The Israeli online trading industry is having a very hard time recently due to the harsh actions of the local financial watchdog. Since the regulating process began the Israel Securities Authority (ISA) has gone after algo-trading, set tough limits on CFDs and FX volatile pairs, and banned binary options completely.

Finance Magnates sat down to talk with Mr Tzah Druker, the head of the Israeli Trading Arena Association, which represents the industry in its dealings with the regulator, to hear how he expects the process to continue. Showcasing the state of despair, this is how he described his role: “My job is to make sure there will be companies left in the market after the regulations will come into effect.”

Tzah Druker will take part in the panel "Financial Regulation in Israel – Where Next?" at the Finance Magnates Tel Aviv Conference, June 29th 2016. To join the new world of online trading, fintech and marketing register now.

Big Hurdles

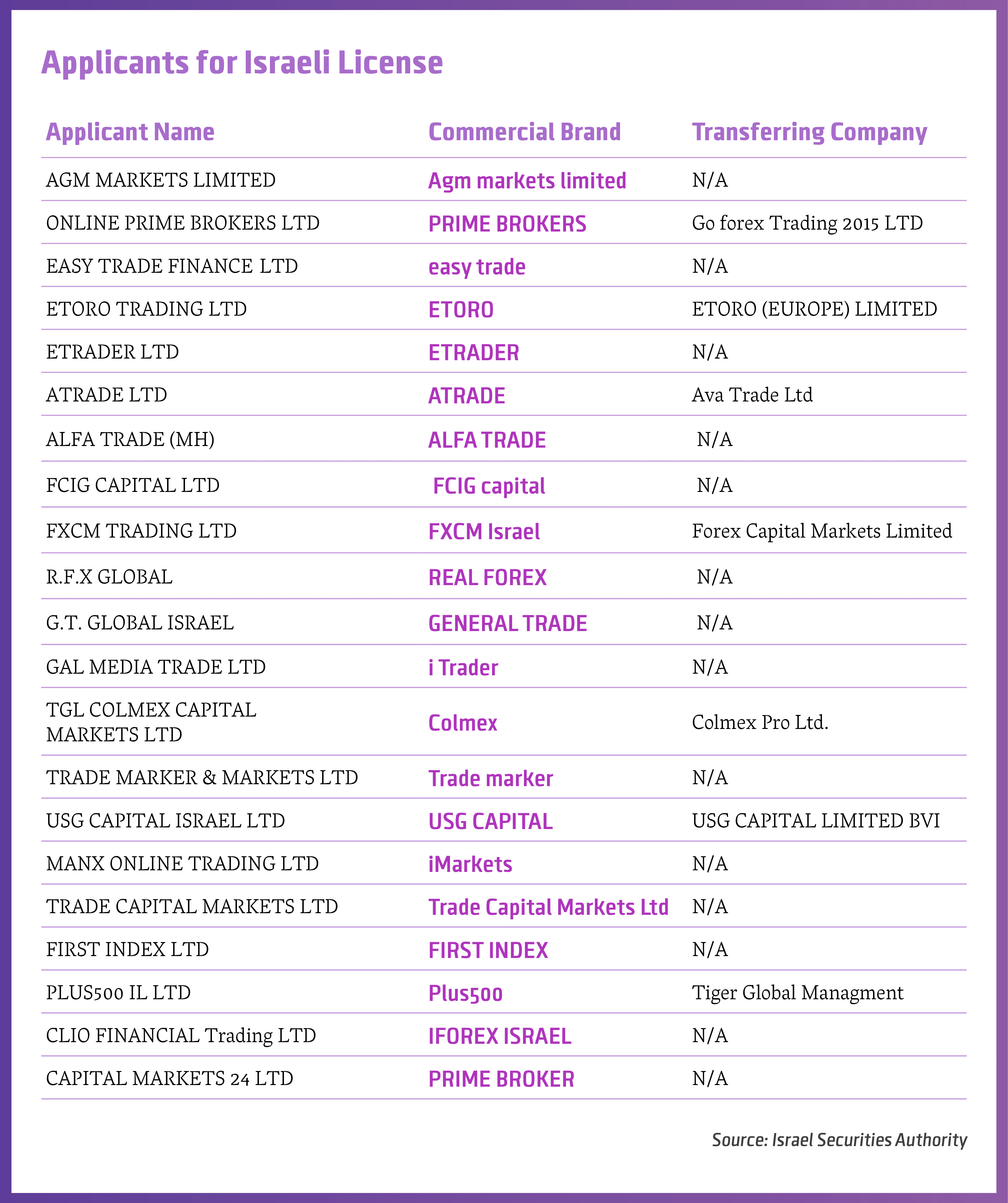

Druker says that due to the way the ISA chooses to interpret capital requirements, brokers will find it very hard to comply, and out of the 21 firms that started the licensing process (see chart at the bottom of the article) only a handful will remain at the end.

“Companies that expected to raise funds after they get the license discovered that will not happen as the ISA demands they have all the capital before the regulating process ends – without knowing if they will get the license or not. Especially some of the companies that were operating before the regulations won’t be able to gather all the funds and will become distressed. For this reason, we can expect that soon the ISA will announce that these companies will not get licensed.

At the moment, after three binary companies are no longer in the processes, the case of UTrade, and three other companies that withdrew their applications, so only 14 companies are left. About another four to six companies are in a process of wrapping up their operations – looking to be bought out or just shut down.

Not all companies will be able to clear the regulatory hurdles erected by the ISA. For example, companies that have clients abroad will need to let the ISA know how much funds they hold in order to set their capital requirements (above the minimum) and not all will be able to bridge that gap. I expect that in the end only around five companies will remain.”

He said that this will hurt clients’ safety, and not just the firms. “When coming to regulate a new market it is not familiar with the ISA might want to limit the amount of players in the field so that there will only be a few big firms it can easily deal with. However, in this case it will cause the amount of clients to shrink too – so that the firms remaining will not be stable and might depend on a few high net worth clients.”

Unfair Handicaps

However, Druker said: “What will determine the size of the market is not how many companies will stay in operation, but what will the companies be able to offer.” Here he is referring to the ISA’s crippling limitations on CFDs.

The Israeli regulator has issued specific demands on calculating CFDs and displaying the information in a way that no other regulator in the world has. In order to offer non-expiring CFDs, they must be based on a weighted average of futures contracts and not a specific one that can be followed. By demanding that CFDs follow a single transparent contract, the ISA is making sure that Israeli brokers will need to operate in a way that is different to all other brokers – and this has costs.

The Israeli brokers have turned to the Liquidity providers and prime of prime brokers and discussed with them what quotes will be needed to comply with the new regulations – they learned that it could be done but that tailored data feeds will cost more, costs that will be passed on to the clients and make them less attractive to the traders.

This all leads to what Druker sees as the worst effect of the new regulations – making the Israeli brokers non-competitive. Israeli citizens are free to trade with foreign brokers and the ISA will not do anything to stop this despite putting handicaps on local operators.

After the licenses are finally given, a trader will face this question: should he choose an Israeli broker offering piece of mind with the knowledge that he can turn to the ISA in case of a problem, or should he choose a broker licensed by the FCA or CySEC that offers many more CFDs and currency pairs, as well as the lower costs that go with not having to comply with the Israeli regulations? According to Druker, enough companies think that the choice will not be favorable to the Israeli license holders.

No More Options

Regarding the banning of binary options, Druker thinks that it will achieve the opposite of the intended goal: “The Israeli public came to the ISA and asked it to regulate the binary options market so that traders will be safer. What happened is that the ISA said we can’t effectively regulate this market. As a result, Israeli traders will become less safe - they will have to turn to offshore brokers, as regulated brokers in Cyprus or the UK might reject them because they don’t have an Israeli license but unregulated firms will welcome them.”

He explains that the Israeli binary options firms decided not to fight this decision because it is not worth the effort. It’s a very small market for international firms, and Israelis are considered to be very demanding clients in terms of support which costs manpower, and it was not worth the trouble.

The full list of applicants for the Israeli License. Source: Finance Magnates