The parameters of the ever-changing and evolving regulatory environment in which OTC derivatives companies find themselves nowadays is making its presence felt on an international level, and such rules aimed at creating greater transparency within the markets are not just the preserve of the US regulators.

Hong Kong’s regulatory authority, the Hong Kong Monetary Association (HKMA) is very much engaged in establishing the final stages of its trade reporting service which is due to come into effect in July 2013, under which FX Non Deliverable Forwards will be classified as reportable instruments.

According to the regulator, an electronic system for collecting, keeping and maintaining details of OTC derivatives transactions efficiently and securely, primarily for market participants to meet the statutory reporting requirements under the OTC regulatory regime will be provided, and all eligible entities will be required to operate the system.

Entities eligible to subscribe to the Trade Reporting Service are either:

• Entities subject to mandatory reporting requirement under the OTC regulatory regime, or

• Other entities at the discretion of and subject to conditions specified by the HKMA.

Scope and Structure

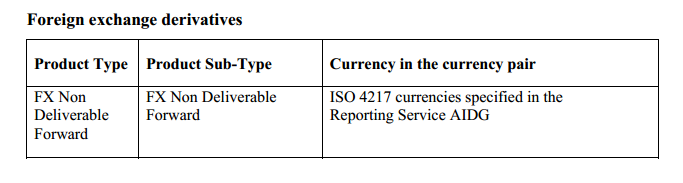

On April 30 this year the HKMA set out its scope for trade reporting, which is depicted here:

Rather in the same vein as the contributing factors toward the commencement of the Dodd-Frank Wall Street Reform Act in the United States, the HKMA cites a global movement to improve transparency and reduce counterparty risks in the OTC derivatives markets as being a direct result of the global financial crisis in 2008.

The resultant reaction by regulators worldwide was to instigate reforms to the OTC derivatives markets on various fronts. The reform measures adopted by the international regulatory community include requiring all OTC derivatives transactions be reported to trade repositories (TRs) and all standardized OTC derivatives transactions be cleared at central counterparty (CCP) Clearing facilities, therefore the HKMA is setting this into effect in early July, although no actual date has yet been specified.

Definition

The HKMA defines a trade repository as a centralized registry which maintains an electronic database of records of OTC derivatives transactions. By collecting and providing OTC derivatives transactions information to regulatory authorities, the TR plays a vital role in supporting authorities in carrying out their market surveillance responsibilities, which will help maintain stability of the financial systems.

It also helps increase transparency in the market, promotes standardization and provides a level of consistency in the quality and availability of transaction data.

Development Period

The HKMA initially announced in December 2010 its intention to establish a TR in Hong Kong under the Central Moneymarkets Unit (CMU), and that a link will be developed between the TR and the CCP for OTC derivatives to be launched by Hong Kong Exchanges and Clearing Ltd. to allow eligible transactions to be passed to the CCP for central clearing.

The HKMA also worked in concert with the Government and the Securities and Futures Commission (SFC) to build a regulatory regime for the OTC derivatives markets under the Securities and Futures Ordinance (SFO), including requirements for mandatory reporting to the TR of the HKMA and mandatory clearing at designated CCPs.

Interim Arrangement Finalized

In March 2013, the HKMA consulted the banking industry on introducing an Interim Reporting Arrangement to require reporting of OTC derivatives transactions to the TR of the HKMA.

The Interim Reporting Arrangement was targeted to be implemented within 2013, and was expected to remain in effect until the regulatory regime under the SFO takes effect.

Functionality

The HKMA has confirmed that it will apply charges to market participants for the reporting service, which will be payable in Hong Kong Dollars and will be provided to members on the 10th day of each month. The actual fee scale has not yet been confirmed, however.

The HKTR provides service to TR Members who are or may be subject to the mandatory reporting requirements under the OTC regulatory regime for capturing, maintaining and updating the details of OTC derivatives transactions through its electronic trade reporting system, primarily for the TR Members to discharge their mandatory reporting Obligations .

Transactions reported to the HKTR will be effected by agreements between the parties involved in the transactions. The fact that they are reported to and maintained by the HKTR does not of itself confer any legally binding effect on such transactions.

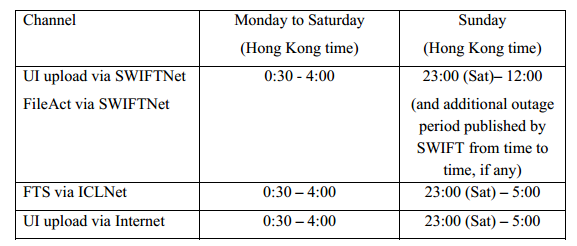

Operating Times for Sending Trade Reports to HKTR