In the wake of the European Securities and Markets Authority’s (ESMA) latest Regulation , a lot of time has been spent examining how brokers are going to have to change their behaviour. Here at Finance Magnates, we predicted some time ago that we would see industry consolidation alongside brokers shutting up shop or moving offshore.

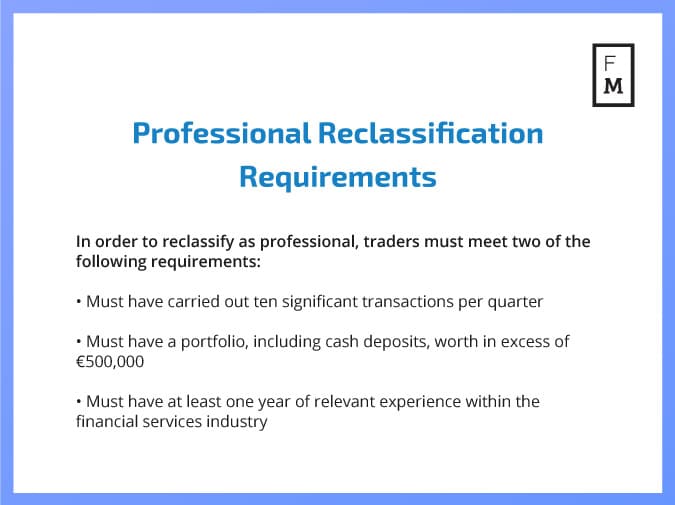

Less attention has been paid to the people who actually make the retail industry’s existence possible - clients. Last month, yours truly wrote an article, which - thanks for asking - you can read here, covering professional reclassification and how it could affect the makeup of the industry’s client base.

Professional Reclassification Requirements

The conclusion of that piece was that, alongside industry consolidation, there would be client consolidation. European brokers are going to start focusing on dealing solely with a smaller, wealthier, professional segment of the public who, prior to ESMA’s regulation, generated the bulk of their revenue anyway.

Mathieu Ghanem, Global Head of Sales and Marketing at ADSS, told Finance Magnates that this was not a bad conclusion to have drawn. ESMA’s regulation, Ghanem said, “has meant that brokerages in countries covered by ESMA are all looking to work with professional traders.”

His statement was also of note as it reflected another change in the dynamics of the retail industry. Confirming the suspicions of other industry insiders, he said that retail traders, who formerly used EU-regulated brokers, are starting to trade using the firm's United Arab Emirates-regulated (UAE) brokerage services.

Mathieu Ghanem, Global Head of Sales and Marketing, ADSS

Chasing Leverage

As noted, many predicted that brokers would move offshore after the implementation of ESMA’s regulation. Less certain was whether or not clients would follow them there.

The reason for this uncertainty was simple: brokers working offshore do not have the greatest of reputations. As we at Finance Magnates have written about frequently, regulatory warnings against offshore brokers are issued on a nearly daily basis.

Prior to ESMA’s regulation, however, traders had access to high leverage trading without the need of offshore brokers. This was vital given that access to high leverage has been one of the main marketing appeals for brokers since the industry’s beginning.

With high leverage gone in Europe, however, it seems that some clients, who aren't based in Europe, are indeed going to be moving. Thankfully, it is not to those dodgy offshore brokers but, instead, to non-EU regulated entities. In its statement on Wednesday, ADSS noted that its Middle East and North Africa-based (MENA) clients are starting to trade with local, rather than European, brokers.

“We have seen a lot of new traders on-boarding with us, and we expect this to continue,” Ganem noted. “MENA traders who have been using European based providers are moving back to regional brokerages which have the capitalisation, levels of service and technology they want, but are not restricted by the ESMA rules.“

Fears assuaged

This state of affairs will certainly be a blow to European brokers - after all, no one wants to lose clients. For the industry as a whole, however, it may indicate that fears of a mass migration to dodgy, unregulated brokers were unfounded.

ADSS’ statement does not indicate that clients are flocking to an unregulated jurisdiction. Instead, former clients of European brokers are moving to a broker regulated by the UAE’s central bank.

The firm was also keen to note that it's UK-regulated business will continue to onboard retail and professional clients. Mifid and ESMA regulated clients will not onboard European clients or Mifid based clients in the UAE

How long this state of affairs will last looks set to be determined by the behavior of non-European regulators. We could be at the beginning of a cat-and-mouse game in which retail traders move from jurisdiction to jurisdiction as regulators clamp down on high leverage trading.

This hasn’t happened yet and, for now, it seems European brokers will continue to consolidate and focus their efforts on attracting professional clients. Concurrently, the average Joe trader, who can’t meet professional reclassification requirements, is going to look offshore.