Last month the Turkish regulator (Capital Markets Board of Turkey) announced without warning that the maximum leverage on Forex accounts will be cut to 1:10 and that the minimum deposit will be hiked to TRY 50,000 (about $13,500). Now we can reveal that despite the best efforts of the local industry to fight the draconian measures via the Turkish Capital Markets Association, the authorities are enforcing them nonetheless.[gptAdvertisement]

Besides greatly hurting workers in the Turkish FX industry, which employed as many as 6,500 people before this, the regulator's actions will also have ill effects on traders who will have to pay higher spreads as a result of lower trading volumes and Liquidity . It is likely to be counterproductive to the goal of protecting FX traders, of which there are 36,000 in Turkey, as they will be driven offshore and outside the protection of their home country.

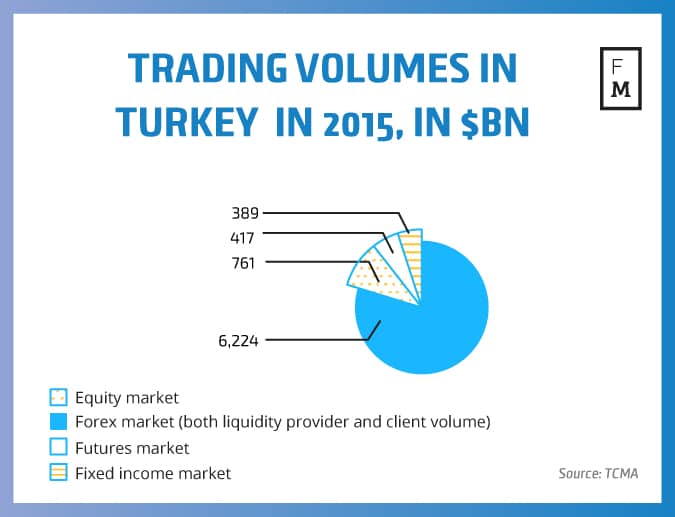

On a national level, it will encourage the flight of capital to other markets where offshore brokers operate freely. The harsh move could also hurt Turkey’s ambition to be a leading financial hub in the MENA (Middle East and North Africa) region.

We asked local legal expert Akın Abbak, Managing Partner at Abbak Attorneys at Law, for his view on the situation.

How will this affect current traders?

“Out of the blue, the CMB, restricted the freedom to dispose of the Turkish people in FX market. With the immediate effect of the regulation on trader’s open positions; those who have been carrying positions, even though they are in loss or not; became not able to hedge or open a counter position to their existing positions with the same leverage rate. This is caused a huge loss for traders and made them not capable of deciding upon their existing positions opened with a contract and with a trust to law.

Akın Abbak

This situation is like that; For instance; you go to a bank and sign a 60 day saving account contract and put money to the account but then suddenly the government says that, there would be no value of the money from today on by saying that; 'from now on in this country nobody will not use any printed money and all printed moneys shall be deemed null in 45 days'.

This is against the well rooted principle of consistency/stability of the state and consistency/stability of the acts of the administrative bodies. However, with this regulation; in my legal opinion, CMB acted unlawfully to those who have open positions opened on the basis of a contract with a broker.

It is understandable to see loss in FX, mainly on small retail clients; but still there were a lot of ways other than decreasing the leverage and not letting small retail clients to trade in this market. One can not ban traffic or driving due to huge amount of accidents. You need to educate them; and increase the market awareness, risk awareness, more and more."

Will ordinary Turks no longer be able to trade FX?

“Although it is said that, the aim behind the regulation was ‘protecting the investors’; this regulation, in my opinion, is far away from protecting the investors. There can be no really applicable restrictions that may be put forward to ban the access of Turkish traders to foreign markets. We are living in an international environment and given the fact that the FX market cannot be restricted with the borders of the state due to its international nature; the market will go on.

In other words, since FX is neither a local business nor an exchange such as stock brokerage at Borsa İstanbul no one-for now- may restrict any regulated brokerage house in the world to on-board Turkish citizens. Another ground for this is that; no one may restrict a Turkish citizen’s investment decisions. This is also a well-rooted human right. “People may freely manage their own assets up only to their own discretion”. However; if the government, within the limits of its power, limits all foreign transactions of Turkish people, then the case changes. In this case, no one may 'even' open a bank account in a foreign country-which seems not possible at all."

What will deter international or offshore firms from accepting Turkish clients?

“After this very change in regulation, the government and the CMB says that there are certain restrictive rules in Turkish Capital Market for foreign brokers on-boarding Turkish clients. Their ground comes from the article 109/2 of Turkish Capital Market Law; which says:

‘Those who perform unauthorized activities in the capital market shall be sentenced to imprisonment from two years up to five years and be punished with a judicial fine from five thousand days to ten thousand days.’

However, in my legal opinion, it can be easily said that a foreign FX company on-boarding Turkish clients is not performing unauthorized activity in Turkish capital market. Because, the wording “Capital Market” may only be understood/construed as Turkish Capital Market and since FX cannot be localized, and it is an over the counter market, a foreign company, who is providing brokerage services in international and over the counter FX Market, with a license given to them by their own regulatory body, may easily perform in anywhere else in the world.

The performance may only be restricted by a law (not by a CMB communique) and through a ban such as the one what NFA and CFTC done as mentioned above (FATCA). But of course, worth to say, marketing operations of foreign brokers may of course can be restricted. this is another issue and in my opinion not related with on-boarding.

In short, although the CMB may have sold the problem ‘investor loss, investor protection’ with a simple law restricting heavy marketing/advertisement operations of the brokers; they opted for shutting down the market with a ground that is not reflecting the facts of the market and the need. In addition, they acted simply unlawfully to those who have been carrying positions opened with a leverage rate of 1.100.”