a forex license regulated by the FSB (Financial Services Board) which is highly respected in the region.

Make sure to also check out the recent Global Binary Options Regulations Overview

In the diversified markets of the Middle East, Cyprus remains the top destination in which to establish a legal presence. A gateway to Europe and a regional hub, Cyprus is one of the leading international forex jurisdictions.

Want to get more valuable data for decision-making? Go to the Finance Magnates Intelligence page

One of the biggest retail forex markets by its own right, Japan remains an island onto itself with regulated online brokerage groups targeting traders in neighboring Asian countries based on Australian, Hong Kongese and even UK licences.

Despite a growing focus on developing markets recently, Europe remains the leading region in terms of the number of markets welcoming forex brokers while ensuring trader safety. A European license is often the most sought after by firms that operate in markets where a local legal framework is not available.

A number of national regulators in Europe have also recently issued specific guidelines for conducting business under their jurisdictions. These include additional client protection measures in Spain, an advertising ban in France, a distribution ban in Belgium, a CFDs advertising ban in the Netherlands and a new minimum deposit and maximum leverage requirements in Turkey.

Where does your jurisdiction stand regarding CFD trading? Finance Magnates Intelligence has mapped this out too.

It’s important to remember that the situation can change from time to time. The maps offer a snapshot of the market as it is in March, 2017. Keep following Finance Magnates to stay up to date with the latest developments.